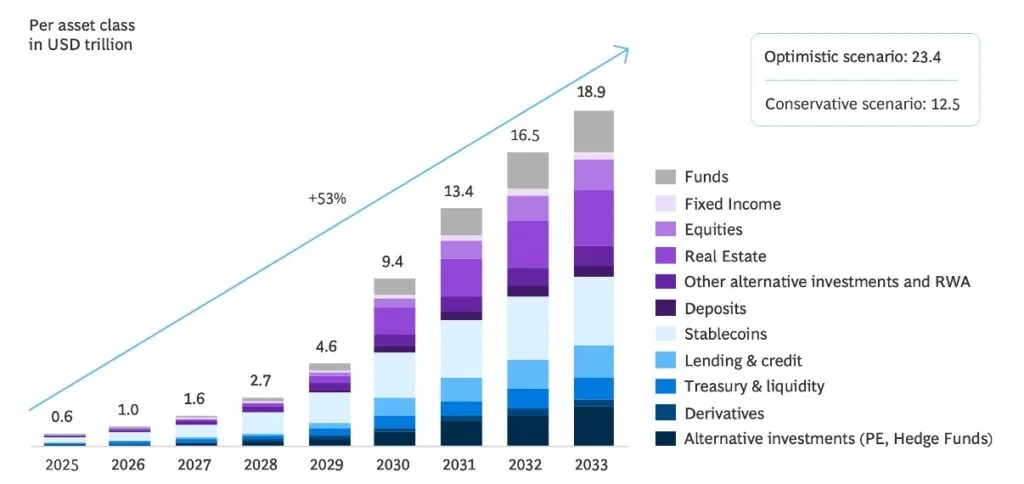

Tokenization of real assets can increase to $ 23.4 trillion in 2033, says a new report from the Boston Consulting Group.

The Report with the title “approaching the tokenization point” revealed that tokenized Rwas will end this year As a market of $ 600 billion. It projects that when more Venture’s transitions from pilots to live platforms, the sector will skyrocket in value and in an optimistic scenario it can be worth $ 23.4 trillion.

However, BCG pointed out that the number is more likely to be about $ 19 trillion, with a conservative scenario of $ 12.5 trillion.

Stablecoins Currently, the majority of tokenized assets are responsible, but mainstream financing will be a more prominent force when the sector matures. Tokenized funds And bonds will be an industrial staple, which accounts for a growing proportion, before alternative investments, real estate, shares and the credit industry will be among the largest players.

BCG projects as the banking sector will account for over a third of all tokenized assets at the end of the decade. This proportion will grow to over 50% by 2033. According to Laurent Marochini, CEO of Standard Chartered Luxembourg,

tokenization will register the highest growth in sectors where it offers concrete benefits.

“Tokenization is moving forward at different speeds over asset classes – fastest where it delivers real efficiency and where conditions allow secondary markets to emerge,” he abandoned.

According to rwa.xyzTokenized assets have a market value of $ 246 billion. However, Stablecoins dominates the sector to over $ 226 billion, with private credit a remote second of $ 12.5 billion. The US Treasury and Goods are the other remarkable asset classes.

Growth in tokenization Has been consistent in recent years, and it has not been affected by “crypto” volatility, BCG noted. It attributes this to “limited link” between tokenization and “crypto”, with the former that grows beyond the digital asset sector.

“With the latest growth of RWA, people outside the crypto industry ask routinely (OM) tokenized assets’ potential to handle historically underpenetrated segments. Global adoption is prepared to grow exponentially,” commented Yue Hong Zhang, the CEO of BCG HONG Kong.

Tokenization grows in three phases, the report added. In the first, characterized by the adoption of low risk, most participants have been involved in limited pilots and tokenized regulated instruments as money market funds. The Blackrock’s BUIDL fund of $ 2 billion has been prominent in this phase.

The second phase will be characterized by institutional adoption aboard higher return assets such as private credits and corporate bonds. This phase will focus on unlocking wider value, from liquidity to compositions, says the report.

A shift at system level will highlight the third and most defining phase as tokenization takes over the ill -widened asset classes, from real estate to private equity.

Poor infrastructure, lack of interoperability, fragmented regulations and high initial costs stand out as the most important challenges for tokenization. However, there has been enormous progress globally, and BCG believes that most of these challenges will be resolved over the next five years.

“The conditions for broader adoption are in line. The technology is clear, the regulation is being developed and cases of basic uses are on the market,” commented Martijn Siebrand, the digital assets leads at Dutch Bank ABN AMRO.

Dubai launches real estate tokenization

As a tokenization abuse globally, Dubai positions himself as a global leader with several high-profile RWA tokenisation projects. In the last step, the city’s real estate and digital asset rules have announced a new partnership to enable Real estate cohenization.

Dubai Land Department (DLD) announced The partnership with the city Virtual assets supervisory authority (Be) on April 6, which aims to “improve Dubai’s global position as a leading hub for investment and innovation in the real estate sector.”

According to the collaboration, the two will link the city’s property register to real estate -pokenization through a tailor -made control system that they claim is the first of its kind globally. The ultimate goal is to increase the liquidity of the market and improve efficiency in DubaiProperty management company.

The announcement comes just three weeks after DLD revealed It had launched a real estate tokenization program, during which it would be the first city in the Middle East to issued the title act on Blockchain. It is estimated that tokenized property in 2033 would account for at least 7% of the city’s lucrative properties, which amounts to $ 16 billion.

Helal Almarri, who commented on the latest cooperation and stated that it reflects the city’s DNA for future -oriented innovation. Almarri leads the Dubai World Trade Center.

“This cooperation agreement aims to advise a clear model that can enable more inclusive financial participation, with legal safeguard measures to recognize fractional ownership,” he said.

See: Tim Draper Talks Tokenization with Kurt Wuckert Jr.

https://www.youtube.com/watch?v=ky-wk2koz3K Width = “560” Height = “315” Ramborder = “0” Allowed STCREEN = “Allowed Santcreen”>