Tokyo-listed Metaplanet has silently become one of the world’s largest business Bitcoin holder. It owns 15 555 BTC today. Based on reports, CEO Simon Gerovich wants to increase it to more than 210,000 BTC by 2027. This goal would set the company’s stash on 1% of all Bitcoin that will ever exist.

Competition to build a bitcoin boägg

According to Gerovich started the company Buy Bitcoin 2024. Initially, there was only a hedge at rising prices. Now it feels more like a sprint. On Monday, Metaplanet spent $ 237 million to add 2,204 BTC to its vault.

Image: Bankless Times

At approximately $ 108,600 per coin, this purchase highlighted its average price per BTC to approximately $ 99 985. Investors have noted. The share price is increasing by 340% this year, although the company still only makes modest revenue.

The Japanese micro strategy MetaPlanet announced that its Bitcoin strategy has entered the second phase and planned to use BTC as a security leverage to acquire cash flow companies. Potential goals include Japanese digital banks, providing digital banking services that are better …

– wu blockchain (@wublockchain) July 8, 2025

Planning to turn crypto into cash

According to reports, The meta plane Has two phases for this strategy. Phase one is about accumulation. Phase two will use bitcoin as collateral to borrow cash. That borrowed money would finance offers to buy profitable companies.

Gerovich has mentioned one Digital bank In Japan as an example. He believes that the company can offer better services than current banks provide. In April, big names by default began chartered and OKX pilot programs for crypto -backed loans. The meta plane hopes to be able to follow its leadership but on a larger scale.

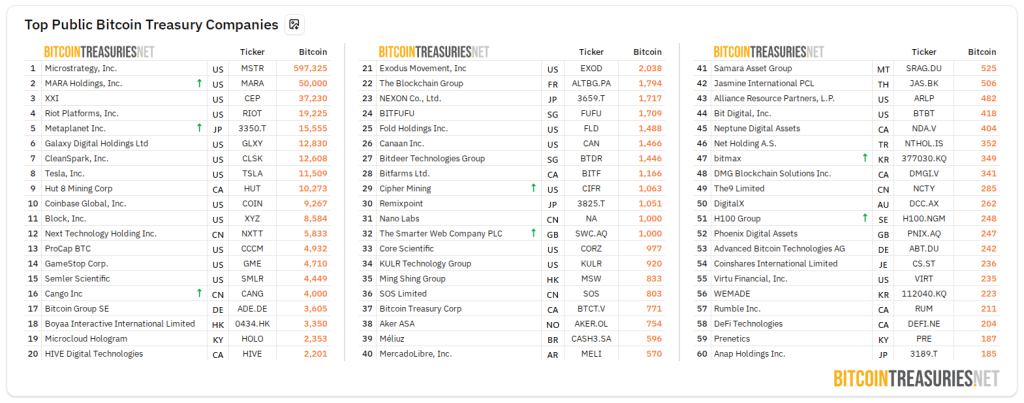

The biggest public Bitcoin treasury companies. Source: Bitcoin Treasuries

Dimensioning of the competition

The meta plane is now ranked among the five best companies in Bitcoin Holdings. To comparison, Strategy Has over 597,000 BTC and has a market value of $ 112 billion. The meta -plane, on the other hand, has a market value over $ 7 billion.

Both companies believe that Bitcoin will surpass cash for a long time. But Gerovich has excluded convertible debts. He prefers to issue preferred shares. He does not want to meet arbitrary repayments tied to a varying share price.

BTCUSD trading at $108,499 on the 24-hour chart: TradingView

Promises and pitfalls of a bitcoin -driven model

Loans against Bitcoin have risks. Banks usually put steep “hairstyles” on collateral. If Bitcoin’s price images, the meta plane can meet marginal calls.

Supervisory authorities in Japan have not yet covered Krypto -backed lending. That uncertainty can slow down or even stop the plan.

BTC price nearing the $109k mark. Source: Coingecko

Then there is the challenge to integrate a digital bank. The meta plane started as a hotel operator. Running a bank requires a completely different competence set.

The game of meta plane is bold. It offers a new twist on how companies can use Bitcoin. If all goes well, a pioneer can be a new breed of corporate financing.

If things go wrong, this Tokyo company can fight under the importance of their own ambition. Either way, its next movements will be carefully seen by both crypto animals and cautious bankers.

Image from meta, charts from tradingview

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.