Key dealers

- Gamestop plans to add Bitcoin as a Treasury reserve supply, which leads to an increase of 15% of stock prices before the market.

- Gamestop joins other companies such as Micro Strategy and Tesla to keep Bitcoin in the midst of challenges in their core business.

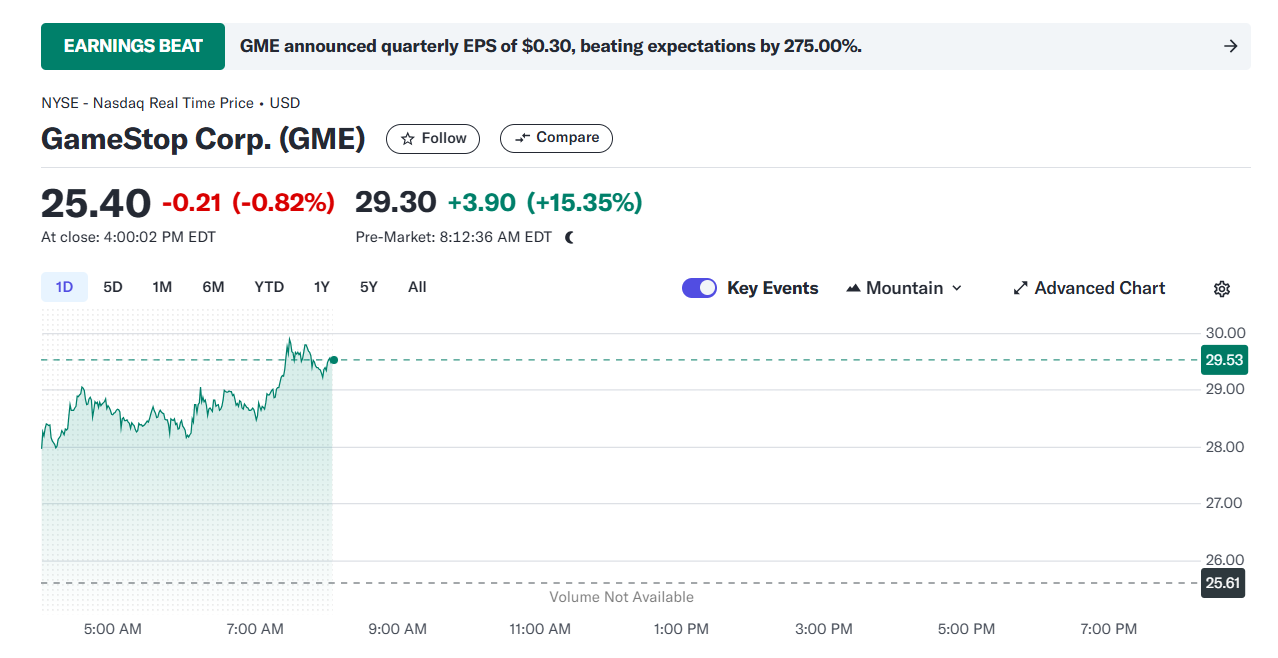

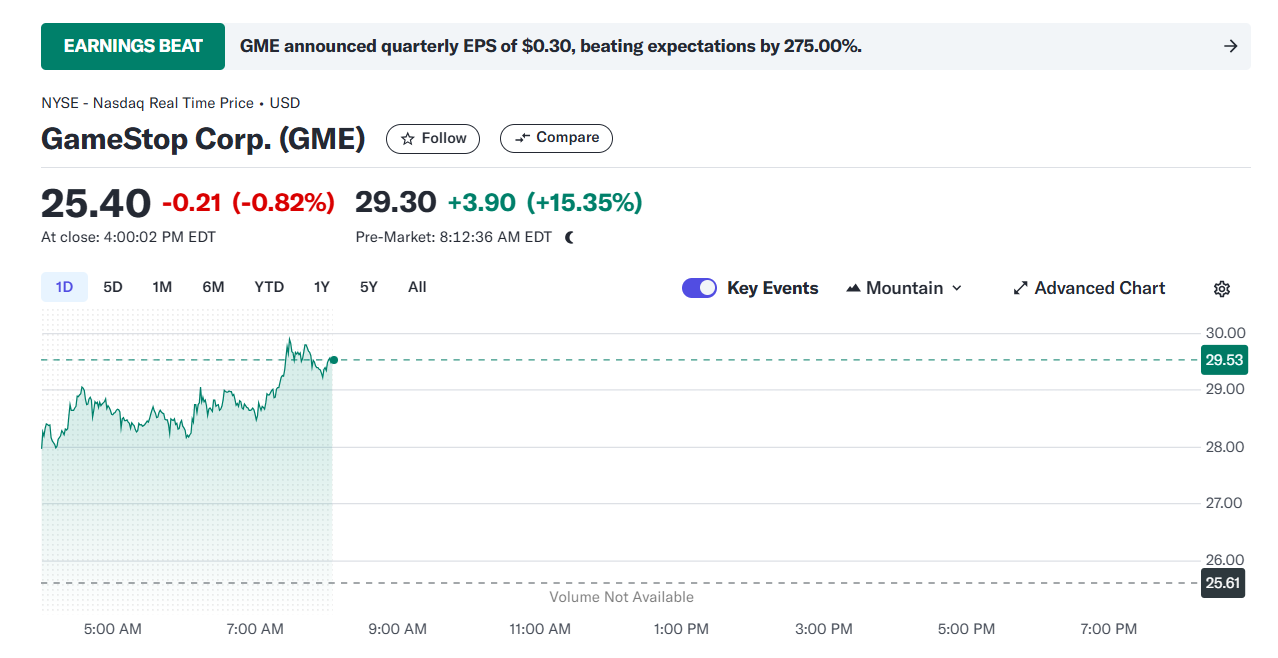

Shares by Gamestop (GME) jumped over 15% in trade before the market today after the video game dealer confirmed plans to add Bitcoin as a Treasury Reserve access, according to Yahoo Finance data.

The company’s share climbed to $ 29.6 in trade before the market, after Tuesday’s closure of $ 25.4. Despite an approximately 68% increase in gamestop shares in the past year, the so-called MEME share is still down almost 19% so far this year.

Gamestop, the short press icon 2021, on Tuesday joined the strategy, Tesla, and a growing list of public companies to stack Bitcoin in the balance sheet.

The company’s board unanimously approved the Bitcoin strategywhich was revealed under its result for the fourth quarter.

Gamestop can use existing cash or future debt and equity offers to invest in bitcoin, although specific purchasing amounts remain indefinite.

The announcement comes together with improved quarterly results, with Gamestop that reported about $ 131 million in net profit for the fourth quarter, up from $ 63 million during the same period last year.

The dealer held approximately $ 4.6 billion in cash at the end of the third quarter of 2024, according to its disclosure to the SEC.

The Bitcoin decision follows a February report from CNBC that revealed that Gamestop was Explore investments in bitcoin And other crypto assets.

The report came just days after the company’s CEO Ryan Cohen met Bitcoin Advocate Michael Saylor, the executive chairman of the strategy. However, Saylor was not involved in the company’s internal crypto discussions.

Later that month, Matt Cole, CEO of Strive Asset Management, founded by Vivek Ramasswamy, founded Sent a letter to Gamestop CEO Ryan Cohen and proposes the company to use its cash reserves to invest in bitcoin.

In his statement, Cole claimed that Gamestop could become “the foremost bitcoin Treasury Company in the gaming industry.”

Gamestop explored previous digital assets through an NFT market place that was launched in July 2022, but scaled back the initiative in early 2024 with reference to “Regulatory uncertainty.” The company also canceled its crypto wallet service at the end of 2023.

The company has faced challenges from increased downloads of digital games. This strategic pivot can help stabilize Gamestop’s sinking core business and provides an opportunity to improve its financial position in the competitive market.

Since Donald Trump’s election win in November 2024, a growing number of companies have begun to convert their cash reserves to Bitcoin. The trend is run by Trump’s Pro-Crypto-agenda and his administration’s commitment to promote a more favorable regulatory environment for digital assets.