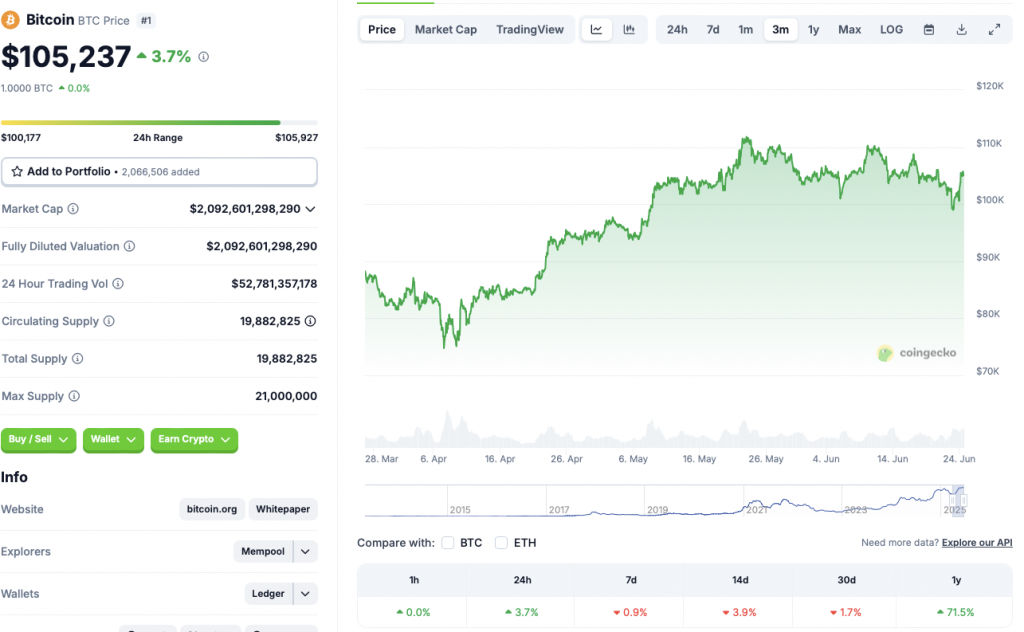

Fidelity Investments have Added 1005 Bitcoin (BTC) worth $ 105.7 million to its Treasury. The company also bought 27 175 Ethereum (ETH) worth $ 60.5 million. Fidelity’s latest purchase comes in the middle of a market -wide recovery. BTC has recycled the land of $ 105,000 after its last dip at the price of $ 98,000. The original crypto has increased by 3.7% in daily charts and 71.5% since June 2024. Despite the turnaround, BTC’s price has dropped 0.9% over the past week, 3.9% in the 14-day diagrams and 1.7% in the previous month.

Cryptocoirs recover among potential peace calls

The Cryptocurrency market met a major correction after the United States began its attack on three Iranian nuclear places. Many feared a whole war between the two countries. Iran is already facing Western sanctions. A potential war with the United States can cause serious burden on the global economy. Bitcoin (BTC) and other crypto assets saw large liquidations when investors lowered exposure to risky assets.

The market dip may also have been triggered by the Federal Reserve, which decides to keep interest rates unchanged. An interest rate reduction may have led to more investments in risky assets.

Will Bitcoin continue rally?

There has been an increase in institutional inflows to BTC in recent weeks. BTC-based ETFs have seen continued influx despite global geopolitical tensions. Retail investors are probably the rally.

Also read: The Meta Planet’s Bitcoin investment of $ 5 billion exceeds Coinbase Holdings