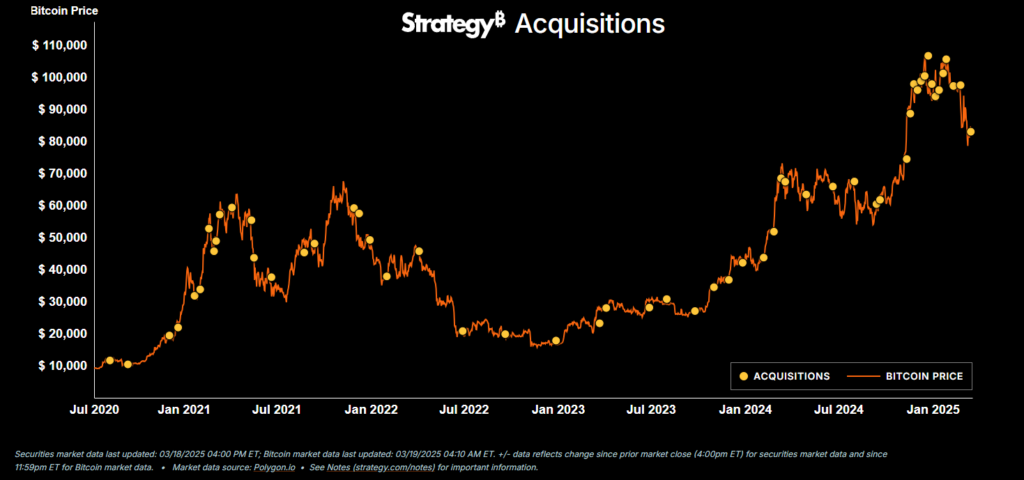

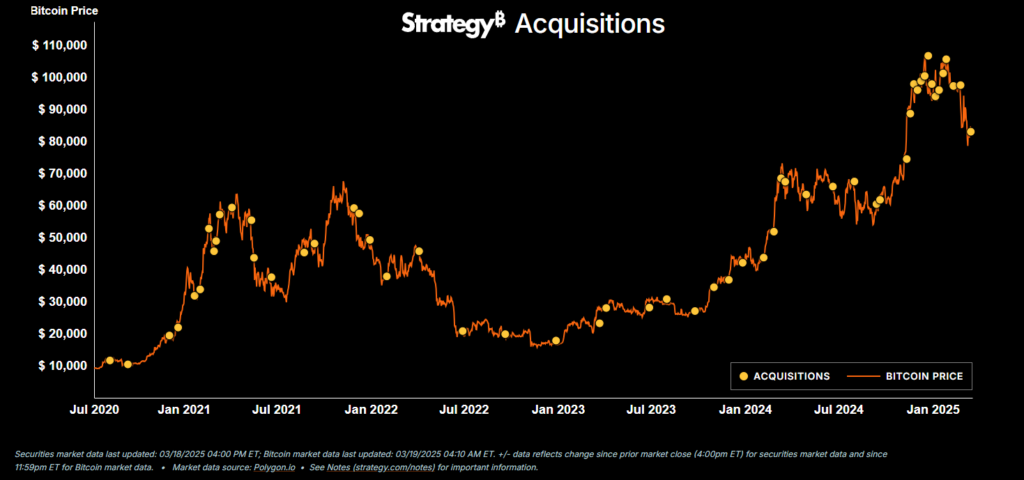

Bitcoin -acquisition has taken the center right now as Strategy announces a stock offer of $ 500 million aims at significant bitcoin accumulation. This bold feature can potentially result in over 100,000 BTC added to their Treasury, which would make it perhaps the largest company’s Cryptocurrency investment that we have seen so far.

Also read: Buy Silver Now: XAG/USD to reach $ 35, nail 15% surface

Strategy stock offer of $ 500 million to Supercharge Bitcoin -acquisition

Stock that offers details

The preferred share includes a fixed 10% annual dividend rate, with payments that are expected to start around June 30, 2025. The dividend rate can increase up to 18% if the payments are delayed or missed.

Strategy specified:

“Strategy intends to use the net profit from the offer for general business purposes, including the acquisition of Bitcoin and for operating capital.”

Also read: Dogecoin: Dogge founded for a 200% wave: here is when

Expanding Bitcoin acquisition

Michael Saylorwhich is the co-founder of the strategist and the executive chairman, has consistently and enthusiastically supported Bitcoin acquisitions as a core strategy for the company.

Saylor forecasted:

“Bitcoin was able to reach $ 13 million in 2045, with a haus -like scenario that pushed its price to $ 49 million and a Baisseish prospect that invests it to $ 3 million.”

Market effect

Strategy’s aggressive and ongoing bitcoin acquisition really stands out against the current marketing entry. At the time of writing, Cryptocurrency acts somewhat cautiously, with several experts suggesting a potential market cooling.

Cryptoquant CEO Ki young after all Predicted:

“Bitcoin will experience 6 to 12 months of either a baisse -like trend or lateral movement.”

Despite this rather cautious view from market analysts, the strategy continues to conduct their Bitcoin accumulation strategy, and it is worth noting that they still have about $ 20.99 billion in STRK shares available for issue and sales from March 16.

Also read: BRICS: New country plans to reduce 25% of trade without US dollars

Long -term vision

Bitcoin acquisitions that the strategy does represent a long-term view of Cryptocurrency investments. The company has also been involved in various supervisory authorities, including Sec’s Crypto Task Force, and has even participated in the White House’s crypto summit, which hosted President Donald Trump.

Saylor claimed:

“A strategic Bitcoin reserve can generate between $ 16 trillion and $ 81 trillion for the US Treasury in 2045 and potentially compensate for national debt.”

This latest share offer for Bitcoin -acquisition signal strategy is unmatched and determined commitment to building what can become the world’s largest company’s bitcoin Treasury, despite all the current market volatility and regulatory uncertainty found in the Cryptocurrency space.

Also read: ChainLink (link) Price: When will Link reach $ 24?