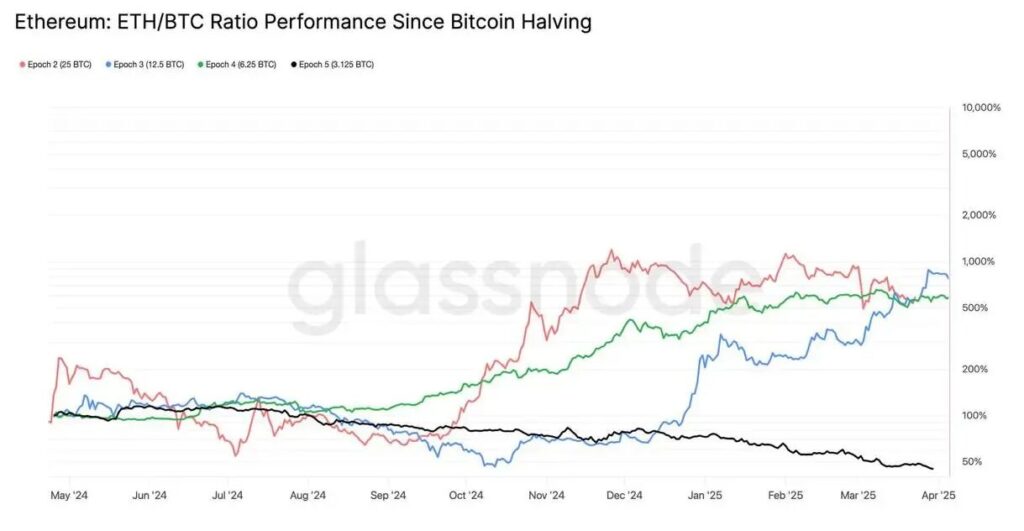

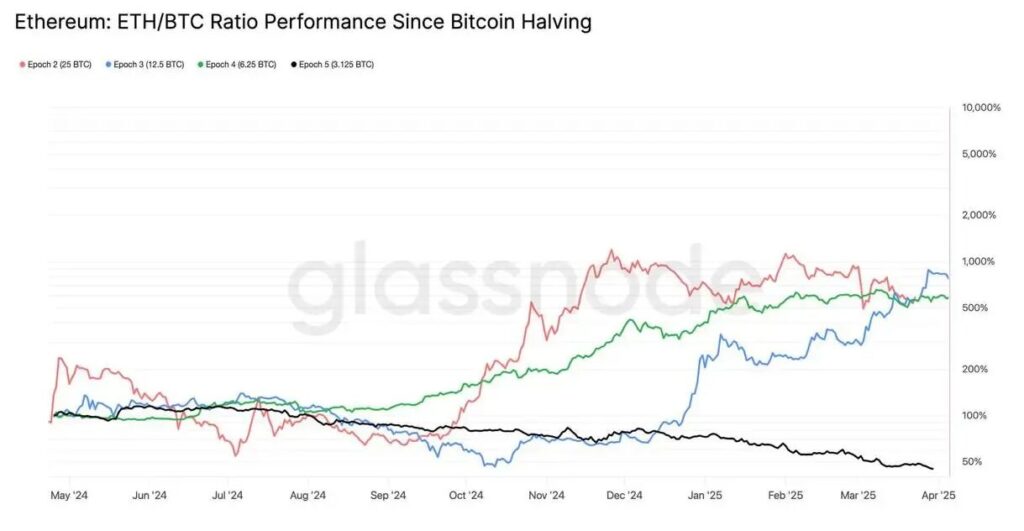

The Ethereum price fall has really been for investors as we go towards the end of the first quarter, with ETH which fell about 39% against Bitcoin to reach a five-year-old. At the time of writing, the ETH/BTC relationship sits on just 0.02191, which breaks many of the historical patterns we have seen in Ethereum vs. Bitcoin performance during these periods after half.

This dramatic ETH market crash happens during what is usually a fairly strong quarter for the asset, and it definitely raises some serious concerns about wider crypto -market vollatility when we are on our way to the second quarter.

Ethereum’s prospects during the second quarter: Price forecasts, risks and market effects

Historical ETH/BTC decline

Ethereum price fall has quite sincerely reached some critical levels, with Ethereum that registered its worst Q1 performance since 2018, almost 46%. This sharp Ethereum vs. Bitcoin Diver is also remarkable as it marks the first time that ETH has underperformed BTC for a year after half, which is outstanding. To make things even worse, ETFs experienced 17 days of outflows in a row, a line that only ended on March 27.

Bitcoin’s more resistant performance

While the Ethereum price fall has recently dominated the headings, Bitcoin has also struggled, but not quite as serious. BTC is currently on its way to a decline of 12.18% Q1 which is actually its worst first quarter’s performance since 2018. This ongoing ETH market crash is really in contrast to the historical patterns that usually show average Q1 gains of about 77% for Ethereum and about 51% for Bitcoin.

Several factors are currently pushing this crypto -market voltility, including a remarkable decline in institutional interest in Tot Bitcoin ETFs, with a total inflow of about $ 1 billion and the longest line of the following inflows this year, which lasts only ten days, which is not very impressive.

