Key dealers

- Strategy has acquired 580 955 Bitcoin, which amounts to almost 3% of Bitcoin’s total supply.

- Institutional interest in Bitcoin Treasury Holdings is increasing, with over 70 units that now hold Bitcoin.

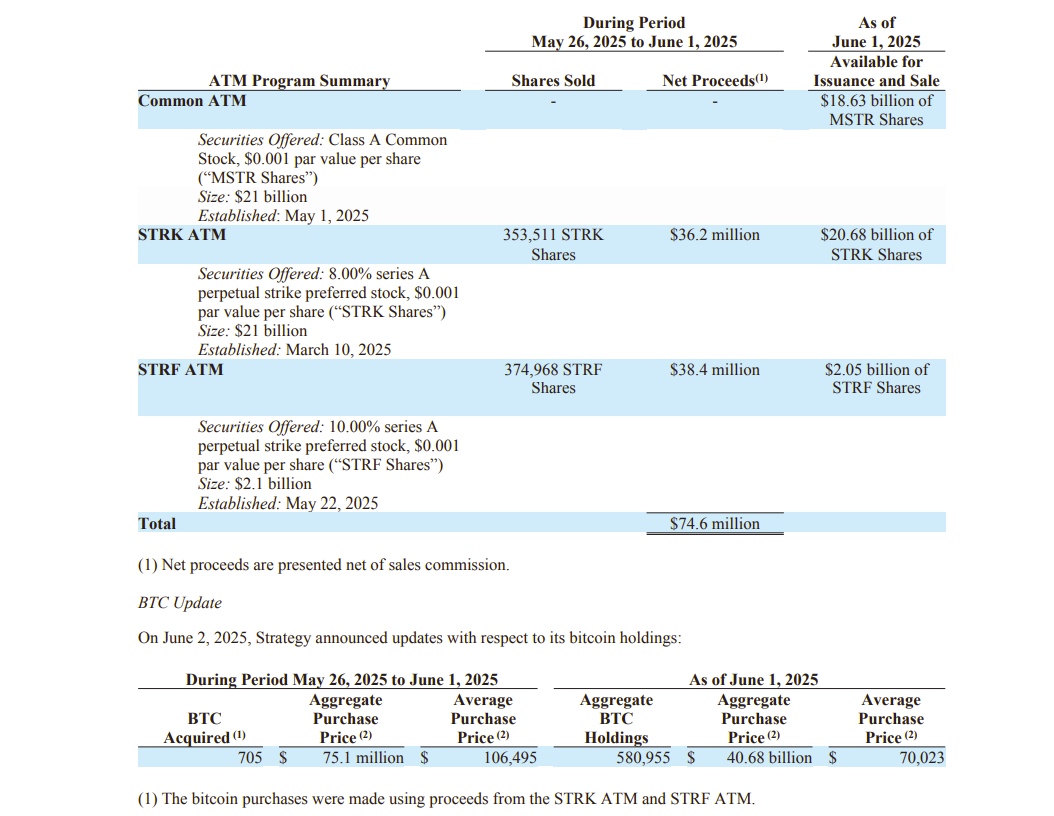

On Monday, Michael Saylor’s strategy announced that the company had scooped up another 705 Bitcoin during its eighth straight week with purchases, giving the total holding at 580,955 BTC valued at over $ 60 billion.

Strategy has acquired 705 BTC for ~ $ 75.1 million to ~ $ 106 495 per bitcoin and has reached BTC exchange of 16.9% YTD 2025. From 6/1/2025 Hodl 580,955 $ BTC Acquired for ~ $ 40.68 billion to ~ $ 70,023 per bitcoin. $ mstrers $ Strk $ STLFhttps://t.co/f1po1gtrio

– Strategy (@strategy) June 2, 2025

The strategy’s latest purchase took place this week, which ended June 1, with an average acquisition cost of $ 106 495 per coin. With Bitcoin, which is now shopping for over $ 104,000, the company’s unrealized profits have risen over $ 20 billion.

