Key dealers

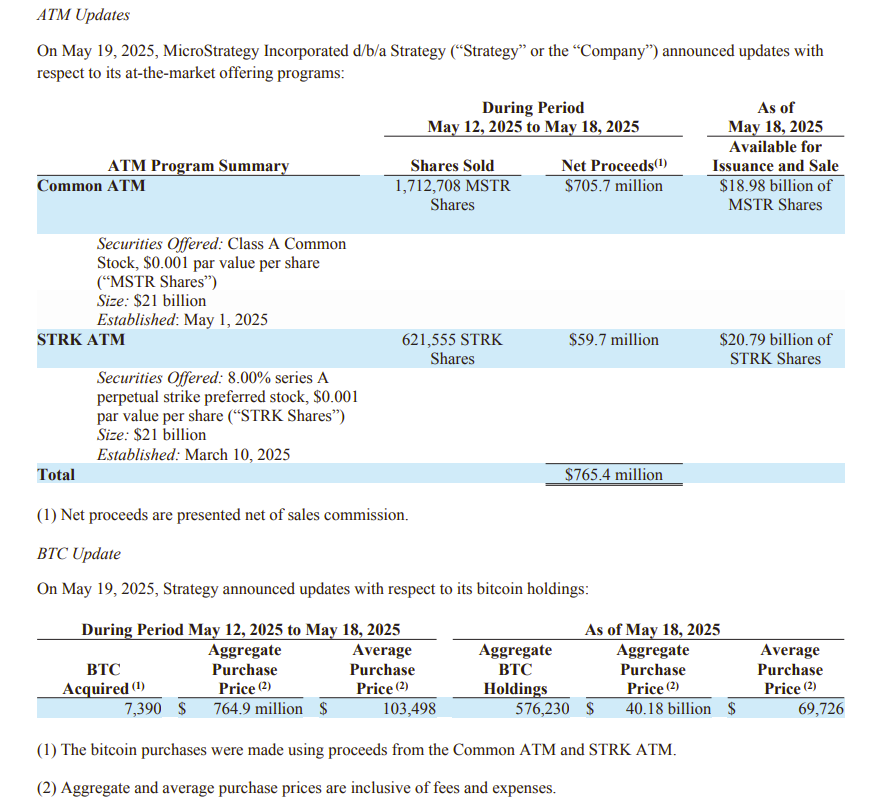

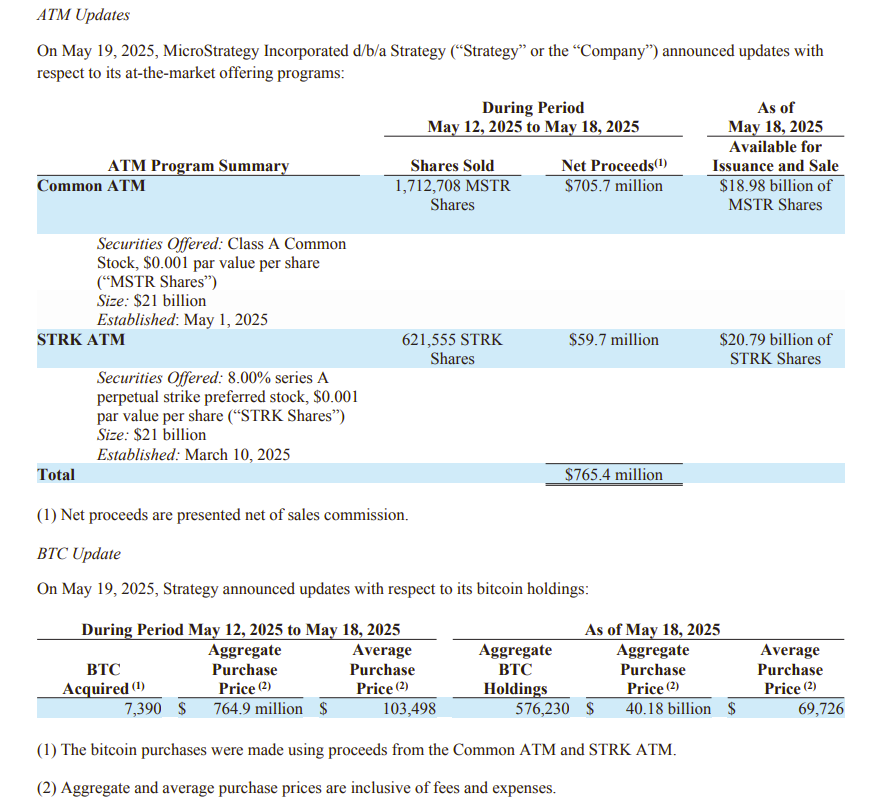

- Strategy bought 7,390 Bitcoin for $ 555 million at an average price of $ 103,498.

- The company aims to hold $ 42 billion in Bitcoin in 2027 and collected 576,230 BTC so far.

On Monday, Michael Saylor’s strategy revealed that it had bought $ 7,390 Bitcoin between May 12 and 18 and invested approximately $ 765 million in the acquisition. With this feature, the company has increased its Bitcoin holdings to 576,230 BTC, currently worth over $ 59 billion.

The software company funded its latest Bitcoin acquisition through capital raised from its joint ATM share program and an eternal convertible with Serie A, according to one Monday File with sec.

During the previous week, the strategy sold approximately 1.7 million MST shares and more than 621,555 STRK shares, generating over $ 765 million in the net profit.

