FOMC interest rate reduction Expectations actually drive Bitcoin toward the critical $ 123K resistance level right now as Federal Prepares its policy message on September 17. The FOMC meeting today can trigger significant FOMC -BITCOIN impact, and analysts map exact price goals around the expected 25 points. Current FOMC news suggests that Bitcoin’s path to $ 123K is due to maintaining support over important technical levels below today’s FOMC decision.

FOMC BITCOIN IMPACT: Meeting Today, News & Market Reaction Guide

Critical FOMC price levels for bitcoin

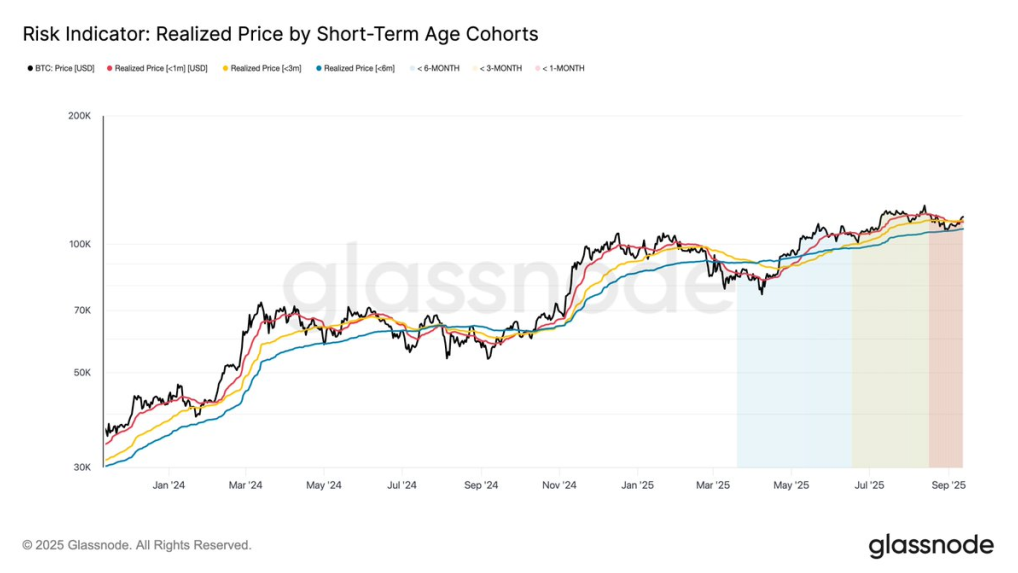

Bitcoin currently deals between $ 114,600 and $ 117 100 when the FOMC meeting approaches. According to Glassnode analysis, Bitcoin continues to respect short-term holding cost bands, with failure to keep 1-month and 3-month-realized price levels that potentially signal momentum loss before the FOMC recognition.

$ BTC continues to respect the short -term proprietor’s cost bases.

Failure to keep 1-month and 3-month realized price levels would confirm the lack of speed in the market. Conversely, maintains above them to optimism about the FOMC sensation and its impact on … https://t.co/hwriltpk8p pic.twitter.com/wawujpwty9

– ice cream node (@glassnode) September 16, 2025

Nik Patel From ostium research indicated:

“This is now the line in the sand for short -term hausse”

The level of $ 112,000 represents the decisive support, and a break below would actually open routes to $ 107K and potentially even $ 99K. For the upside of the Fed Open Market Committee Bitcoin scenario, Clean Acceptance would over $ 120K trigger a quick drive against the $ 123K target.

Expert FOMC Presents and Market Scenarios

Peter Schiff Had this to say about market dynamics:

“Although gold is stuck in a new record area today, which is ready to break over $ 3,700, Gold Running shares are lower on the day when dirty traders take winnings before tomorrow’s FOMC approach and Powell press conference. I expect buyers will rush back in soon.”

Although gold is stuck in a new record area today, prepared to break over $ 3,700, gold mining shares are lower on the day when Skittian traders take winnings before tomorrow’s FOMC approach and Powell press conference. I expect buyers will rush back in soon.

– Peter Schiff (@Peterschiff) September 16, 2025

Crypt strategist Moon Explained the current Fed Open Market Committee scenario:

“The most likely scenario is currently a 25 point, with a very high, exceeding 90% market has already priced in a 25 point cut, but after all, at each edition more liquidity the market has already moved before FOMC, and a 25 points can continue to drive an upward trend.”

Market point of view

FOMC’s expectations

The most likely situation is to fall by 25 points, with a very high probability of more than 90%…

– bioupa (@biupa) September 17, 2025

Also read: Altcoins to buy before FOMC – Whales invests heavily in these!

FOMC Meeting Timing and Bitcoin Strategy

The announcement will be made at 14:00 and the FED’s open market committee and the subsequent Powell press conference at. 14.00 also marked the day -critical trigger point in the price of Bitcoin in FOMC. Market positioning reflects a 68.8% raised market position at present, and the traders are aimed at the expected reduced interest rate.

The trade methods are linked at the Breakout level of 117, 900, whose successful violation may in fact increase the speed with which Bitcoin would hit its 123K resistance. Possible tension slopes for the support of $ 113,300 -110,000 if profit monitoring is made after FOMC.

Also read: FOMC meeting could trigger Bitcoin’s price increase at the end of January

The event is similar to September 2024 when the first Bitcoin weakness after the interest cuts later gave way to doubling over a maximum time of 100,000 at the end of the year, which may mean that the FOMC result will be used today to create the same Hausse signal on the 123K goal.