The Philippines rapidly grow out as a crypto assets, with Filipino crypto owners who are now ranked among the top globally in terms of average holdings. According to Crypto Friendly Cities Index 2025 Through the Global Financial Migration Platform Multipolitan, the country is ranked 20th cryptocentation, with Filipino crypto holders who own $ 14,194.46 (PHP790,000).

This marks a transition from the first few days when crypto interest in the Philippines was largely driven by Play-to-earn (P2E) game. The report noted: “Axie Infinity in the Philippines became a lifeline for thousands of players who wanted to earn income through Play-to-Earn mechanics.” At the height of its popularity, Philippines accounted for 40% of Axie Infinity Global User Base.

While the value of Axie’s symbol Has dropped from its peak during the pandemic, crypto ownership in the country continues to expand. Multipolitan emphasized that the Philippines is no longer defined solely by speculative activity or game But is part of a major transformation in Global Finance.

Southeast Asia’s crypto power plants: where the Philippines stand

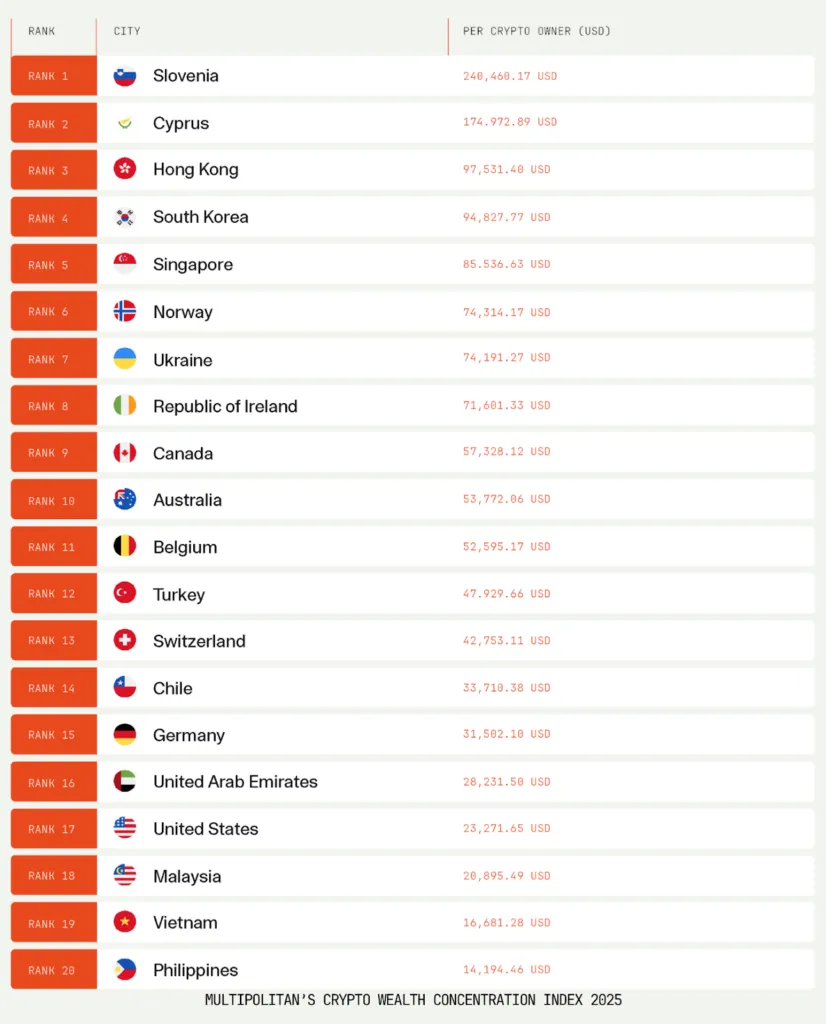

In Southeast Asia, the Philippines Singapore (ranked 5th globally), where each crypto holder owns an average of $ 85,536.63. Malaysia is placed 18th with $ 20,895.49 per holder, followed by Vietnam on the 19th, where each owner holds $ 16,681.28 in crypto assets.

