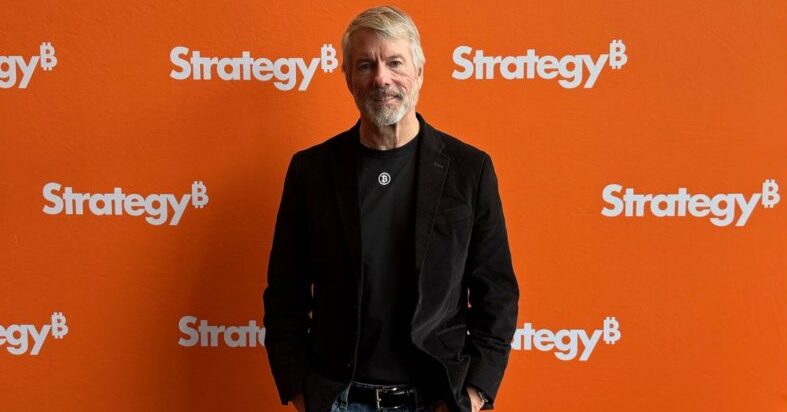

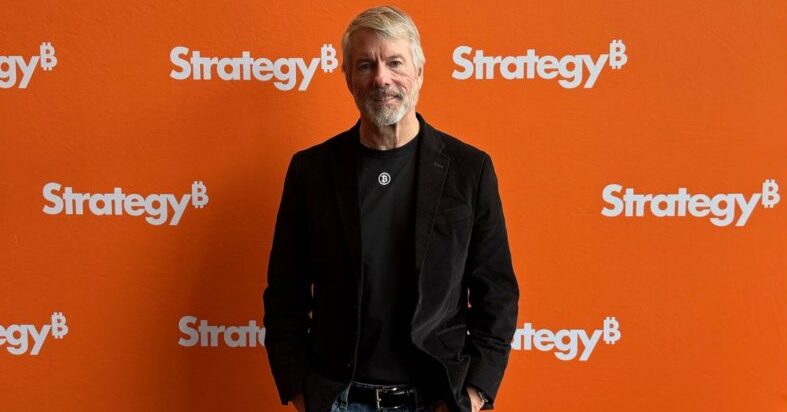

Michael Saylor’s Bitcoin purchase has just sent significant ripples through the crypto world as a strategy (formerly micro strategy) acquires 22,048 bitcoin worth approximately $ 1.92 billion. This latest movement further strengthens the company’s position as the largest company’s bitcoin holder right now, at a time when institutional investments in Cryptocurrency continue to grow despite ongoing market vollatility and uncertainty.

Just in: Michael Saylor’s “Strategy” buys 22,048 bitcoin worth $ 1.92 billion.

– watcher.guru (@watcherguru) March 31, 2025

Also read: Shiba Inu: Shib Price Drawing 6 months from now

How Saylor’s Bitcoin Bet affects investors and crypto markets

Build a bitcoin fortune

$ mstrers Has acquired 22,048 BTC for ~ $ 1.92 billion to ~ $ 8699 per bitcoin and has reached BTC return of 11.0% YTD 2025. From 3/30/2025, @Strategy Holds 528,185 $ BTC Acquired for ~ $ 35.63 billion to ~ $ 67,458 per bitcoin. $ Strk $ STLF https://t.co/1Sfybiglnt

– Michael Saylor⚡ (@Saylor) March 31, 2025

Saylor stated:

“It becomes a FAIT -implementation. It is one of the geopolitical features that when you embrace the network, you first force your allies to assume it, and then all your enemies must assume it.”

Market effects

Michael Saylor’s Bitcoin purchase has previously triggered positive market movement. The strategy’s share jumped 4.8% in the premark just last week when Bitcoin climbed over $ 87,000. Other crypto -related companies such as Coinbase and Robinhood also saw some gains after the previous announcements. Such large acquisitions often create purchase prints that act as a hilarious signal for questionable institutional investors that are still on the Cryptocurrency fence.

Also read: Ripple: With the SEC atmosphere settled, will XRP hit $ 4?

A vision of $ 200 trillion

Sayor’s Bitcoin Institutional Investment Strategy extends far beyond just companies’ financial management. He imagines that Bitcoin will eventually become a $ 200 trillion access class by 2045 and serves as a global settlement layer for AI-driven interactions and transactions.

Saylor had this to say:

“When Bitcoin spreads … and there is a trillion dollar digital capital in the banking system, it will not only be in the US, it is a virus. And so the virus spreads. And in this case it means you will have hundreds of thousands of banks and trillion dollars held by a billion people.”

President Trump’s executive order to set up a US Bitcoin strategic reserve has certainly strengthened this vision. The order mainly leads the Treasury to never sell us bitcoin and develop additional ways to acquire more, mark a significant milestone for crypto market effects and institutional adoption.

Sayor’s influence now extends beyond just companies, as he actively recommends nations about bitcoin strategic reserves. His aggressive Bitcoin Holding enlargement may well be the drawing for other companies and governments, which validates many optimistic Bitcoin prize ratios in the coming years.

Also read: De-Dollarization: Trade sets on Chinese Yuan up 0 to 30%