XRP & ETH Breakout patterns suggest a potential increase that can currently dramatically change market dynamics for Cryptocurrency. As XRP approaches a critical level of resistance to Ethereum, and such resistance has been tested several times before, indicates trade in an imminent watercourse. The current XRP/ETH ratio is approximately 0.0011233, at the time of writing, with market analysts and also industry experts who carefully monitor this important threshold and its potential consequences for investors.

Also read: Cryptocurrency: 3 MEME coins with the potential reserve access qualities

XRP resistance test: How 160% Breakout affects Ethereum price and market vollatility

Historically prejudice points to massive gains

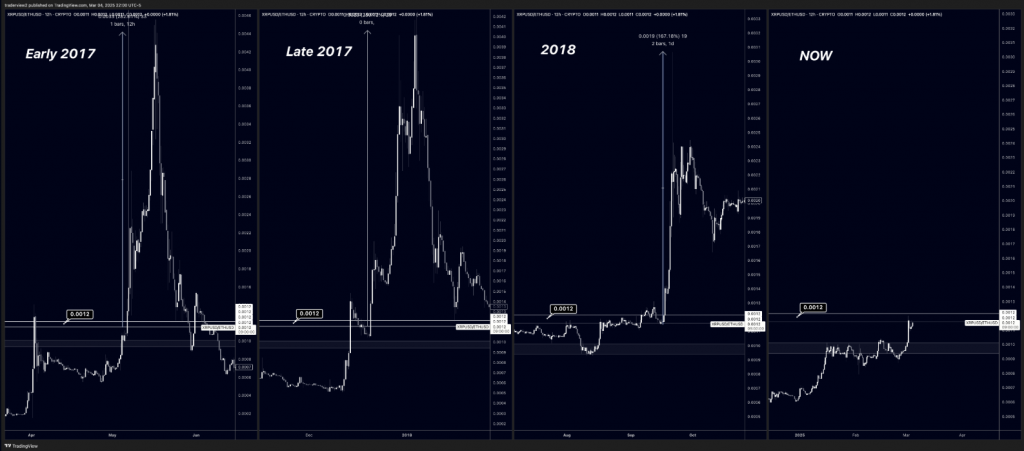

“XRP tries to break the greatest resistance in history against ETH,” They noted in a recent post about X. “Price has historically only gone in parabolic if it is broken, which has at least printed a move of 160% after breaking this zone.”

$ XRP trying to break the greatest resistance in history against $

Price has historically just ever gone in parabolic if it is broken, which has at least printed a move of 160% after breaking this zone

Even half of it and $ XRP anger $

Warnings set for a confirmed break … https://t.co/xixjalknbg pic.twitter.com/ionyn68gcr

– judgment (@traderview2) March 5, 2025

Traders have repeatedly observed these patterns through XRP’s trade history. At the beginning of 2017, late 2017 and also in early 2018, Cryptocurrency experienced dramatic rally after succeeding in breaking through 0.0012 ETH threshold. Each of these outbreaks resulted in rapid price estimate in condensed time frames and thereby led various major changes in the feeling of investors.

Current market results show strength

The relative strength of XRP against Ethereum has received significant attention in recent months. Since November 2024, XRP has increased by over 480% against ETH, which has shown remarkable resilience during a period when most cryptocorate has fought, for example during the current market conditions.

At the time of writing, XRP deals with $ 2.50, after posting a profit of 20% since the beginning of 2025. This performance is in sharp contrast to Ethereum’s struggle, which has seen its price decline by 35% year to day. Even Bitcoin has experienced a modest reduction of 3.7% during the same period, and this has designed several significant changes in market positioning.

“This may be the beginning of a huge change in which ETH seriously underperforms or XRP exceeds strongly,” They proposed in a follow -up analysis.

Consequences for the broader market

A successful interruption above 0.0012 ETH levels would probably trigger significant market vollatility. Historically, such outbreaks have been accompanied by increased trade volumes and also increased investors’ interest in XRP and thus used several important market indicators. Right now, many traders are looking near this level, and such attention often creates further speed in the market when an outbreak finally occurs.

Traders carefully monitor the technical indicators. The level of resistance has been adopted for extended periods throughout XRP’s trade history, and such consistency makes this level quite important right now, which makes its potential infringement particularly significant for Ethereum prize ratios and even broader market dynamics for CryptoCurrency at the time of writing.

Also read: Shiba Inu: Shib may be represented at the Crypto -Top meeting today: like this

The path to $ 10 becomes clearer

The potential profit of 160% projected by analysts would put XRP on a clear path to the psychological $ 10 brand. Such a milestone would represent a significant performance for XRP, which has spent several years rebuilding speed after regulatory challenges, and this has revolutionized various large investment strategies throughout the sector.

XRP is in the process of reversing the most important resistance in history, to support

The last time this was support was March 2020 …

This may be the beginning of a huge change there $ underperforms seriously or $ XRP Strongly surpasses 👀 pic.twitter.com/fd5hzcgxu

– judgment (@traderview2) March 4, 2025

The marketing position against XRP has shown signs of improvement when traders predict the resistance test. If history repeats itself – or even if Rally reaches half of the historical gain to about 80% – XRP would establish itself as one of the strongest artists against Ethereum in the current market cycle.

The extended period for XRP -better results against Ethereum adapts to broader technical analyzes that suggest that this trend can also continue throughout the current bull cycle. For investors who are concerned about Cryptocurrency Market Volatility, these historical designs provide valuable context for potential price movements in the coming weeks.

Also read: Trump’s US Crypto Reserve: Top coin that made (and missed) the incision

Whether XRP will successfully violate this critical level of resistance remains to be seen, but the historical precedent suggests that if it does, a significant price movement is likely to follow and thus catalyze various major changes over several essential cryptocurrency -trading pairs.