April has been about customs. The US government under the leadership of Donald Trump introduced broad new tariffs that focused mainly on imports. Several countries such as China, India, Vietnam and others were hit by customs up to 46%. Trump did not stop at this; Several studies on the pharmaceutical and electronics industry and mineral imports are ongoing. In the middle of this, the United States once again met China with a retaliation tariff of 245%. With this trade war that took place in full swing, several markets were affected. Bitcoin (BTC) has often been proclaimed as a safe refuge. But the king’s coin was seen sliding while the gold was strong.

Also read: De-dollarization: Goldman Sachs predicts a gloomy future for American dollars

How much has bitcoin dropped since the customs message?

Also read: Here’s how much $ 2,000 in Solana at its low time is worth today

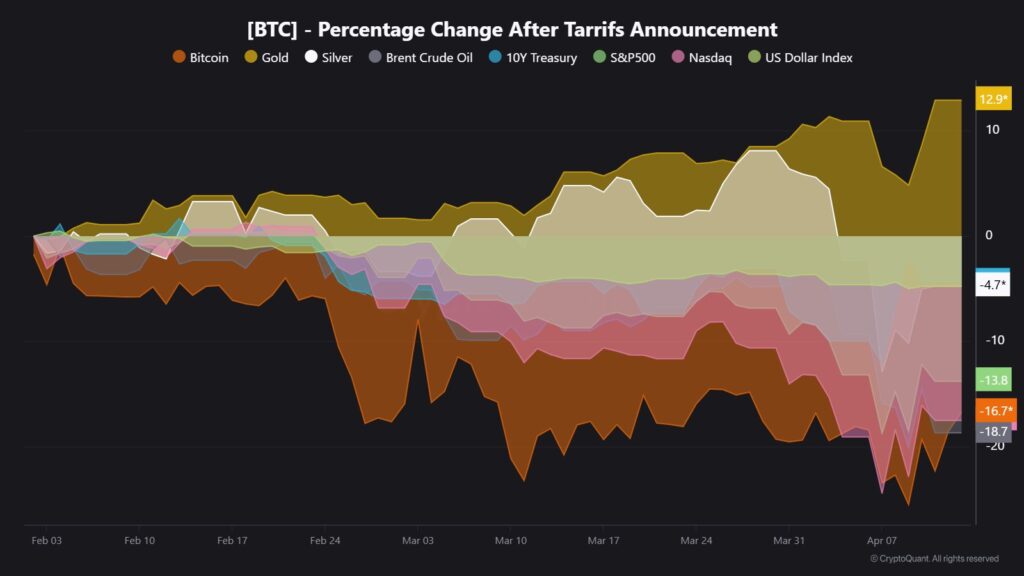

It looks like several other markets saw a much larger drop. Although Bitcoin is unstable, its decrease currently places it between Nasdaq and oil. This further indicates a modest recovery but no indication of safely the Haven behavior. But Bitcoin’s latest behavior had society to doubt its ability as a safe refuge.

At the same time, gold was at the top of its game. Although the asset went from its highest time, it managed to stay afloat. Ever since the customs message, gold has increased by 12.9%. This is the only asset that saw an uptick. Cryptoquant revealed that Silver and the US Dollar Index dipped with 4.8% each. In addition, the S & P500 registered a loss of 13.8%.