There is not a strong case to issue a retail Central Bank digital currency (CBDC) in Namibia, and the central bank should focus on promoting existing payment improvements, says the International Monetary Fund (IMF).

An assignment from the IMF was in Namibia in January, and in a new report it was against continuing a superb digital currency for retail consumers.

“Since the assignment did not find a strong support for RCBDC emission to deal with gaps in payments, it recommends that I carry out advanced technical exploration in addition to Proof-of-Concept until concrete benefits of CBDC for payments are obvious,” Report says.

Bank of Namibia (Bon) has explored a digital Namibian dollar over the past three years. 2022, it revealed that it conducted research on a CBDC could improve the country’s digital payment landscape and promote economic inclusion. It has also collaborated with other members of the common monetary area-which includes South Africa and Swaziland-to explore a cross-border CBDC.

According to the IMF, however, Namibia should focus on improving existing local solutions.

“Instead of developing a new payment infrastructure such as RCBDC, Non could consider alternative solutions such as supporting measures or regulations to improve financial inclusion,” it said.

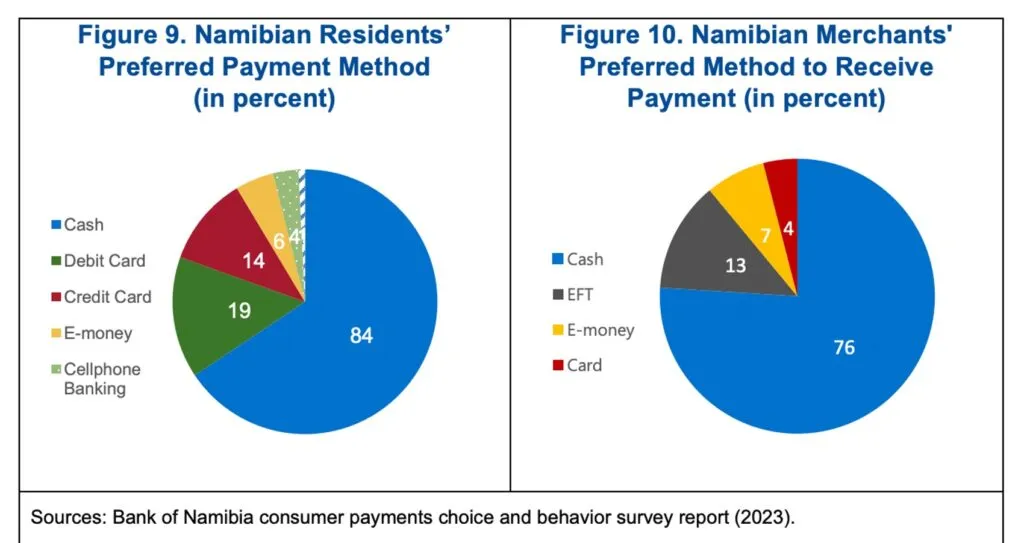

Namibia is home to 3 million people, making it one of the smallest African countries. It has settled after other southern African countries in digitization over the years. A study from 2023 of nests found that cash remains the most preferred payment method.

The IMF says that the Central Bank should focus on creating an enabling environment for companies that raise this GAP “by offering incentives and alleviate legislative burden.” In addition, it should be launched Campaigns for education and awareness To ensure that consumers are well informed about available products and services and their rights in the digital space.

“RCBDC may have the potential to handle some of the challenges but does not offer a unique value proposal to address financial exclusion issues at this time. Nor could RCBDC be able to address underlying issues such as restrictions on digital infrastructure and deficiencies in financial literacy. “

Namibia should continue to explore CBDCs, but not for immediate launch, dedicated to the IMF. The top bank should investigate the effect that a digital dollar would have on monetary policy and financial stability and challenges that would prevent assumption, such as poor digital infrastructure.

Nigeria is still the only African nation to start a CBDC. Euraira was a flopWith Nigerians either distrust the new digital currency or select the existing digital payment methods. A Recently launched Stablecoin In the West African nation hopes to succeed where Enaira failed.

Watch: Increase financial inclusion in Africa with BSV -Blockchain

https://www.youtube.com/watch?v=3oo8u8imwmc title = “youtube video player” Framebord = “0” Allow = “accelerometer; Autoplay; clipboard writing; encrypted media; gyroscope; image-in-image; web-share” reference policy = “strict-origin-short-origin” allow of screen>