Key dealers

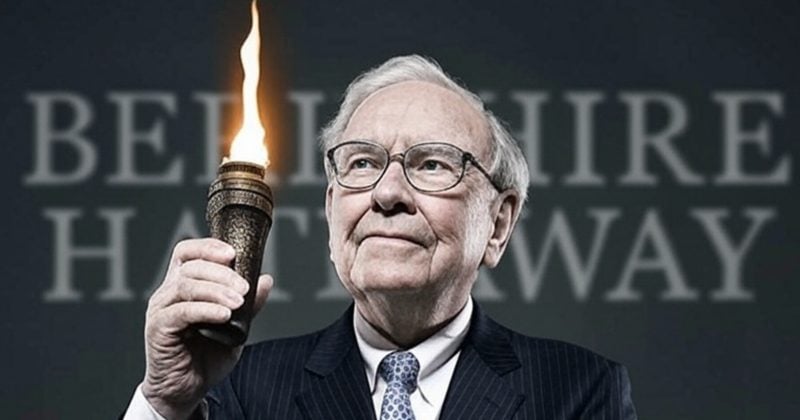

- Warren Buffett will resign as CEO of Berkshire Hathaway at the end of the year, with Greg Abel taking over.

- Under Buffett’s leadership, Berkshire reached a 20% composed annual profit from 1965 to 2024, which surpassed the S&P 500.

The President of the Strategy Michael Saylor has called Berkshire Hathaway, the famous securities company helped by the legendary Warren Buffett, Bitcoin from the 1900s.

Berkshire Hathaway is 20th Century Bitcoin.

– Michael Saylor (@Saylor) May 3, 2025

Saylor made the statement on May 3, the same day as Berkshire Hathaway’s annual shareholder meeting in Nebraska. Shortly thereafter, Buffett announced that he planned to resign as CEO at the end of the year and transferred the torch to Deputy Chairman Greg Abel.

“I think time has come where Greg should become the company’s CEO at the end of the year,” Buffett said at the end of Berkshire’s meeting.

The 94-year-old billionaire, who has been led Berkshire for 60 years, said he would not sell any of his Berkshire shares and plans to remain involved in certain issues, CNBC reported.

The move marks the end of an era for one of the most iconic figures in global financing. Buffett has turned Berkshire into a $ 1.1 trillion conglomerate and has become a symbol of disciplined, long -term investments.

Buffett suggests diversifying to other currencies

During the meeting, Buffett also noted that Berkshire avoids keeping assets tied to collapsing currencies. The company, he said, is open to diversifying to other currencies if the United States is facing financial issues.

“Of course, we wouldn’t want to own something we thought was in a currency that was really going to hell,” he said. “There may be … Things happen in the US that … makes us want to own many other currencies.”

Other important topics that were raised during the meeting included trade, the US economy, investment and politics. With regard to trade policy, Buffett emphasized the value of a balanced global trade and warned that trade conflicts can act as economic warfare.

Buffett expressed deep faith in American exceptionalism and called the United States the best place to be born and invest, but expressed concern about the country’s growing tax deficit and described it as unsustainable in the long term.

He emphasized Berkshire’s opportunistic investment method and revealed that the company had recently considered a deal of $ 10 billion and was able to spend up to $ 100 billion under the right conditions.

Buffett claimed that securities offer much better opportunities than real estate, especially in the United States, and emphasized the company’s unique ability to invest in large -scale energy infrastructure on national politics. He dismissed the latest market vollatility as less and urged investors to remain unmotional.

Buffett avoids bitcoin, but Berkshire has indirect exposure

Warren Buffett has long been a vocal critic of Bitcoin and other crypto assets, famous to describe Bitcoin as “probably rat poison square” and claims that neither he nor Berkshire Hathaway would ever invest in Cryptocurrency directly.

Despite this attitude, Berkshire Hathaway’s warehouse has largely underperformed Bitcoin as a percentage.

Since 2015, and especially since 2020, the gap has been widened. Bitcoin has delivered profits of more than 780% since 2020, compared with about 150% for Berkshire during the same period.

At the time of writing, Bitcoin traded over $ 96,800, slightly down over the past 24 hours, Per Cooiken.

While Buffett claims that Bitcoin has no inherent value, Berkshire has nevertheless been indirectly exposed to the digital asset space through its portfolio companies.

Noteworthy Berkshire has a significant proportion in Bank of America, which has invested in multiple Tot Bitcoin ETFs, including Blackrock’s Ishares Bitcoin Trust (Ibit), according to applications Tracked by FINEL.

The conglomerate has also invested over $ 1 billion in NU Holdings, a Brazilian Digital Bank that runs a cryptop platform and offers various crypto services and thus deepens its exposure to the sector.

In addition, Berkshire has shares in Jefferie’s Financial Group, a company that not only owns a share in Ibit but also actively promotes Bitcoin as a hedge against inflation.