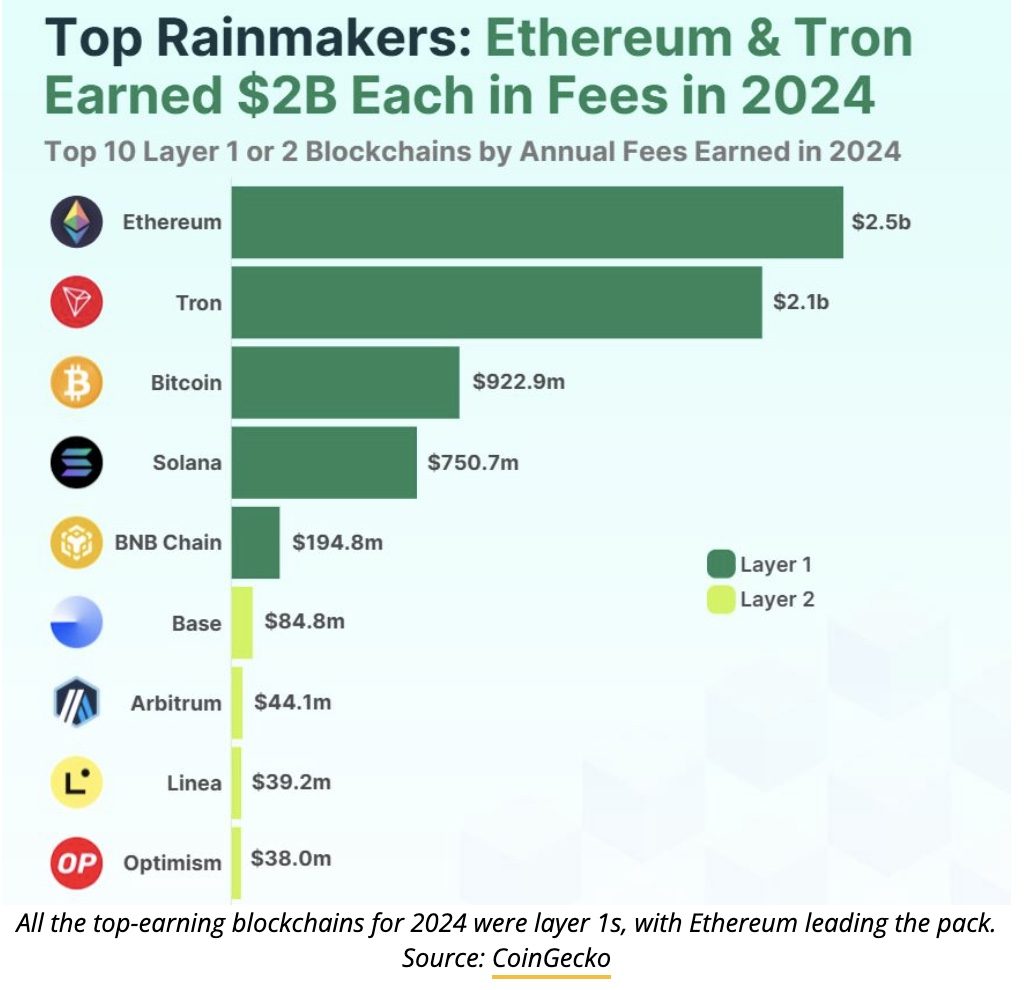

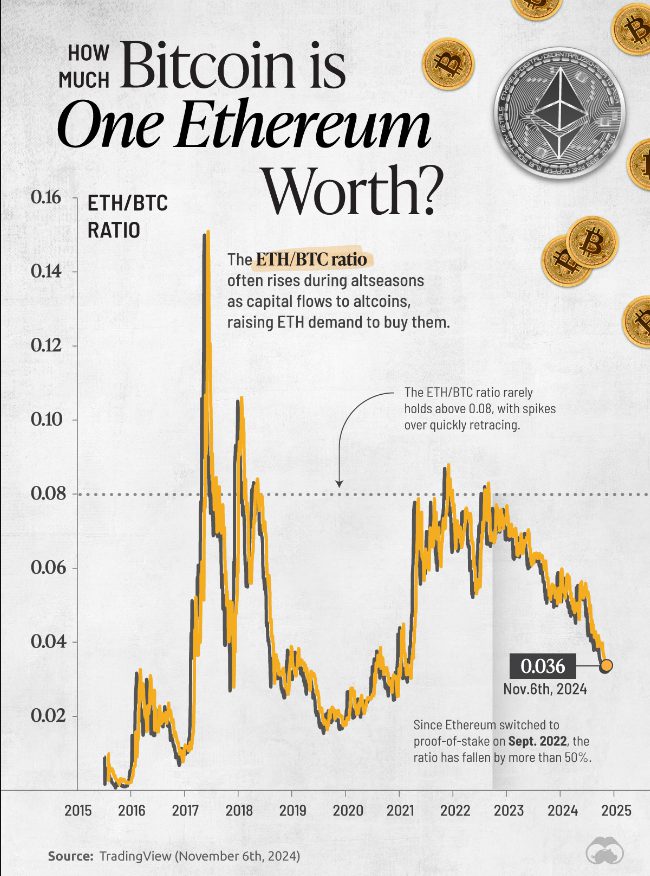

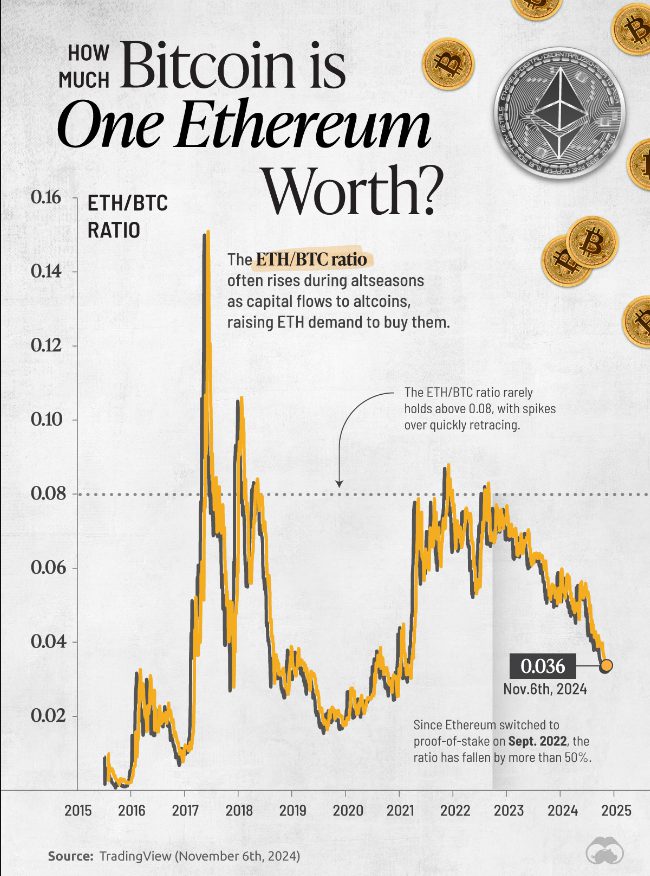

Ethereum is facing some mounting pressure amid market volatility and regulatory uncertainty as cryptocurrency investments face increasing scrutiny in 2025. The second-largest cryptocurrency by market capitalization has entered a period of prolonged price consolidation, drawing some stark parallels to XRP’s previous regulatory challenges. These developments have raised some concerns about potential security risks and wider implications for the digital asset market.

Read also: CME Set to Launch XRP and SOL Futures in February – Big Market Shift on Incoming

Ethereum’s legal issues, market volatility, security risks and regulatory uncertainty are explained

Price stagnation sparks market anxiety

$ETH seem few $XRP treatment now with hate being thrown at it from all sides because the award has been sidelined for a year 😂

Fascinating to watch…

Dw $ETH loyalists, when the number goes up, the hatred will mysteriously disappear 😬

— CrediBULL Crypto (@CredibleCrypto) 21 January 2025

“$ETH seems to be getting the $XRP treatment now with hate being thrown at it from all sides as the price has gone sideways for a year… Dw $ETH loyalists, when the number goes up the hate will mysteriously disappear.”

A number of market volatility indicators paint a troubling picture of Ethereum’s fundamental value proposition.

The regulatory environment is intensifying

