Bitcoin has produced an interval -bound movement recently, with prices that oscillate between $ 83,000 and 86,000. Interestingly, the popular crypto analyst Burak Kesmecia has identified the important price levels for all short -term measures.

Support of 82,800, resistance of 92,000 – but where is bitcoin on the way?

On one New post At X, Kesmeci shared an interesting analysis in the chain of the Bitcoin market. With the help of the short -term investor cost base identified analysts two important price levels that may prove to be crucial to Bitcoin next big move.

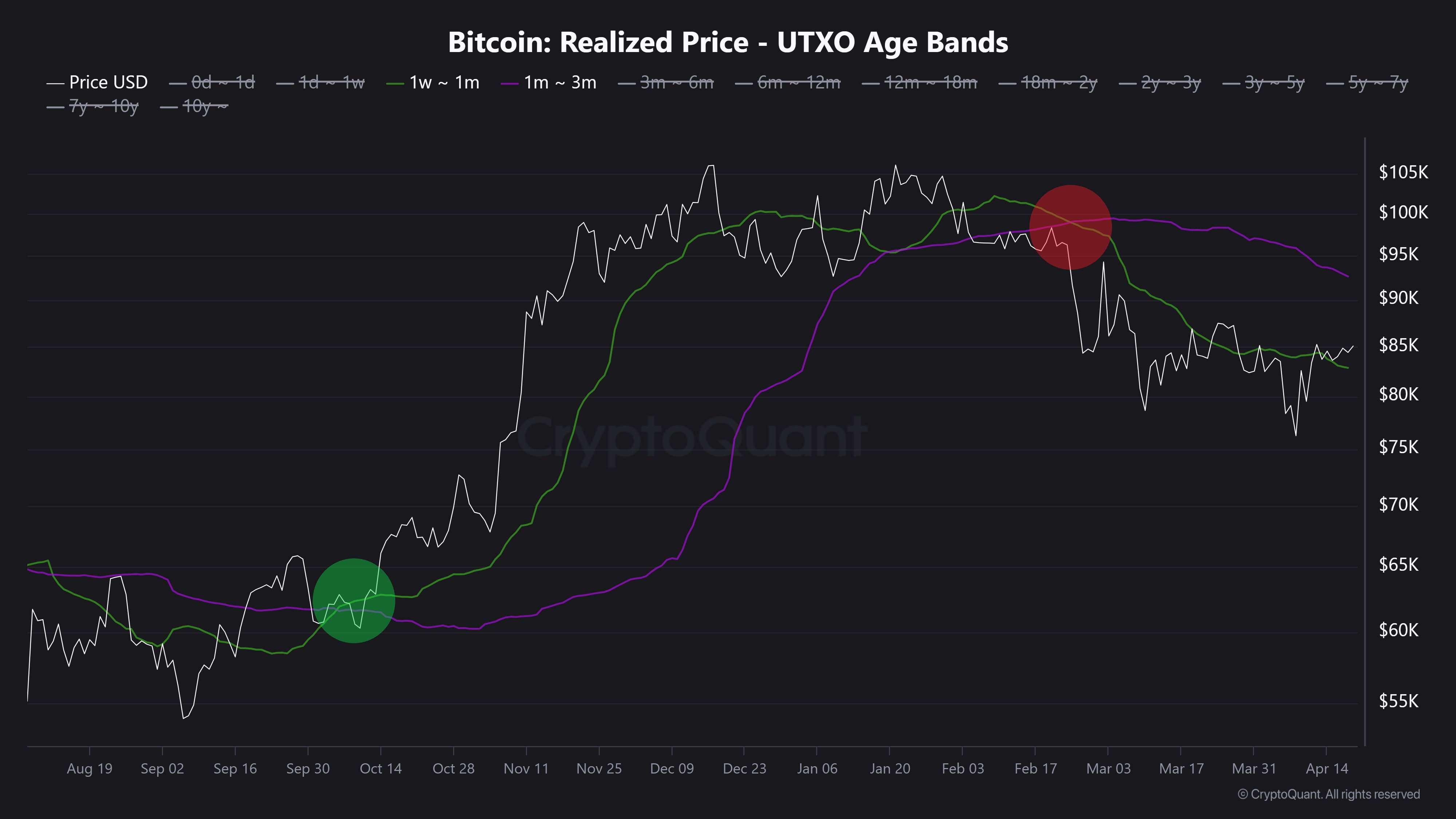

First, Burek Kesmeci focuses on the average cost prices for new traders over the past 1-4 weeks, which is probably the most reactive on price changes. The realized price for these traders is currently at $ 82,800, and forms a short -term support that indicates that many most recent buyers are still in profit and can defend this level as a psychological floor.

At the same time, Kesmeci also highlights the price level of $ 92,000, which marks the average cost base for BTC holders for 1-3 months. This price point has emerged as an important resistance zone, as investors are likely to leave the market when they break evenly. In addition, the price level of $ 92,000 is also characterized by a confluence with various technical indicators.

The interaction between these two levels is significant. Historically, short-term hausse-like trends in BTC tend to begin when the cost base for newer investors, 1-4 weeks, crosses the 1-3 BTC owners. This shift signals increased confidence and willingness to buy at higher levels, which often fits wider rally.

But that dynamic remains to be played out in the current market. From now on, Bitcoin trading around 85,000 and places it over its support at $ 1-4 weeks of $ 82,800 but still below $ 1-3 months of resistance of $ 92,000. In addition, both cost base levels have decreased over the past two months, which reflects doubt or lack of aggressive purchases from new participants.

In particular, Kesmeci says that BTC must increase over $ 92,000 in order to confirm a strong rais -like momentum for a price turnover.

Bitcoin ETFS Offload 1 725 BTC

In Second News Ali Martinez reports that Bitcoin ETFs have been hit by the withdrawal of $ 1,725, valued at $ 146.92 million over the past week. This development illustrates a high level of negative feeling among institutional investors, which adds market uncertainty around the BTC market.

At the same time, Bitcoin is shopping for $ 85 249 after a price change of 0.89% over the past day. Premier Cryptocurrency also reflects a loss of 0.58% on this week’s diagram and a profit of 1.06% on a monthly chart.

Functional image from Adobe Stock, chart from TradingView

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.