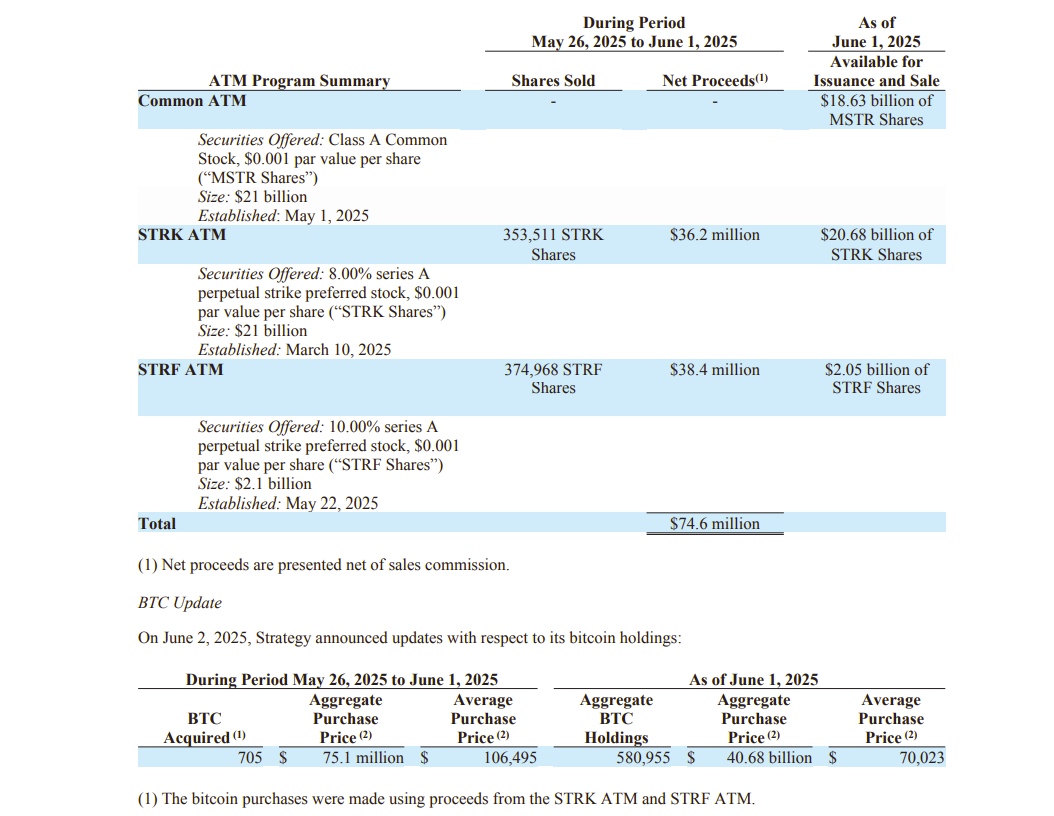

The company financed the acquisition through the sale of various shares between May 26 and June 1, including 353,511 STRK shares for approximately $ 36 million and 374,968 SK -shares for approximately $ 38 million in the net profit.

Bitcoin is down over 4% in the past seven days, tradingview data shows. The digital asset recently reached a record height of approximately $ 112,000 before declining among Baisse-Tarted market factors, including stopped trade calls in USA-Kina, Trump’s proposed steel tariff is increasing and ETF outflows.

During the weekend, Saylor hinted to buy the bitcoin dip With a post showing the strategy’s bitcoin portfolio on Sunday with the caption “Orange is my preferred color”, a feature that usually precedes the purchase messages.

“We will continue to buy bitcoin,” Saylor in a interview With CNBC at Bitcoin 2025 in Las Vegas. “We think it will be exponentially more difficult to buy bitcoin, but we will work exponentially more effectively to buy bitcoin.”

More institutions follow the strategy’s strategy for Bitcoin Treasury Holdings. Over 70 units now have bitcoin on their balance sheets, including the newly established Tether-backed twenty, Trump Media and Gamestop.

The market has had mixed reactions despite the movement’s speed. After announcing their Bitcoin strategies, Trump Media and Gamestop shares decreased 20% and 17% respectively.

“This is short -term dynamics. In the long term Bitcoin in the balance sheet has proven to be extremely popular,” Saylor to CNBC.

Strategy Lager (MRST), despite the recent volatility, has received over 27% year to date and exceeded much of the S&P 500, according to Yahoo Finance data.

MSTR was slightly down in trade before the market on Monday.