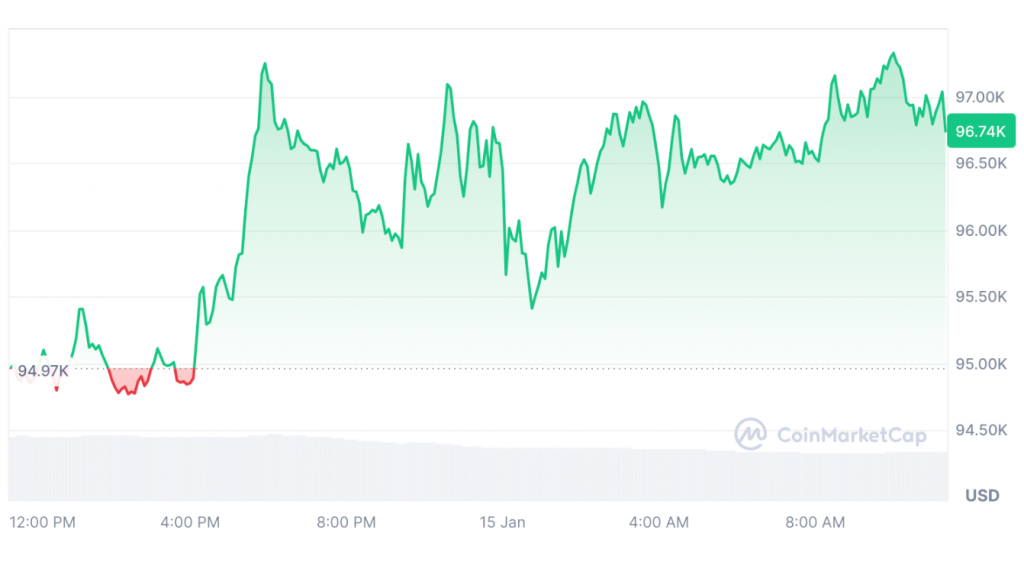

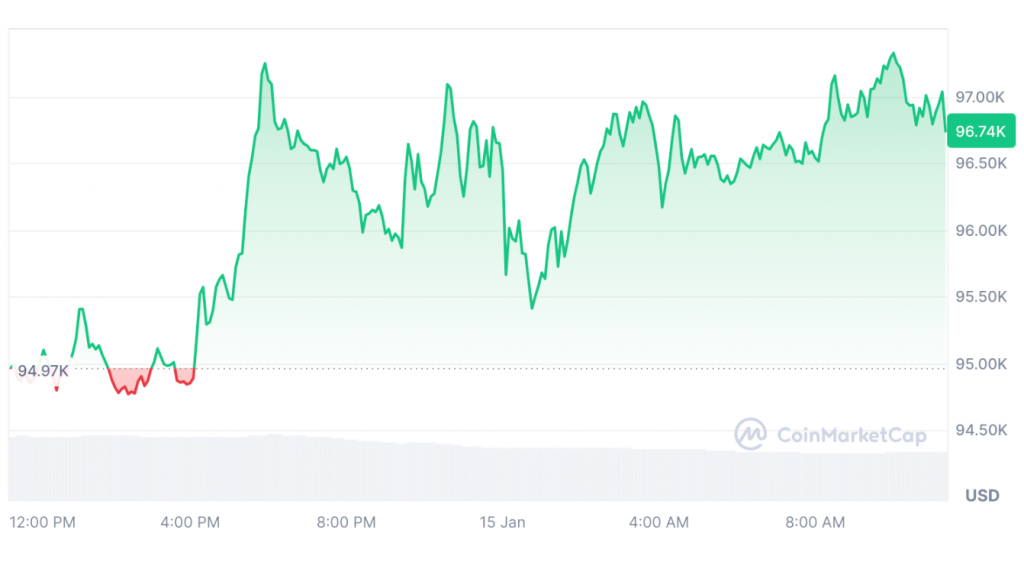

Some traders expect a price rally for Bitcoin as the January FOMC meeting approaches. Bitcoin is hovering around $96,794 in a narrow range. The recent volatility in the market and some trends in the crypto market suggest an upcoming move, as about half of the traders are keeping track.

Read also: What is anti-de-dollarization: Support for the US dollar grows in 2025

How the FOMC meeting and market volatility could affect Bitcoin’s price rally

Technical analysis points to impending breakout

The Federal Reserve’s position and market impact

The The FOMC charts its first course election of 2025 soon. Some measures of market volatility point up. Bitfinex noted on January 13 that this was “one of the most hawkish stances from the Fed in recent months.” Many traders believe that the next Bitcoin price increase depends on the Fed’s choice.

Read also: XRP’s Golden Cross Signals Major Bull Spring Ahead—Don’t Miss Out!

Price action and presidential transition

Markets falter as Trump’s inauguration approaches. About 38.3% of CME FedWatch users see no rate cuts through June 2025. Lark Davis noted, “Bitcoin Repeats Similar Price Action to Last Presidential Election and Inauguration,” looking at old patterns.

Consumer price index and market expectations

Read also: Dogecoin: 3 Ways Elon Musk Could Affect Doge’s Price After January 20th