Moscow Exchange Bitcoin Futures has increased to almost 7 billion rubles in total trading volume since the launch, and this marks a Significant milestone for Crypto Futures in Russia Right now. The exchange Bitcoin index trading platform Currently, over 10,000 qualified investors, with the Russian crypto regulation, enable structured cryptocurrency exposure through Moscow Exchange Crypto Derivatives market at the time of writing.

Also read: Russia approves cryptoderivate for rich investors

Moscow Exchange Crypto Futures Surge among index launcher, new rules

“Since then, trading volume has been a total of almost 7 billion rubles. Over 10,000 qualified investors have made transactions with it.”

Bitcoin Index Trading Powers New Growth

Moscow Exchange Bitcoin Futures uses the platform’s new Moscow Exchange PFI Bitcoin Index (MoexBTC)which has been calculated since June 10. This Bitcoin index trading system is the basis for the second crypto offer from Moex, and it follows their Blackrock Bitcoin ETF -Futures launch. Crypto Futures Russia’s market extension shows a strong institutional demand for regulated exposure to digital access right now.

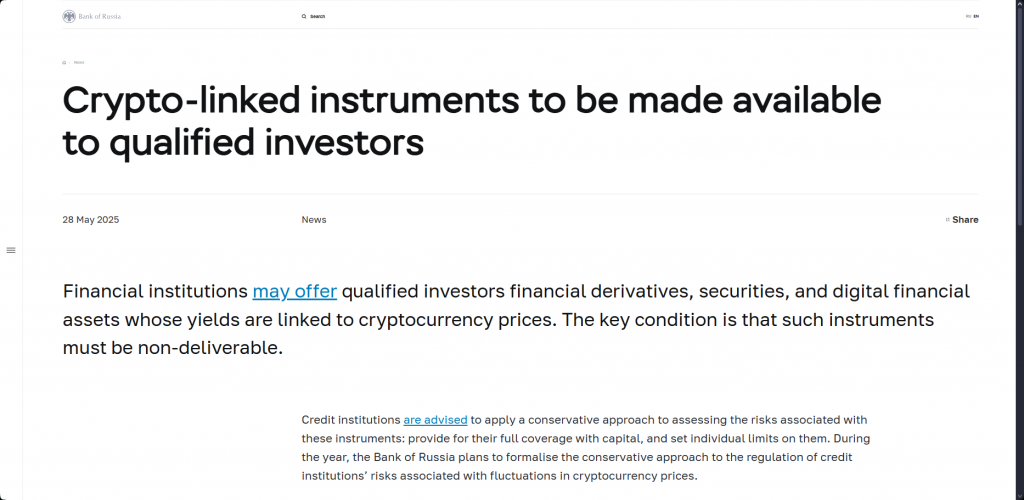

Regulatory Frames Forms Moscow Exchange Crypto Access

Russia’s bank allows limited Cryptocurrency purchases for investors! This decision can signal a shift in the country’s position on crypto. #Crypto #Bitcoin

The rules are still ongoing, but this feature may have a global impact on the Cryptocurrency market. pic.twitter.com/vkjhukf1mh

– defihub (@defihub_fi) March 12, 2025

Access to Moscow Exchange Bitcoin -Futures remains limited to highly qualified investors according to Russian crypto regulation at this time. The Bank of Russia’s experimental legal regime requires 100 million rubles in securities or deposits, and also 50 million rubles annual income. This framework ensures that Bitcoin index trading takes place within controlled parameters while expanding crypto -Futures Russia’s opportunities for institutional participants.

The success of the Moscow exchange in the trade in Bitcoin-Futures with the volume of 7 billion rubles makes Russia an important non-retrospective player in trading in regulated Cryptocurrency derivatives at the moment. The Bitcoin index trading platform on the exchange and its growing crypto -futures Russia products indicates how Russian crypto regulation can liberalize institutional exposure to digital assets over time, but with severe control of Moscow Exchange Crypto, as at the time of writing.