Bitcoin’s Treasury fusion activity has reached outstanding levels as Entrepreneur Anthony Pompliano announced a $ 1 billion deal to create Procap Financial. This institutional milestone for crypto adoption involves merger Procure BTC with Columbus Circle Capital inAnd that Represents the largest Bitcoin Investment Strategy Collection in Bitcoin Treasury History. Crypto Treasury Management Company secured $ 500 million in equity and also $ 250 million in convertible notes for this groundbreaking crypto agreement of $ 1 billion.

Also read: The Meta Planet’s Bitcoin investment of $ 5 billion exceeds Coinbase Holdings

Bitcoin Treasury Fusion Spark’s Institutional Crypto Adoption Boom

POMPLIANO pronounced:

“The older financial system is disturbed by bitcoin just in front of our eyes.”

Today, I announce a merger of $ 1 billion to create Procap Financial, a Bitcoin-in-born financial services.

The company will be a listed unit on Nasdaq at the end of the proposed business combination between my private company ProCap BTC, LLC and Columbus Circle …

– Anthony Pompliano 🌪 (@APOMPLIANO) June 23, 2025

Revolutionary income generation model

Contrary to other traditional Bitcoin Treasury companies, ProCap Financial will use its Bitcoin holdings to generate profits in the form of lending, derivatives and financial services also. Crypto Treasury Management Model is a valuable consideration by handling the challenge of market vollatility by generating opportunities to generate several income streams that are not only due to an estimate of the value of bitcoin.

“Our goal is to develop a platform that will not only acquire Bitcoin for our balance sheet, but will also implement risk-mounted solutions to generate sustainable revenues and profits from our Bitcoin holdings.”

Large institutional support

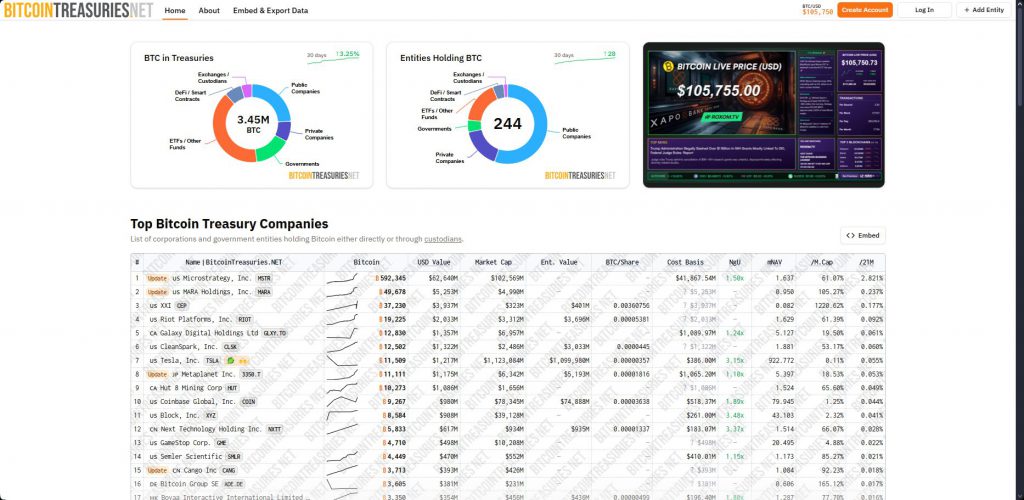

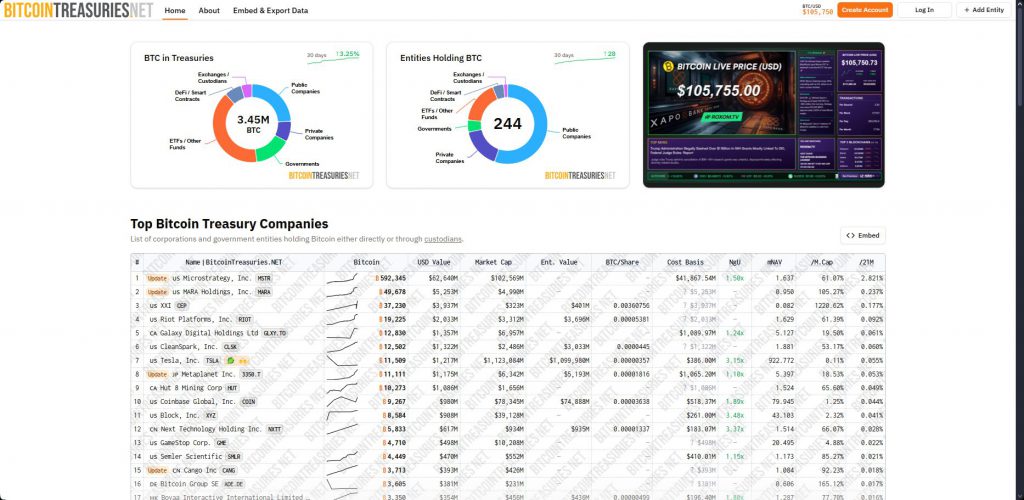

Crypto business of $ 1 billion attracted significant institutional supportincluding commitments from Citadel, Susquehanna, Jane Street and even magnets. Crypto -focused companies like Outside the chain capital, Pantera, Coinfund, Parafi, Blockchain.com and Falconx Also participated in this Bitcoin Treasury merger and strongly signaled institutional crypto adoption confidence at the time of writing.

Strategic market timing

This Bitcoin investment strategy appears when President Trump seeks reforms of Cryptocurrency, including setting up a strategic Bitcoin reserve. The timing supports growing crypto tax management acceptance among traditional financial institutions, and it addresses previous problems with uncertainty in the legislation that has been persistent.

Also read: Bitcoin, ETH, XRP & SOL SOAR ON ISRAEL-IRAN CEASEFIRE AND FED RATE CUTS

The Bitcoin Treasury fusion can speed up similar offers, with ProCap Financial Active Management Model showing sustainable income generation from Bitcoin Holdings. This institutional milestone for crypto adoption can encourage more companies to explore Bitcoin investment strategial alternatives, especially when inflation problems remain and continue to affect decision-making.

This crypto transaction of a billion dollars is an upward movement towards the broader acceptance of the crypto paw for the management of crypto and it possibly establishes new principles in Bitcoin Treasury Fusion Transactions in the current Cryptocurrency market today.