Globally, Slovenia leads an average of $ 240,40.17 per crypto owner, followed by Cyprus ($ 174,972.89), Hong Kong ($ 97,531.40) and South Korea ($ 94,827.77). These high averages indicate concentrated crypto wealth, usually associated with jurisdictions that provide regulatory clarity and strong digital infrastructure.

“Crypto Wealth no longer belongs to traditional financial capitals such as New York, London or Singapore. It is boundless, fluid and finding new homes wherever innovation and clarity converges,” pronounced Crypto Friendly Cities index 2025.

Regulatory environment shapes crypto -friendly cities

The report emphasized that cities and countries that offer clear, consistent and crypto-supporting regulations are increasingly drawing both talent and capital.

“Regulatory Clarity is not only advantageous – it is important,” it noted, with reference to cases such as binance relocation and coinbase (Nasdaq: Coins) threaten to leave the United States due to hostile regulations.

In the Philippines, the supervisory authorities gradually capture. In 2024, Securities and Exchange Commission (Sec) compiled rules for Crypto Asset Services suppliers (CASPS), which aims to protect consumers and create a more stable legal framework for digital assets. This comes when fraudulent activity and unclear rules continue to pose risks.

Cities compete for cryptochapter

Multipolitan’s analysis clearly shows where Future of Finance are on the way and which cities position themselves to lead. Cities such as Dubai, Singapore and Zug draw global crypto entrepreneurs, institutional investors and digital nomads, thanks to clear regulations, fiscal benefits and high quality of life.

“These cities are not only friendly to crypto – they build entire financial ecosystems around it,” says the report. “The next episenter of Global Finance will not only include crypto – it will enjoy it.”

Among the most important driving forces are regulatory arbitrage, digital infrastructure and cryptoculture. In Crypto Friendly Cities index 2025, cities such as Zurich, Lisbon, Abu Dhabi and Singapore ranked high above all five measured measurement values: regulation, tax regime, wealth and lifestyle, digital infrastructure and cryptoinfrastructure. The report emphasized that “first relocation not only leads – they dominate.”

Crypto concentration: Who keeps the keys?

In addition to adoption, the multipolit also introduced a cryptoconcentration index, which adjusts ownership data by means of a Gini coefficient to assess the inequality in crypto holdings. This highlights how deeply integrated crypto is among populations and whether it is concentrated among a few elites or largely distributed.

The The United Arab Emirates stood out as the global adoption leaderwith over 25% of the population that holds crypto, thanks to “proactive government policy and clear regulations.” At the same time, the United States continues to lead in trading volume and register $ 2.07 trillion, largely due to institutional commitment.

In contrast, countries such as Slovenia and Cyprus, despite smaller populations, showed higher average holdings per user, which indicates concentration with high wealth among a relatively small but active group.

“The question now is not who assumes crypto – it is who will keep the keys to Crypto’s huge wealth in the future,” the report concluded.

The future financial capital

Multipolita sees the race against becoming a global crypto as more than a trend – it is a fundamental change in financial geography.

“The global financial landscape is changing,” the report explained. “Cities that move quickly to embrace crypto is not just positioning themselves for relevance – they secure their place as tomorrow’s financial centers.”

This shift is particularly relevant to countries such as the Philippines, where crypto adoption has gone from grassroots use in the gaming communities to broader economic integration.

Watch: The Philippines Go against Blockchain-enabled technology

https://www.youtube.com/watch?v=pdnjawmurxo Title = “Youtube video player” Ramborder = “0” Allow = “Accelerometer; Autoplay; Clipboard writing; encrypted media; Gyroscope; Image-in-Bild; Web Dividend” Reference Policy = “Strict-Origin-When-Cross-Origin” Allowing Lorscreen = “>”