The Gold Price rose to another highest time of $ 3,977.19 todayOctober 7. Bitcoin (BTC) also climbed to a new top of $ 126 080 on October 6. Both financial assets have seen incredible price upper schools in recent months. In this article, let’s discuss what asset, gold or bitcoin, which yields better returns by 2030.

Bitcoin vs. Gold: Which comes out on top until 2030?

Bitcoin (BTC) is the best performing financial asset in the last decade. The original Cryptocurrency traded to approximately $ 240 in October 2015 and has risen to $ 126,080 in October 2025. BTC has long exceeded such as gold, silver, technical layers, etc. The crypto market is plagued by sharp and volatile price fluctuations. Gold, on the other hand, is quite stable.

Like Bitcoin (BTC), gold is also expected to continue to increase in the coming years. According to Market Veteran Ed Yardeni, the yellow metal can increase to $ 10,000 by 2030. Yardeni quotes continued gold purchases from central banks as a reason for his haus -like vision. Central banks, especially the Chinese central bank, seem to go into gold. Rising gold purchases may be to counteract the feeling of the growing anti-USA dollar. If gold hits $ 10,000, the price will have increased by about 151%.

Also read: Gold price hits $ 3,924: Is $ 4,000 within reach by the end of this week?

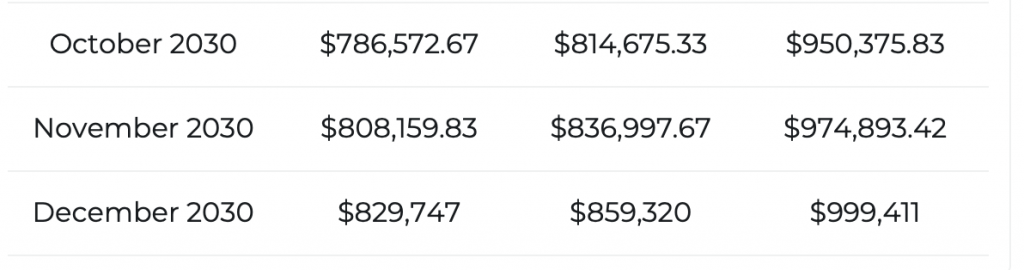

With the aforementioned price conditions, Bitcoin (BTC) is likely to yield higher returns by 2030. But unforeseen challenges can be shown for Bitcoin (BTC). Sharp swings can cause BTC not to hit their intended goal.