Key dealers

- None of Tesla’s 11 509 Bitcoin was sold during the first quarter of 2025.

- Energy production and storage revenue for Tesla grew by 67% during the first quarter.

Tesla held 11 509 Bitcoin in his reserves during Q1 2025 without selling any, according to the company’s first quarter Income report was released on April 22.

The electric vehicle manufacturer remains involved in his Bitcoin Holding strategy regardless of market conditions.

Bitcoin finished in the first quarter by about 12%and left Tesla’s Bitcoin holding at about $ 951 million at the end of Q1 2025, according to the report.

But with Bitcoin growing about 6% to $ 93,000 on Tuesday, the value of Tesla’s Bitcoin Stash has risen over $ 1 billion, data From TradingView -Show.

While its Bitcoin position remained untouched, Tesla’s revenue report from Q1 2025 revealed several changes within its core business.

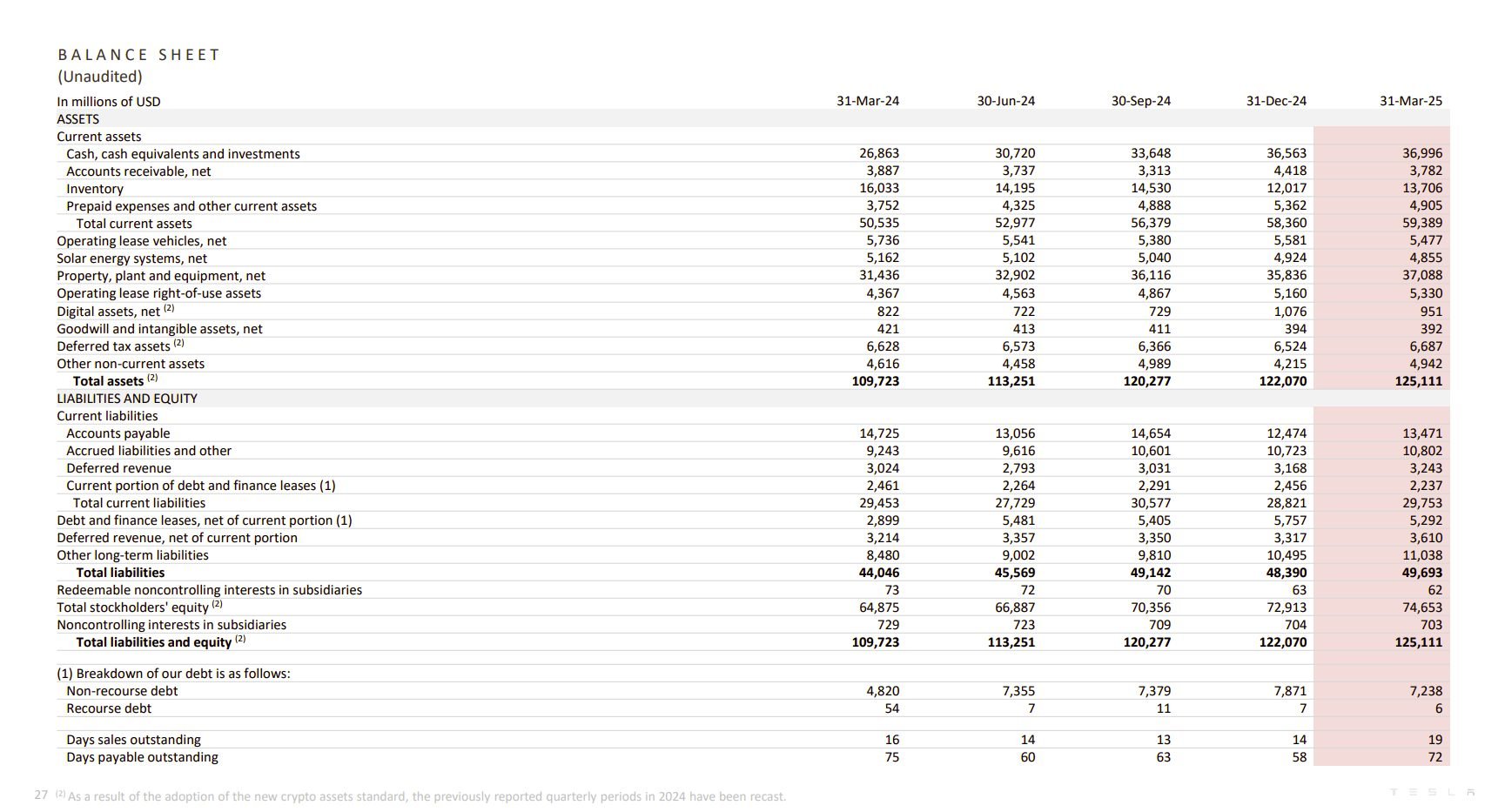

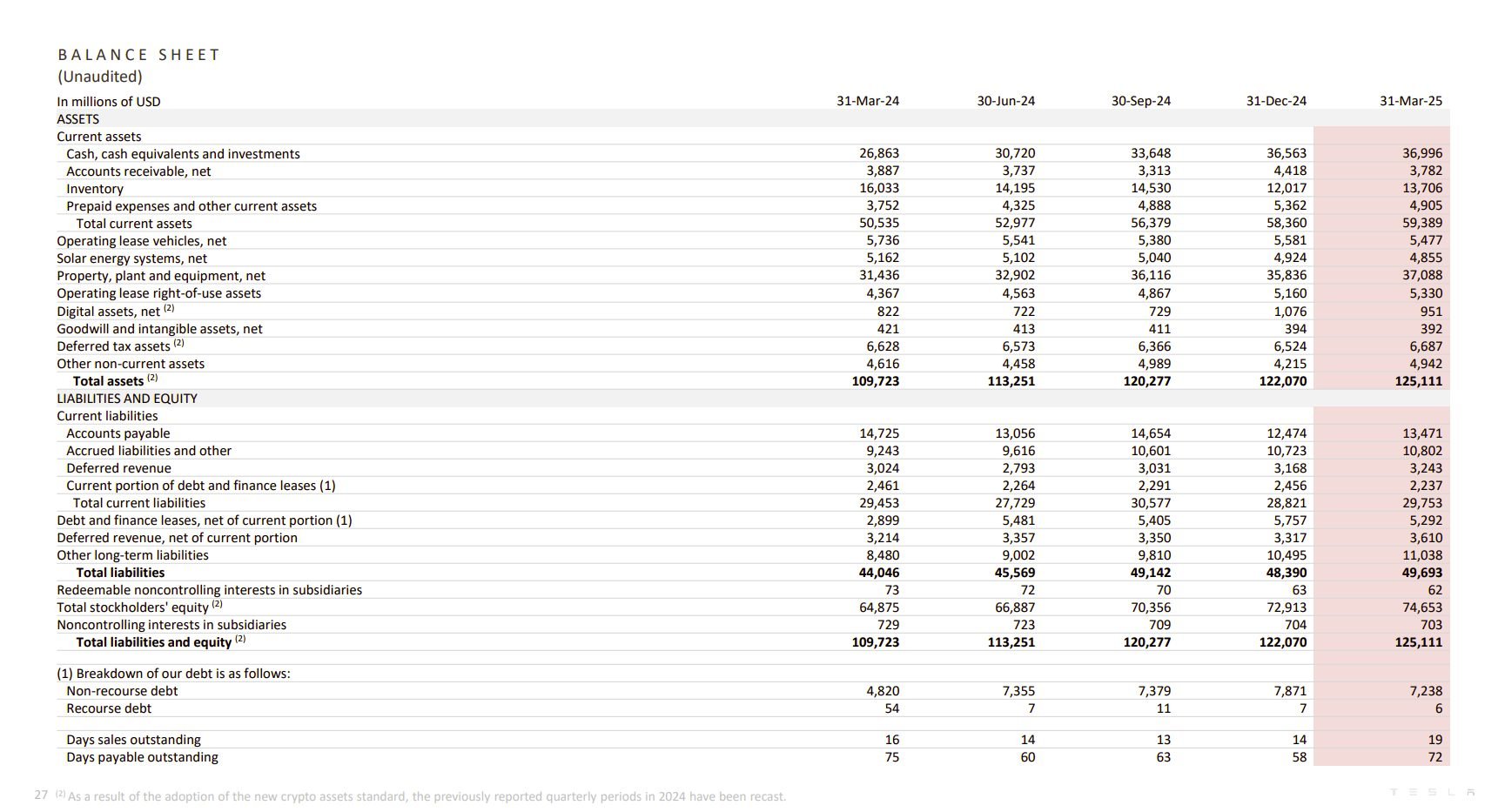

Tesla reported a disappointment quarterly financial results, with adjusted earnings per share of $ 0.27, missing analysts’ expectations of $ 0.41– $ 0.42.

Revenue decreased by 9% compared to approximately $ 19 billion, during the expected $ 21 billion. Automotive Revenue also dropped 20% in the middle of lower deliveries and price reductions.

The company’s vehicle delivery decreased 13% compared to Q1 2024, while production decreased by 16%. According to Tesla, the production decline was caused by an update of four production lines for Model Y.

However, Tesla’s energy segment saw strong growth and reported revenue from 67% from year to year. Revenue for regulatory loans increased to $ 595 million, up from $ 432 million a year earlier.

During the revenue call, Elon Musk announced plans to reduce his involvement in the White House’s Dogge office to focus more on its operations.

“From next month, I will distribute much more of my time to Tesla, now that the great work of establishing the department for the government’s effectiveness is done,” Musk said.

Musk’s controversial role in the Trump administration has led to protests, vandalism and boycotts in recent months.

Tesla’s shares have dropped by about 41% so far this year, according to Yahoo Finance data. The share increased almost 5% in trade after hours after Musk’s announcement.