Key dealers

- Sayor’s strategy bought $ 6,556 Bitcoin for $ 555 million between 14 and 20 April.

- Strategy aims to hold $ 42 billion in bitcoin by the end of 2027.

Michael Saylor’s strategy today announced that the company had purchased another 6,556 bitcoin at an average price of $ 84,785 between April 14 and 20 and spent approximately $ 555 million on the coins.

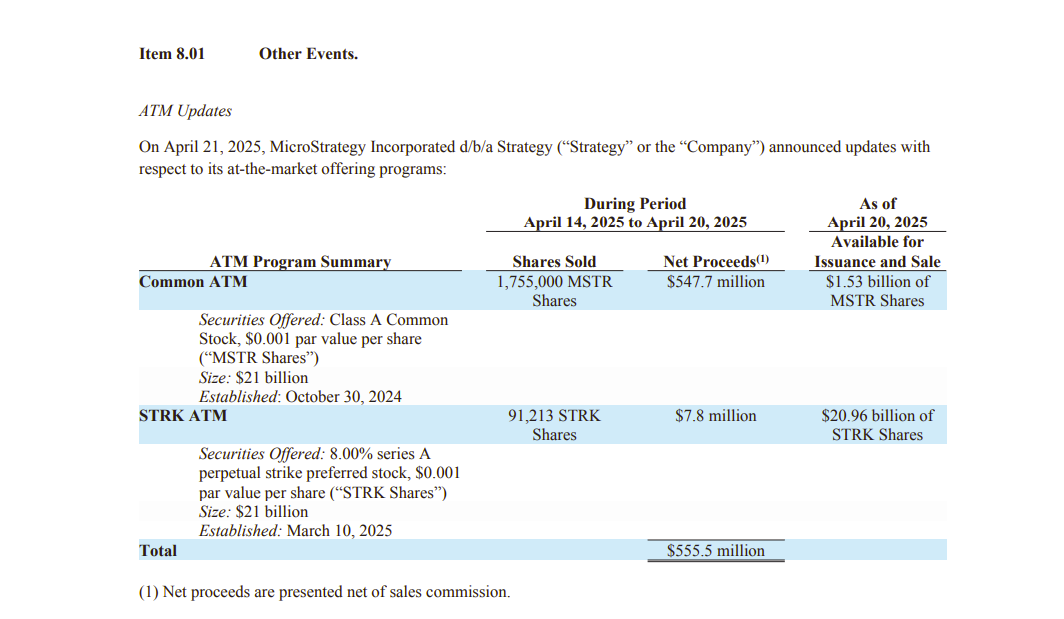

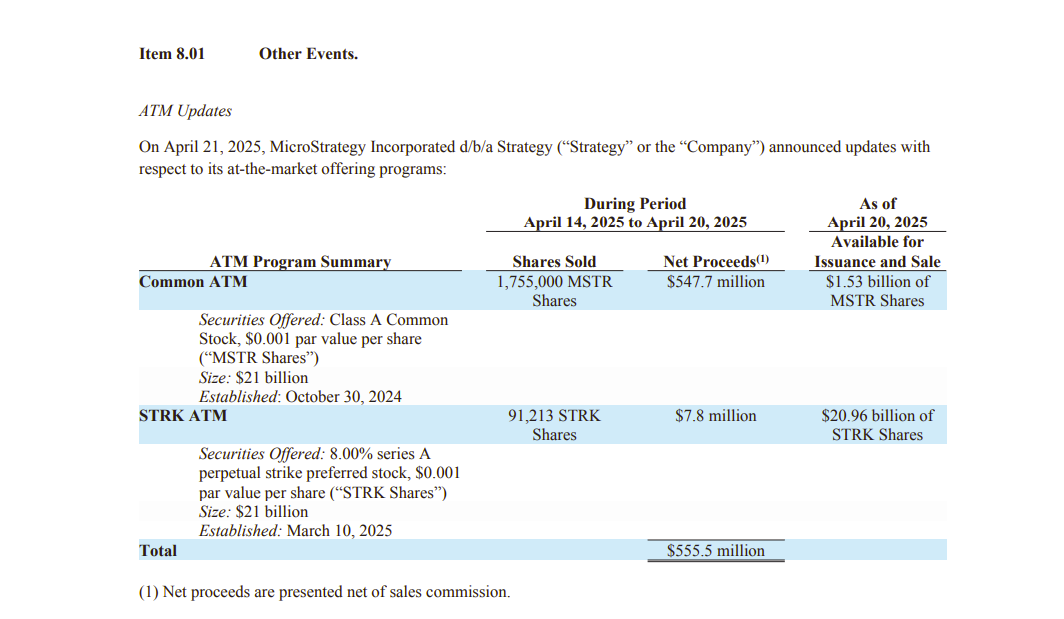

The purchase was funded through revenues from the strategy’s joint ATM share offer and Serie A ever convertible preferred share offer. Between April 14 and 20, the company sold 1.7 million MST shares and over 91,200 STRK shares, generating a total net profit of over $ 555 million, as described in a Monday Sec File.

As of April 20, the strategy still has over $ 1.5 billion in MRST shares and almost $ 21 billion in STRK shares available for future emission and sales.

Strategy has undertaken to increase its Bitcoin holdings after setting a goal to collect $ 42 billion in Bitcoin at the end of 2027, regardless of market conditions.

With the new purchase, the company now has 538 200 Bitcoin, corresponding to over 2.5% of the total BTC range. The stash is valued at approximately $ 47 billion at current market prices.

The announcement followed Saylor’s post on Strategy’s Portfolio Tracker on Sunday, a feature that was often regarded as a signal that an acquisition announcement is imminent.

The latest purchase also marks the other weeks in a row with Bitcoin acquisition. Last week the company revealed that it had acquired 3,459 bitcoin for almost $ 286 million.

Saylor also revealed on Sunday that over 13,000 institutions now have direct exposure to strategy. The expanding presence of strategy in the financial markets and its inclusion in Nasdaq 100 has attracted both retail and institutional investments and channeled more capital to Bitcoin.

Based on public data from the first quarter of 2025, over 13,000 institutions and 814,000 retail accounts $ mstrers directly. An estimated 55 million beneficiaries have indirect exposure through ETFs, funds, pensions and insurance portfolios.

– Michael Saylor (@Saylor) April 20 2025