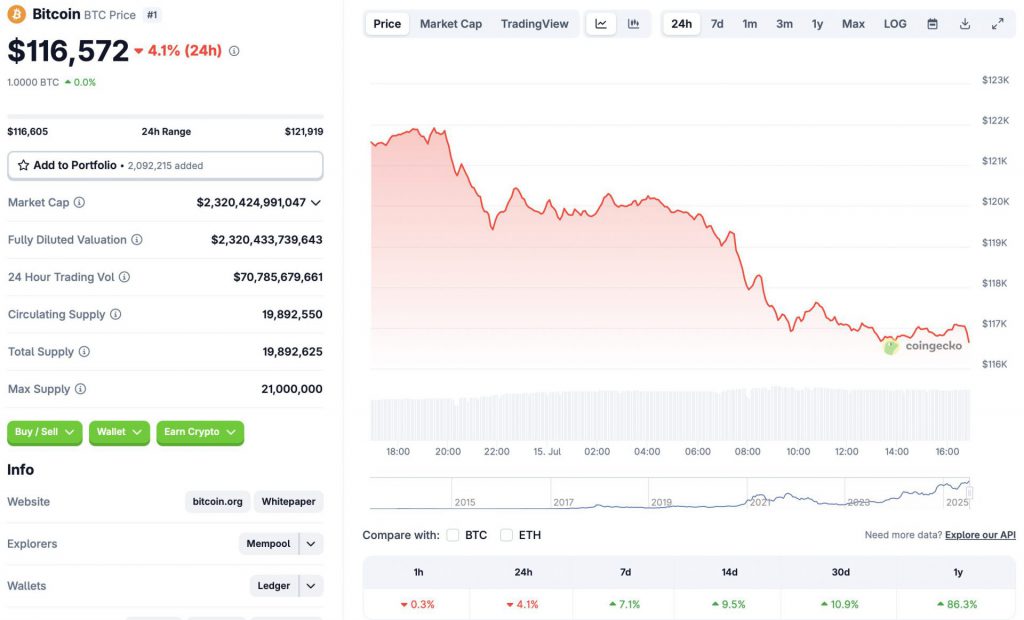

Bitcoin (BTC) had one of its most significant runs in recent days. The largest Cryptocurrency after the market climbed to a new highest time of $ 122,838 on July 14. BTC’s price has dropped by 5% from its last peak. The asset’s dip has triggered a broader market correction. BTC is currently down 4.1% in the daily charts. Despite the detAKen, BTC continues to glow green during the second time frames. The asset has collected 7.1% in the weekly charts, 9.5% in the 14-day diagrams, 10.9% compared with the previous month and 86.3% since July 2024.

Less bitcoin correction, or does the bull end?

The latest market dip comes in the middle of a massive profit phase. Election activity has increased significantly on Binance, the world’s largest crypto exchange in volume.

According to Cryptoquant analyst CrazyBlockk, ”Large -scale investors are either preparing to secure profits after (BTC’s) historical driving to $ 122,000 or plans to use the deep liquidity of the bin to secure or open new positions in the midst of top volatility.“

The crypto market has also witnessed the absence of retail players this cycle. The Federal Reserve’s decision to keep interest rates unchanged may have led to a dip in the retail participation. Massive inflows in BTC ETFs were one of the main causes behind the latest market rally. ETFs even registered inflows during volatile moments. Trade war and geopolitical tension did not seem to have a great effect on ETF inflows.

Also read: Analysts reveal Bitcoin’s (BTC) next key zones – breakout or division?