The company still owns over $ 18.9 billion in MRT shares and approximately $ 20.7 billion in STRK shares that remain authorized for future issue and sales. It aims to collect $ 42 billion in Bitcoin at the end of 2027, regardless of market conditions.

As the largest business owner of Bitcoin, the strategy now controls over 2.7% of the total BTC offering, followed by Mara Holdings and Tether-backed twenty, the recently established Bitcoin-in-born company.

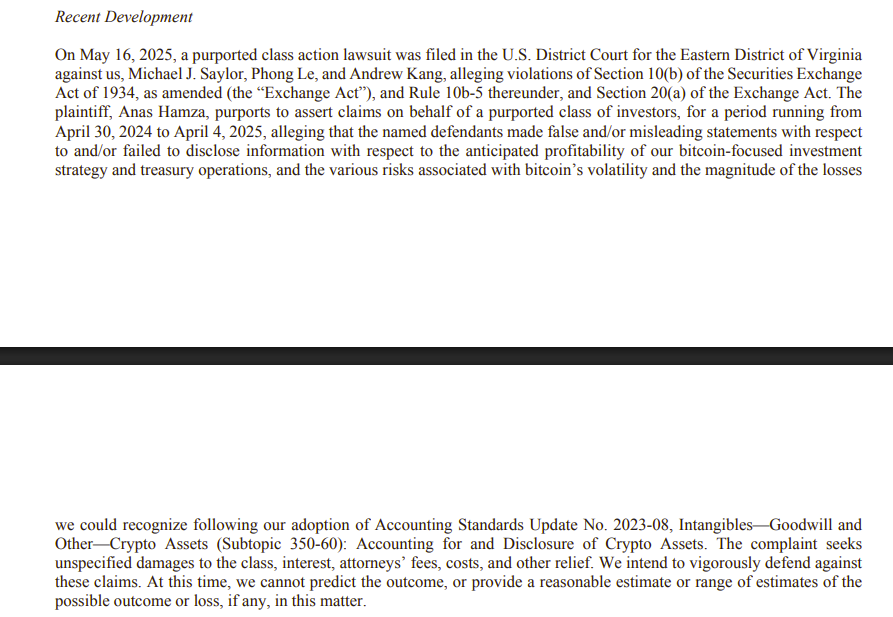

In today’s Sec -disclosure, the strategy also said that it is facing a lawsuit that was submitted on May 16, 2025 in the US District Court of the Eastern District Virginia. The suit claims that strategy and its managers made misleading statements and failed to reveal risks related to its Bitcoin strategy and new crypto accounting rules.

The company plans to vigorously defend itself against the claims and said that it cannot yet estimate the result or the potential financial effect.