According to reports, Michael Saylor’s micro strategy bought another 130 Bitcoin (BTC) between March 10 and March 16. The value of the coins is about $ 10.7 million, with an average cost of $ 82,981 per coin. The company may have decided to buy the dip, a practice that it has often followed. From March 16, micro strategy holds approximately 499 226 BTC valued at $ 33.1 billion. The average purchase cost of each BTC owned by micro strategy is about $ 66,360.

Also read: De-dollarization and the digital currency struggle: Why gold-supported Stablecoins could replace USD

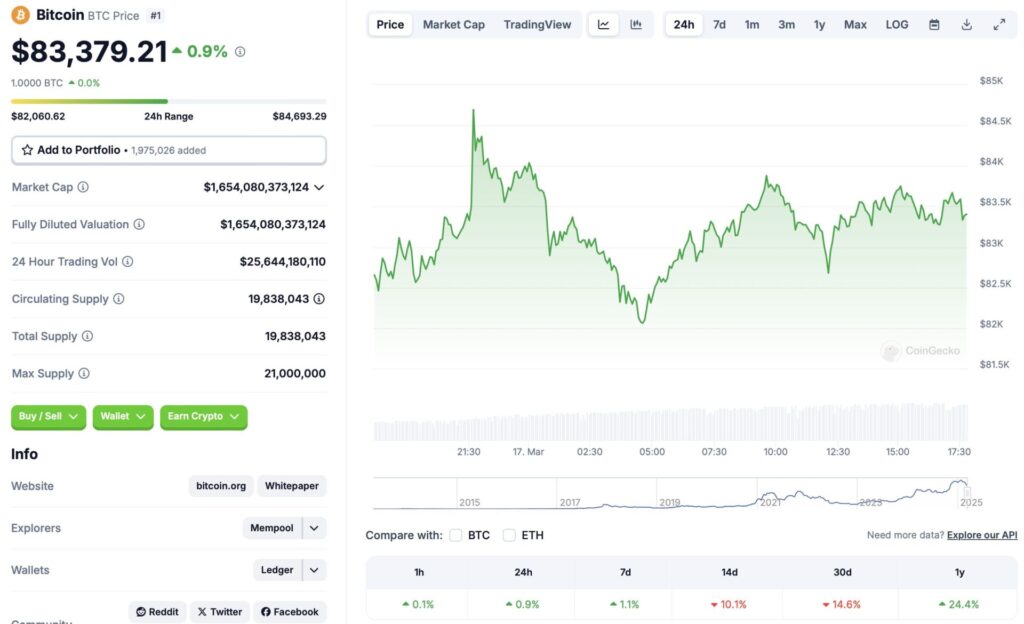

Bitcoin makes a slow recovery

Also read: Binance explains 0% Trade Fees on the Wallet Until September 2025

The shiny market result is probably due to macroeconomic problems. Global trade war may have haunted investors away from risky assets. US tariffs against other nations have caused significant concern among market players. If the Federal Reserve announces an interest rate cut, we can see that the crypto market bounces back. BTC was able to recover the $ 100,000 mark under such conditions.

All-Time High can be around the corner

Bitcoin (BTC) hit a maximum time of $ 108,786 in January 2025. The price of the asset has dropped by more than 23% from its peak.

According to Coincex, BTC may be on its way to a new highest time. The platform predicts the asset to collect in the coming months. Coincex predicts that BTC will hit a new top of $ 160 519 on June 14. The asset price will rally with about 92.5% if it hits $ 160 519 target.