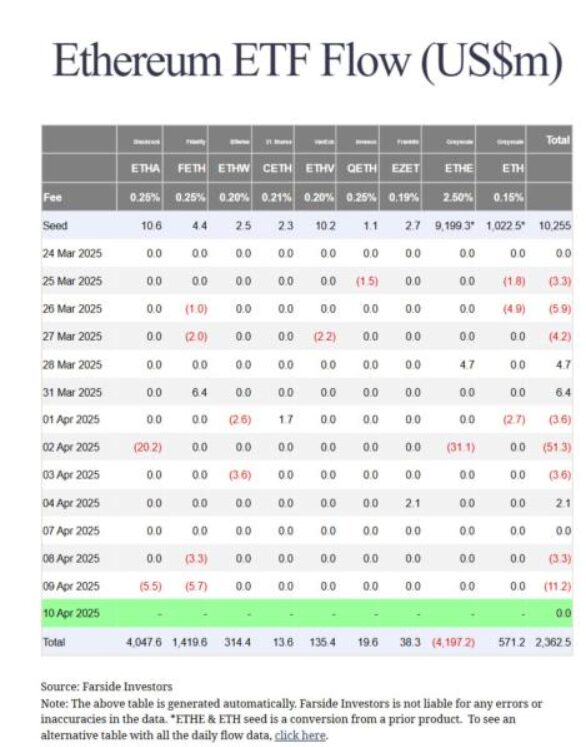

Grayscale announced the public that market deletions from Secs have prevented investors from collecting $ 61 million in rewards through Ethereum ETF bet. The prolonged regulatory dispute between Sec and grayscale continues to affect the Ethereum price stability while market-related uncertainties create. Gray scale At present, try to secure approval Just as international market regulators have achieved.

Also read: Trump misleading on China Tariff Talks – Gold Price Dip in the middle of chaos

Grayscale shoots Sec for Ethereum ETF approval as $ 61 million lost in stakes

Craig Salm, Chief Legal Officer at Greyscale Investments, said:

“We appreciate the opportunity to get involved in Securities and Exchange Commission’s Crypto Task Force.”

The economic effect of these restrictions is clearly described in Greyscale’s memorandum:

Also read: Sec Clears Path for XRP 2x ETF Launch: Big Move will be on April 30

Network benefits

Ethereum ETF efforts would benefit both the network and also investors. Grayscale has also emphasized this dual advantage in its presentation to Sec:

International precedent

At the time of writing, the Sec Ethereum decision is behind global markets, where Ethereum ETF efforts are already allowed in various jurisdictions. Grayscale noted this difference in their documentation:

“At present, Spot ETH ETPs does not completely represent the underlying ETH, since they are currently not allowed to operate.”

Grayscale has also confirmed its operational preparedness with this statement:

“By drawing on traditional financial analogues and experience in managing ETPs that are facing similar liquidity challenges, in combination with the gray scale’s connection and partnership of the digital asset ecosystem, we can effectively and responsible spell ETH in our ETH ETPs.”

Also read: Top 3 Crypto courses to watch this week

Future prospects

Ethereum ETF situation in grayscale shows how regulatory strengths are contrary to new crypto developments. The potential result of Sec’s decision on this proposal will determine Ethereum price fluctuations. Thehasil will determine significant factors that affect traditional investors’ access to Ethereum ETF opportunities and set new instructions for Cryptocurrency investment vehicles in the US market.