Key dealers

- Strategy acquired $ 15,355 Bitcoin for $ 1.4 billion, which increased its holding to 553,555 BTC.

- The acquisition was financed by selling shares.

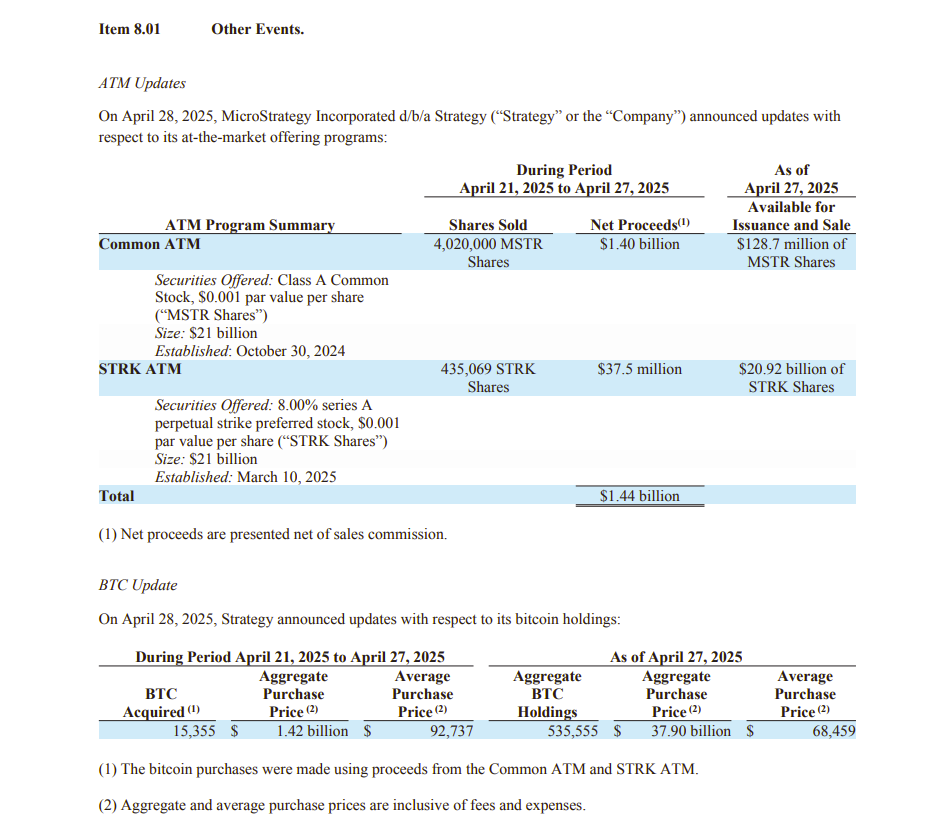

Strategy, the largest business owner in Bitcoin, announced on Monday that it had acquired another 15,355 bitcoin for approximately $ 1.4 billion. The purchases, which were made between April 21 and April 27, were made at an average price of $ 92,737 per coin.

The strategy has acquired $ 15 355 BTC for ~ $ 1.42 billion to ~ $ 92,737 per bitcoin and has reached the BTC exchange at 13.7% YTD 2025. From 4/27/2025, we Hodl 553,555 $ BTC Acquired for ~ $ 37.90 billion to ~ $ 68,459 per bitcoin. $ mstrers $ Strk $ STLFhttps://t.co/m5acwas6kn

– Strategy (@strategy) April 28 2025

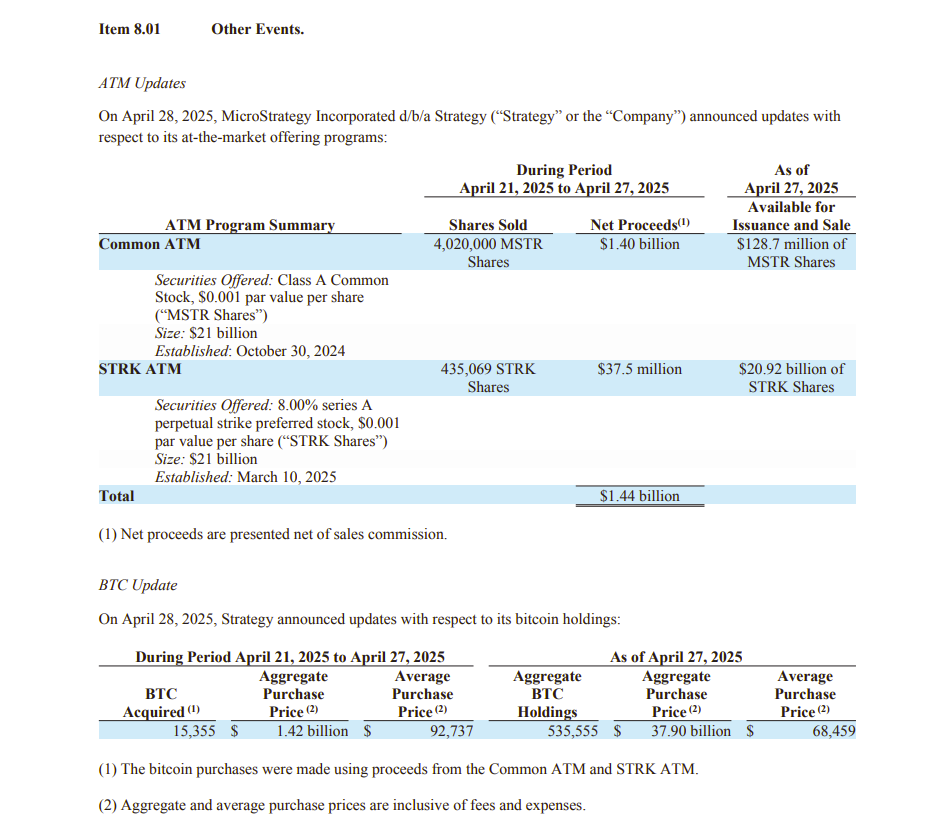

Strategy funded its latest Bitcoin acquisition through revenue from its stock offers, shown in a new Sec File. Between April 21 and April 27, the company gathered at approximately $ 1.4 billion by selling 4.02 million shares by its Common A -Stamaktie (MRST) and 435,069 shares in its 8.00% Series A Preferred Stock (StRK).

The latest acquisition provides the strategy’s total Bitcoin holding to $ 553,555, valued at approximately $ 52.7 billion at current market prices. From the press time, Bitcoin is traded close to $ 95,300, according to TradingView data.

Bitcoin’s increase to $ 95,300 has turbocharged Strategy’s Bitcoin holding and transforms its investments of $ 37.9 billion, acquired at an average price of $ 68,459 per coin, to approximately $ 15 billion in unrealized profits.

This marks the third week’s strategy in a row has added its Bitcoin reserves. Just last week the company reported buys 6 556 BTC During the week ending April 20th.

The announcement follows a post from Michael Saylor on Sunday Airing Strategy Bitcoin Portfolio Tracker, often interpreted by the market as a precursor to a large acquisition update.

Shares of Strategy (MRST) increase 1.6% in trade before the market on Monday, after a profit of 5% last Friday, according to Yahoo Finance.