Key dealers

- Strategy plans to offer up to $ 21 billion in the preferred warehouse to expand its Bitcoin holdings.

- The company uses different financing methods, such as shoulder offers and outdoor issues, to finance Bitcoin acquisitions.

Strategy plans to sell up to $ 21 billion in 8.00% Serie A Eternal strike preferred warehouse through one on market victim, according to a Monday File with sec. The company intends to use the net profit from this offer for general business purposes, including Bitcoin acquisition and operating capital.

As described in the archiving, the NASDAQ-listed company entered into a sales agreement with multiple financial institutions, including TD Securities, Barclays Capital and Cantor Fitzgerald, to manage share sales. The preferred shares will trade on the Nasdaq Global Select market under the ticker “Strk.”

The offer will be implemented over time through 12 financial institutions that act as sales agents, which will receive up to 2% of gross income.

The preferred share has an annual dividend of 8.00% based on a liquidation preference of $ 100 per share, is paid quarterly on March 31, June 30, September 30 and December 31. Shareholders can convert their preferred shares to a -share to a price of $ 0.1000 A shares per preferred share, with a first conversion price of $ 1,000 per class A share.

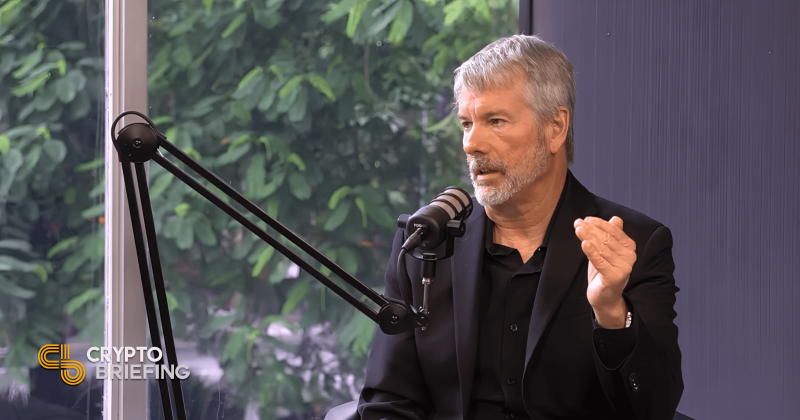

The offer marks another feature by strategy to increase its bitcoin Treasury position. The company has previously used debt offers and issues for shares to finance Bitcoin acquisition under the leadership of the executive chairman Michael Saylor, who has proclaimed Bitcoin as a Treasury Reserve access.

Earlier this year, the strategy announced a plan to raise $ 2 billion through equity offers to finance more Bitcoin purchases as part of their “21/21 plan.”

The 21/21 plan is the company’s strategic initiative to raise a total of $ 42 billion over three years, including $ 21 billion in equity and $ 21 billion in interest rates. The goal is to use the raised capital to acquire more Bitcoin, further strengthen its position as the world’s largest Bitcoin Treasury Company.

From the beginning of 2025, the strategy had already collected $ 15 billion through equity and $ 3 billion through convertible debt. The company shifts its focus on interest emissions this year.

Strategy currently has 499 096 BTC, valued at $ 41.5 billion at current market prices.