The US dollar has recently experienced several woes, elements that have shaped its next value trajectory. With the US economic deterioration gradually taking place, as well as US trade negotiations, volatility fueling global market fluctuations, in such dramatic times, which will be a better asset to hold in the long run, gold or Bitcoin?

Read also: Bank of America revises 2025-2026 gold price outlook

Gold or Bitcoin: Better hedge against inflation?

“Gold is slowly but steadily grinding higher, allowing miners to catch up. I think the next impulsive wave could take gold to $5,000 with little effort…”

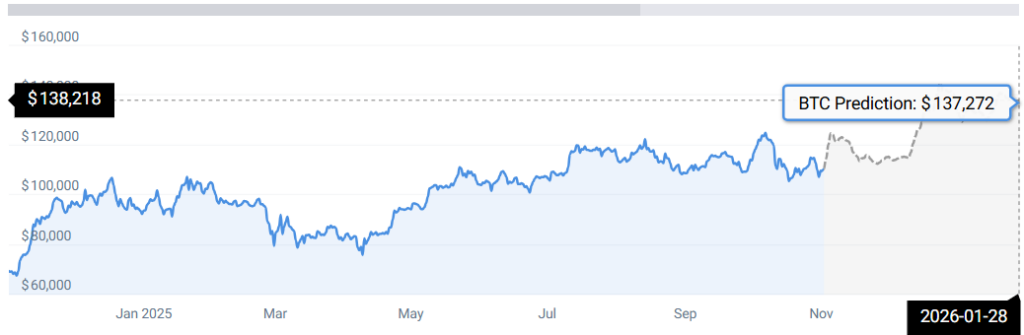

Bitcoin, on the other hand, has also soared steadily in the process. With slow economic growth in the US and trade tariffs fueling volatility, Bitcoin has gradually gained steady momentum, eyeing fresh price gains worth $137,000 as predicted by technical platforms.

“According to our latest Bitcoin price forecast, BTC is expected to rise along 25.26% and reach $137,134 by January 29, 2026. According to our technical indicators, the current sentiment is Bear down while the Fear & Greed Index is displayed 29 (Fear). Bitcoin recorded 16/30 (53%) green days with 4.83% price volatility in the last 30 days.”

Which is a better inflation outlook?

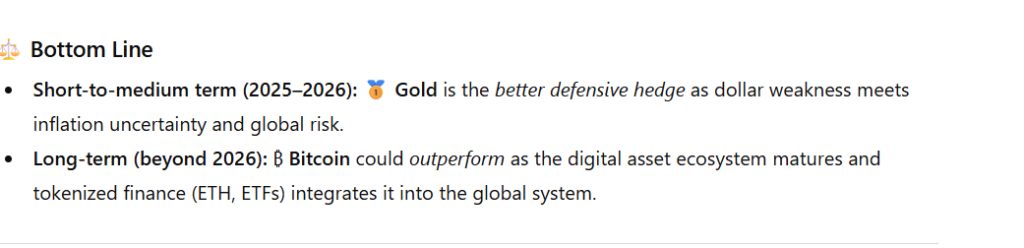

AI, on the other hand, supports Bitcoin as the best hedge for long-term investment prospects. The platform praises Bitcoin for its scarcity and notes that increased tokenization momentum could ultimately help BTC rise in popularity in the near future.

Read also: LBMA Survey Forecasts $5,000 Gold Price in 12 Months