Goldman Sachs Bitcoin ETF investments are actually marking a real turning point right now in institutional crypto investments. The bank giant has invested approximately $ 1.4 billion in Blackrock’s Spot Bitcoin ETF, and this shows their strong confidence despite the ongoing bitcoin market vollatility that we have seen. This movement also affects the entire crypto ecosystem, including Shiba Inu and other alternatives as well.

Also read: Global Financial Authority IIF supports XRP as a rapid option for payments

Wall Street Giant’s Historic Crypto Bet: What this means for Shib Holders

$ 1.4B Goldman Sachs Bitcoin ETF game

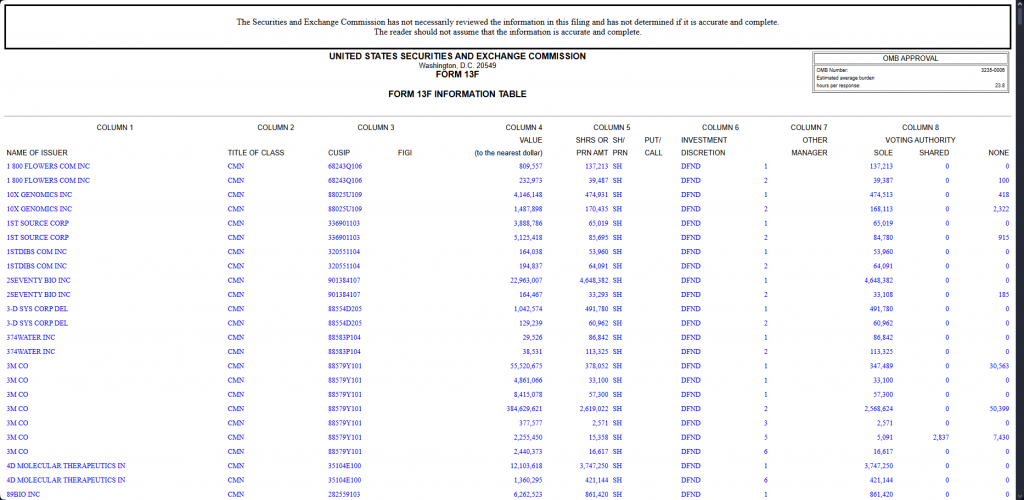

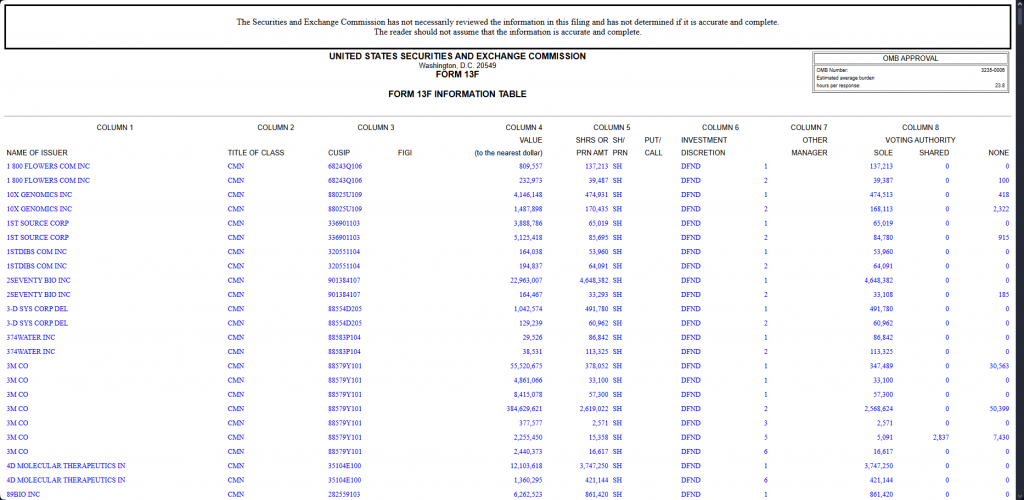

This huge investment was in principle revealed by one Form 13F archiving at Sec. Goldman Sachs has acquired about $ 1.4 billion of shares in Blackrock’s Ishares Bitcoin Trust, which is really significant.

U.TODAY reported:

“Goldman Sachs has taken a significant position in Ishare’s Bitcoin Trust ETF with an allocation of $ 1.4 billion.”

Also read: Ripple (XRP) rallies 21% for one week: $ 3.50 might be closer than you think

Institutional crypto influence on shiba inu

The current influx of institutional money to Bitcoin has created a positive feeling about the crypto market. And Shiba Inu News has actually been particularly encouraging lately, with several developments.

U.TODay noted:

“Shiba Inu (SHIB) will take advantage of the growing institutional interest in digital assets.”

Since Goldman Sachs Bitcoin ETF Investment’s type of normalizes crypto as an asset class, alternative tokens like Shiba Inu may possibly see increased attention from traditional financial actors in the coming months.

Manage Bitcoin Market Volatility

Even with institutional assumption, Bitcoin Market Volatility is still a concern for many investors. The Blackrock Place Bitcoin ETF provides a regulated vehicle that helps institutions navigate these challenges, and this is something that is really important for mainstream adoption.

Analysts have observed that Goldman Sachs Bitcoin ETF investment signals confidence that institutional frameworks can handle crypto -Volatility effectively, although the market is still experiencing ups and downs.

Also read: Blackrock grabs $ 22.8B Panama ports in silent power movement

This latest institutional crypto purchase on regulated ETF products can be the way forward in mainstream Crypto adoption, and Goldman Sachs is currently at the forefront followed by others with examples.