Ethereum Breakout signals have started to emerge right now, with the latest market data that actually indicates a potential bottom formation. The second largest Cryptocurrency after market cases is currently showing promising signs of recovery in the midst of the ongoing market vollatility that has plagued investors lately. Vale accompanying patterns, and even declining volatility metrics, as well as significant net inflows, provide important indicators that Ethereum’s price pre -operative models may soon become Hausse, at least according to current analysis.

Also read: Dogecoin: Elon Musk’s Grok predicts when Doge will hit $ 0.90

Ethereum’s path to recovery: Price pregnancy, market volatility and key signals

Valenization signals Bottom formation

Small Dex dealers (SDTS) were also found accumulated ETH, with purchasing volume of $ 3.21 million against selling volume of $ 2.34 million. These trends collectively point to a market stabilization that usually precedes an upward price movement, and this is something we definitely see at the time of writing.

Significant buyingress has followed weeks with Cryptocurrency -investment uncertainty and widespread fear. While smart money traders showed more caution in buying volume of $ 1.77 million compared to selling to $ 1.96 million, the total trend generally supports the hypothesis that ETH may have reached its market bottom.

Ethereum breakout imminent? Historical price patterns suggest significant upward potential

Ethereum Price President models often rely on historical designs, and the current market structure has striking similarities with previous bottom formations from what we can see. The rally from the end of 2023 to the beginning of 2024 saw the ETH increase by about 157.49%, and the current price measure seems to form a comparable pattern near important moving average, which is quite interesting.

Also read: US car dealer officially accepts PI coins as a new payment option

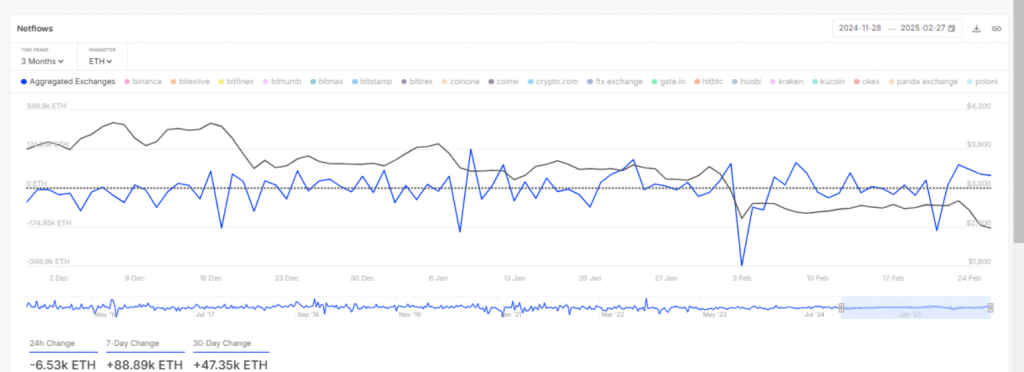

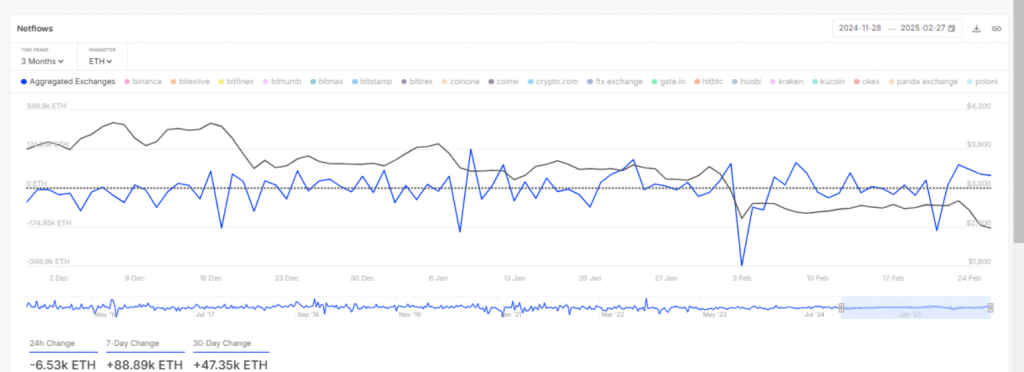

Net inflows paint the haus picture despite short -term outflows

Institutional and major holding activity provides further confirmation of accumulation trends, at least in some ways. ETH’s total Netflow was at 55.34K ETH, with the 7-day period that showed strong net inflows at +88.89K ETH. The 30-day accumulation also reached +47.35K ETH, which indicates long-term accumulation despite short-term fluctuations and temporary dip.

These measurement values reveal that while 24 -hour flows showed an outflow of -6.53K ETH, possibly because of profit and such, the medium and long -term trends remain somewhat positive. Such designs usually precede price recycling in the Cryptocurrency market, which we have seen many times before.

Volatility stabilization reinforces bottom theory

Ethereum’s volatility metrics show a significant reduction, which further supports the bottom formation theory that many analysts discuss. After topping 81.61% on February 25, volatility has dropped considerably to about 15.47% in the last few hours, which is a fairly significant change.

This reduction in market vollatility often signals the end of panic sales and capitulation phases that characterize the market floor, and this is really something to keep an eye on. Ethereum showed similar volatility patterns in October 2023 before began their upward track and created a clear historical precedent.

Several haissearted catalysts can further support Ethereum’s recovery, including leadership changes at Ethereum Foundation, gas limit changes and potential intervention integration for Spot Ethereum ETFs. This development can maintain momentum if volatility continues to decrease and the market term improves.

Also read: Ripple: Ai predicts how low can XRP fall into the current market scenario

The combination of valence collection, historical price patterns, positive net flows and volatility stabilization provides compelling evidence that ETH may be positioned for an Ethereum outbreak. Although short -term market vollatility remains concern for many investors, the convergence indicates these indicators that ETH’s recovery phase can already last, although of course nothing is ever guaranteed in the crypto markets.