An overwhelming number of security risks surrounding Ethereum have caught the attention of countless regulatory bodies investigating cryptocurrency classifications. Dozens of experts emphasize that Ethereum’s transition to proof-of-stake has reduced energy consumption by about 99%, but still a significant amount of regulatory uncertainty regarding its status. Many analysts draw striking parallels with regulatory challenges XRP has faced in the past.

Read also: Binance’s BNB Predicted to Break $1000: Here’s When

Market sentiment and trading patterns

Technical development and network growth

A large number of technical indicators show that Ethereum’s fundamentals are maintaining stability amid market turbulence. The platform now processes thousands and thousands of smart contracts daily, with many measures addressing regulatory uncertainty through improved compliance. A significant number of scalability issues remain as network usage grows, contributing to widespread market volatility.

Read also: Dogecoin drops 6% after logo removal and Ramawsami exits DOGE

Investment landscape development

Recent market conditions for Ethereum mirror a staggering number of previous cycles, with dozens of periods of consolidation preceding dramatic price movements. A remarkable increase in trading volumes shows unprecedented strength at key price levels, while hundreds of institutional interests remain steadfast despite mounting regulatory headwinds. An extraordinary collection of platform responses to security risks, including nearly 30 major technical upgrades, has fundamentally changed its position in the cryptocurrency investment landscape, attracting the attention of countless market participants.