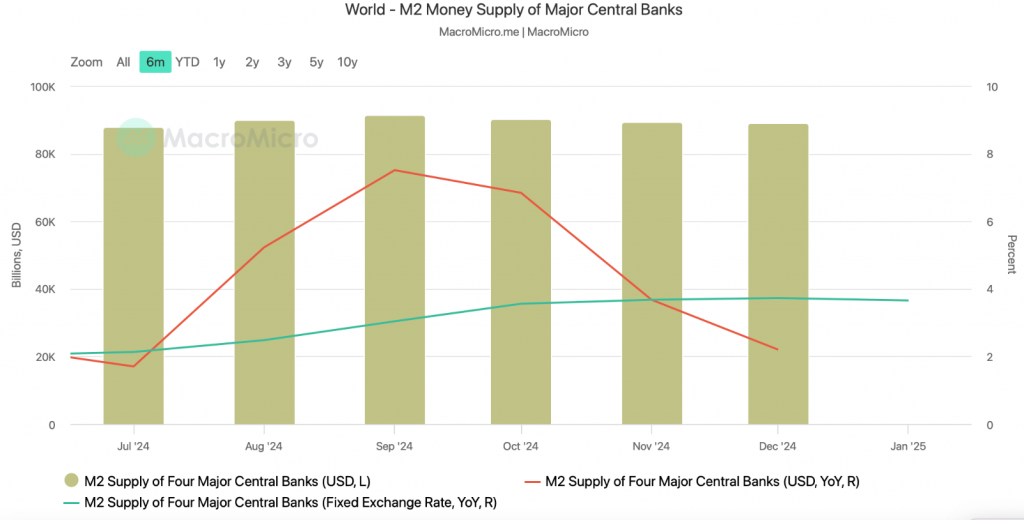

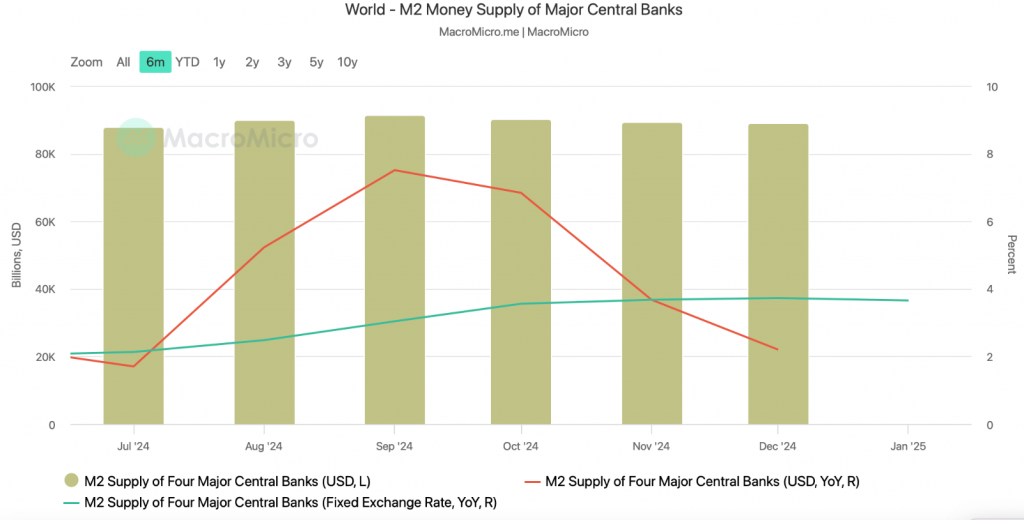

M2 Money supply growth has caught attention from Cryptocurrency -analysts. They see strong correlations between expanding global liquidity and Bitcoin Price Rally Potential. New data indicates the fixed exchange rate for year to year for the M2 money for the four major central banks reached 3.65% in January. This signals some possible favorable conditions for volatility for the Cryptocurrency market.

Also read: Ethereum -buyers stack in when Aya Miyaguchi takes over -comes ETH -Rebound?

How M2 Money Supply affects Bitcoin prices and market vollatility

Analysts point to historical correlations

Several cryptocurrency analysts have been highlighted the statistical relationship between M2 growth and Bitcoin performance. According to economist Lyn Alden, Bitcoin moves towards Global M2, 83% of the time. This was noted in her research report in September.

“During normal times, global unloading measures are a rather reliable lead indicator for crypto,” Pav Hundal, leading analyst at Australian Crypto Exchange Swyftx, told Cointelegraph. “The information we have suggests that place buyers are active right now, and the United States has raised its debt ceiling by $ 4 trillion.”

Current M2 trends and market consequences

Global M2 (shifted forward by 30 days) vs Bitcoin

With weakness in the dollar that causes a net overall effect on Global M2, just a matter of time hopefully before Bitcoin realizes. pic.twitter.com/sao7xrpype

– bitcoindata21 (@bitcoindata21) February 25, 2025

The extension of the global M2 money has looked carefully by investors trying to understand potential market movements. The recent weakness of the US dollar has been identified as contributing to positive effects on global M2 statistics.

Also read: Bitcoin Crash: How high can BTC grow 2025 now?

US money doubling creates potential catalyst

The American money has doubled in just ten years

This Liquidity Transfer can operate Bitcoin’s Parabolic Run-Up

If Bitcoin reached Gold’s Market Cap, it would hit $ 1 million

Is it really possible?

A thread 🧵 pic.twitter.com/HEACXMJ1VZ

– Bravos Research (@bravosrearch) February 24, 2025

The US money has experienced significant expansion in recent years. This development has been emphasized by market studies as a potential trigger for appreciation of Cryptocurrency.

Investment research account Bravos research It pointed it out “The American money has doubled in just ten years,” adds that “This liquefied transfers can drive Bitcoin’s parabolic rise.”

Expert caution among optimism

Despite positive indicators, some analysts recommend measured expectations. “This is not a market to invest your entire stash on a quick correction, but our central scenario is still for a strong march and then,” Dogs warned.

Crypto analyst Colin is talking crypto Echoed this feeling. He stated it “The Global M2 money predicts a great move comes for Bitcoin” while recognizing the inherent uncertainties at the time of marketing.

The Global M2 Money Supply predicts a great move will come for bitcoin pic.twitter.com/azaaru7pp

– Colin Talks Crypto 🪙 (@colintcrypto) February 15, 2025

Also read: Ripple XRP predicted to hit $ 4.20: Here’s when

Bitcoin’s award recently showed part of its typical volatility. It fell below $ 90,000 at the end of February after Trump’s customs comments, which showed how factors outside monetary policy affect short -term prices.

Investors are looking at as the growing global M2 money grows. They see it as an important indicator to predict Bitcoin’s price movement in the midst of market uncertainty.