Reset signals for Q2

Despite the ongoing Ethereum price fall, some analysts and market strokes still maintain an optimistic view of the second quarter. Various market experts point to potential catalysts that can potentially reverse Ethereum vs. Bitcoin underperforming trend that we have seen.

21st Capital founders their G. stated:

“Within a quarter or less, the uncertainty about customs and cuts of state expenditure is likely to be resolved. The focus will then switch to tax cuts, liberalization and interest.”

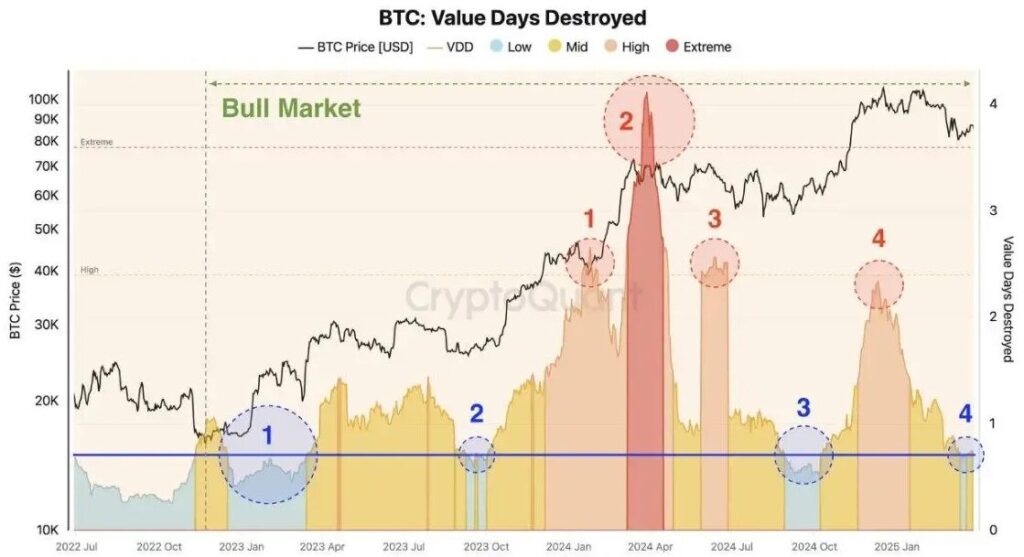

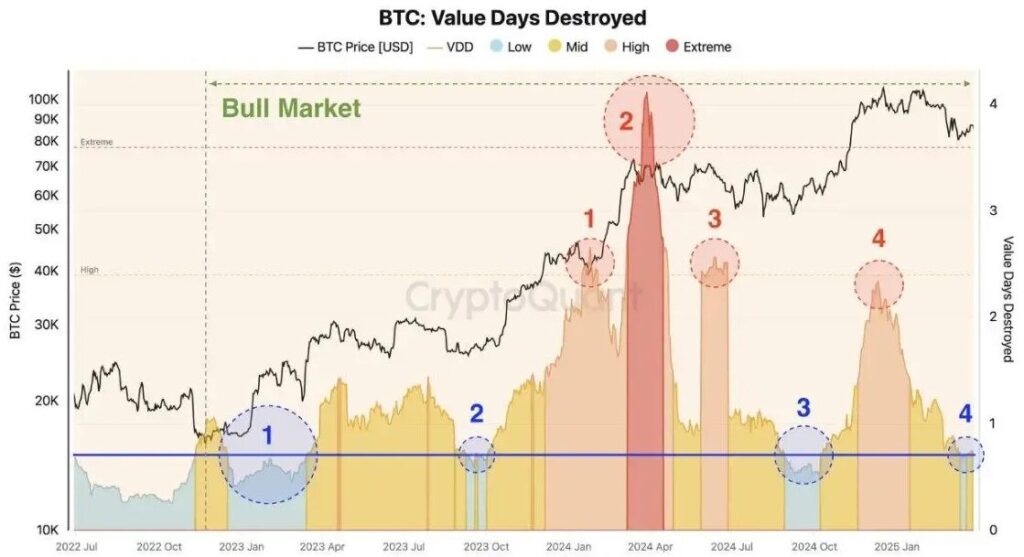

There are also some positive investors’ behavioral signals that emerge, such as the fact that investors have withdrawn over 30,000 BTCs from exchanges just over the past week, which historically indicates a transition from short -term trade to long -term holdings.

In theory, the ETH market crash can start reversing the course soon, especially considering that historical data shows that both Ethereum and Bitcoin usually perform better during the second quarter compared to Q1. However, it is also worth noting that in the short term, crypto market voltility may well continue with President Trump’s customs message planned for April 2 and the upcoming US inflation data on April 10.

Also read: Ripple: With the SEC atmosphere settled, will XRP hit $ 4?

When the Ethereum price fall continues to worry in investors and traders, market players should probably keep a close eye on regulatory development, broader macroeconomic conditions and the potential solution of trade voltages that can affect both assets in the coming quarter.