StrategyBitcoin holding can potentially double in the near future, according to a new Bernstein Analysis which has set a fairly ambitious price case of $ 600 for the company’s share at the time of writing. This particularly hausse -liked views comes right after Strategy’s performance report And also signals a significant growth potential for Cryptocurrency investments in the midst of the current market conditions we see.

Also read: Shiba Inu Surge Eyes 61% rally in 2025 – But first a 20% test?

Bitcoin price target of $ 600: Why the strategy holding will increase

Expanding bitcoin position

The strategy that Bitcoin Holdings is currently expected to reach up to about 5.8% of the total Bitcoin offering, according to the latest Bernstein forecasts that were just released. This enlargement is in line with its aggressive bitcoin prize goals that see Cryptocurrency that may reach about $ 200,000 at the end of 2025, about $ 500,000 at the end of 2029, and even a staggering $ 1 million at the end of 2033.

Also read: Pepe at launch vs. Today: What would an investment of $ 500 look like?

Forecasts for economic growth

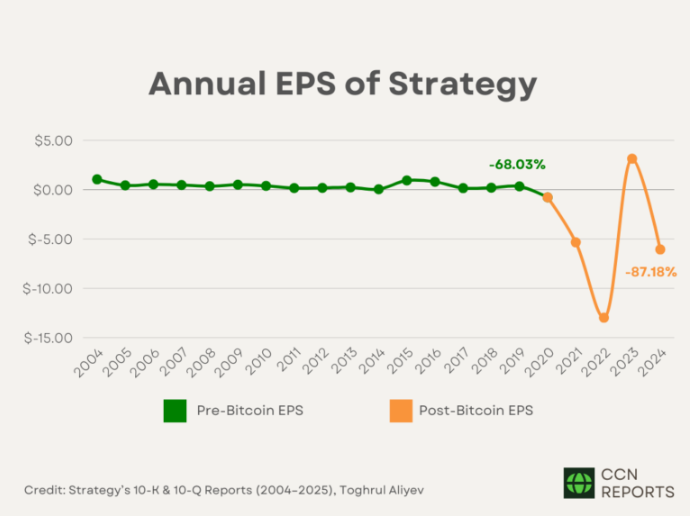

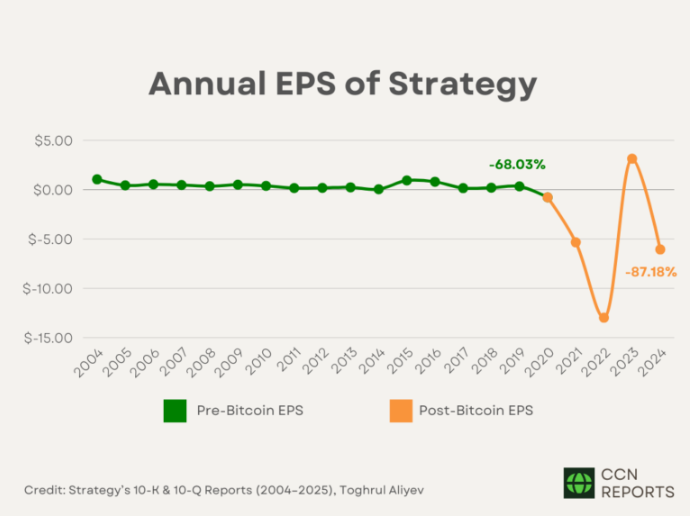

The analysis also predicts a fairly dramatic expansion in the financial position of the strategist, with debt that is potentially growing from the current $ 11 billion to something like $ 100 billion. This utilized strategy for Cryptocurrency investment is expected from now to generate capital gains of about $ 84 billion or so.

Market consequences

The Bitcoin Price Goal of the $ 600 for the strategy share represents a potential 75% up from current levels at this time, which is quite significant. This somewhat optimistic view comes despite the ongoing concerns about uncertainty in the legislation and also the market fluctuations that have happened recently.

Also read: Gamestop to follow Strategy’s Bitcoin Playbook: Will Gme Stock Skyrocket or Crash?

Investment perspective

The strategy Bitcoin Holdings represents one of the most aggressive institutional positions in the Cryptocurrency space right now. The success or failure of this approach can affect how other companies are approaching Digital Asset Treasury Management in the future.

The long-term Bitcoin pricing target calculations from Bernstein seem to indicate a certain confidence that extends beyond just the short-term market conditions that we are currently experiencing. These forecasts mainly frame bitcoin as a strategic reserve access rather than just a speculative investment, which is an interesting perspective.

Bernstein’s Cryptocurrency -Investment Analysis recognizes several challenges, such as regulatory obstacles, security problems and even environmental considerations, but it still maintains its generally haus -like view on the strategy’s strategy at the moment.

In summary, Bernstein’s $ 600 prize target reflects a degree of optimism about both the company’s Bitcoin accumulation strategy and also the long-term growth potential of digital asset in general.