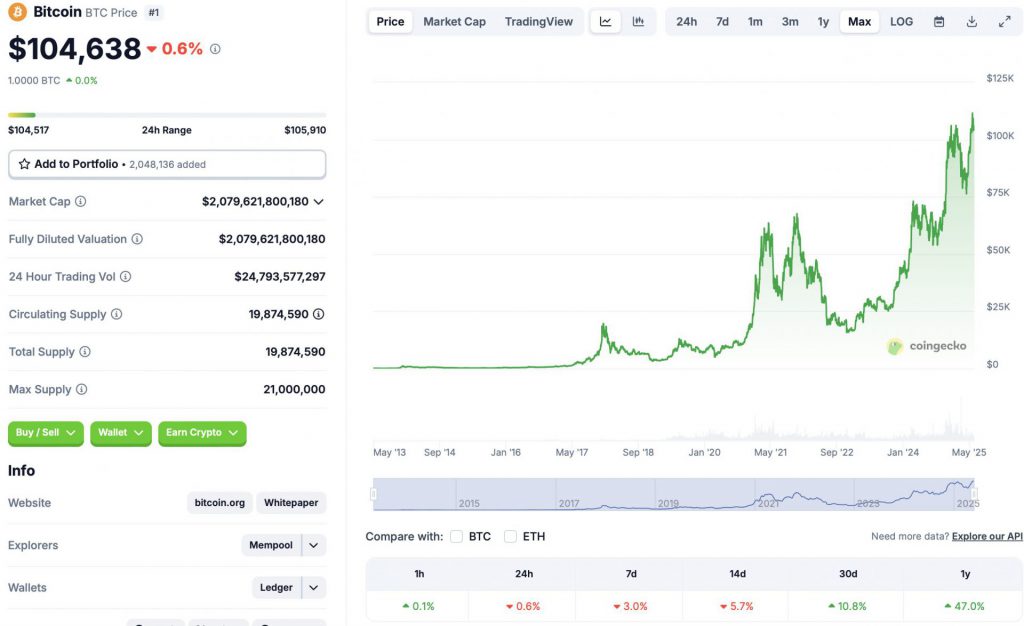

Bitcoin (BTC) experienced one of its most significant meetings in May this year. The original Crypto’s price increased to a maximum of $ 111,814 on May 22. BTC’s price has since met a small correction. Access has dropped by 6.4% since its peak.

Bitcoin dips when blackrock sells

BTC’s incredible rally last month was probably due to an increase in institutional investments. Blackrock, the world’s largest asset manager, bought more than $ 3 billion in BTC in May.

Also read: Blackrock sold Bitcoin and bought Ethereum: Are you going?

BTC’s price is down 0.6% in daily charts, 3% in the weekly clips and 5.7% in the 14-day diagrams. Despite the dial, the original crypton increases by 10.8% compared to the previous month and 47% since June 2024.

The dip may also have been triggered due to macroeconomic factors. Negotiations between the US and China have introduced significant uncertainty. The Federal Reserve has not yet announced an interest rate reduction for 2025. An interest rate reduction can lead to an increase in risky investments when borrowing becomes easier. Bitcoin (BTC) and the larger crypto market may experience a large rebound if the Fed will lower interest rates soon.

Massive incoming rally

According to Coincex, BTC will collect in the next two months. The platform expects the asset to hit a new highest time of $ 177,917 on August 22. BTC’s price will face a close to 70% rally from current levels if it climbs to $ 177,917 level.

According to Ark Investment Ceo Cathie Wood, Bitcoin (BTC) will see a price increase very soon. Wood emphasized BTC’s scarcity as a reason for her faith. Wood has previously said that BTC could even increase to a high $ 1.5 million.

BTC to $ 1 million

Wood is not the only person who thinks BTC will break $ 1 million. Binance founder Changpeng Zhao (CZ) also shares a similar feeling. In an interview, CZ stated that BTC could hit a high out of $ 500,000 to $ 1 million this cycle.

Bitcoin (BTC) is among the best performing assets for the past half a decade. The original Cryptocurrency has exceeded large technical shares and goods. The crypto industry has seen incredible growth in recent years. The approval of 11 Spot BTC ETFS 2024 was an important milestone for the industry. Financial institutions were finally able to open their doors to the budding industry after many years of crypto has been driven around.

Blackrock CEO Larry Fink has gone so far as to say that the US dollar may not remain the global reserve currency for a long time. In a 2025 letter to the shareholders, FINK said that digital currencies such as Bitcoin (BTC) could eventually become the global reserve currency. Fink’s words have a lot of emphasis for them because Blackrock is the world’s largest asset manager. The company has about $ 11 trillion of assets under its management.

US President Donald Trump has also taken a cautious attitude to the crypto industry. He even accepted Bitcoin (BTC) as payment for his presidential campaign. Trump has said he wants the crypto industry to flourish in the United States. The pro-Crypto administration can lead to an increase in investors’ trust. We may come into one of the most haus -like phases in crypto history. The scene can be set for BTC to finally break $ 1 million.