Ethereum (Ethics) buyers increase their positions despite the latest market vollatility, as Verse cleaner assumes the chairmanship for Ethereum Foundation. ETH is currently acting at $ 2,389.93 at the time of writing after experiencing a decline of 5.06%. Some important accumulation zones were identified at $ 2,632 and $ 3,149 and suggest strategic purchasing activity among Ethereum buyers who could signal a potential ETH recovery in the coming weeks.

Also read: Bitcoin Crash: How high can BTC grow 2025 now?

Ethereum’s price prospects under new leadership – will buyers win?

Miyaguchi’s new role at Ethereum Foundation

Miyaguchi said:

“This wealth – where technical and social innovation is intertwined and affects each other – is not just a trait in Ethereum; That is why it lasts. “

Vitalik ButerinEthereum co -founder, expressed strong support for Miyaguchi’s leadership:

“Any success for EF – to rise the implementation of Ethereum hard forks and the equity ratio in its culture – is largely attributable to Aya’s administration.”

The leadership change occurs in the middle of Ethereum Price pre -disposals and growing interest from Ethereum buyers who are trying to benefit from the current market conditions.

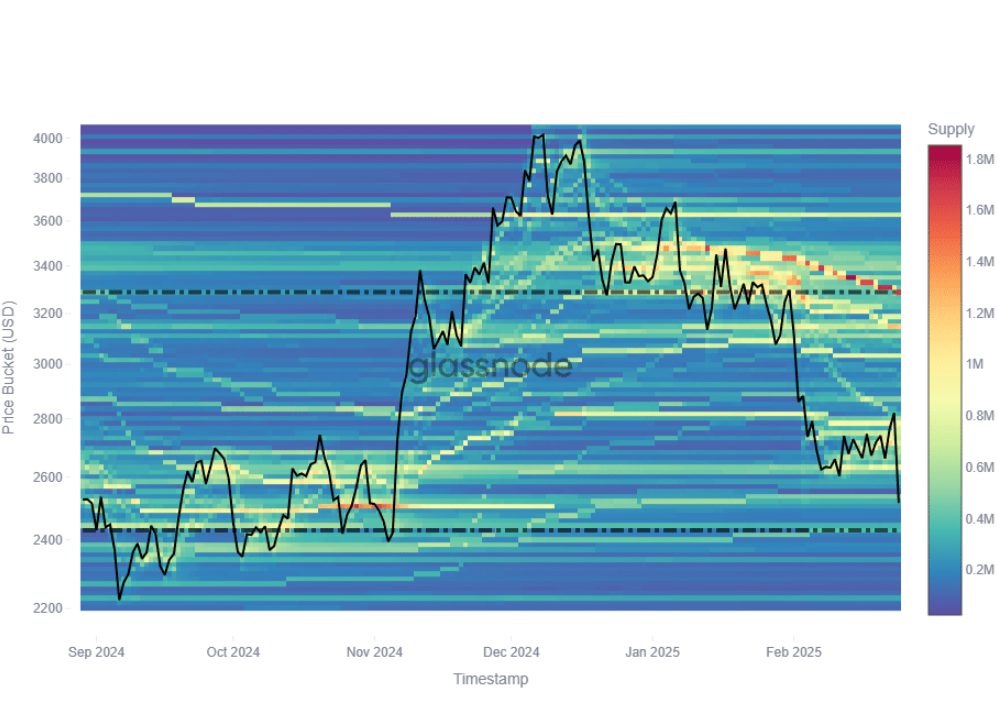

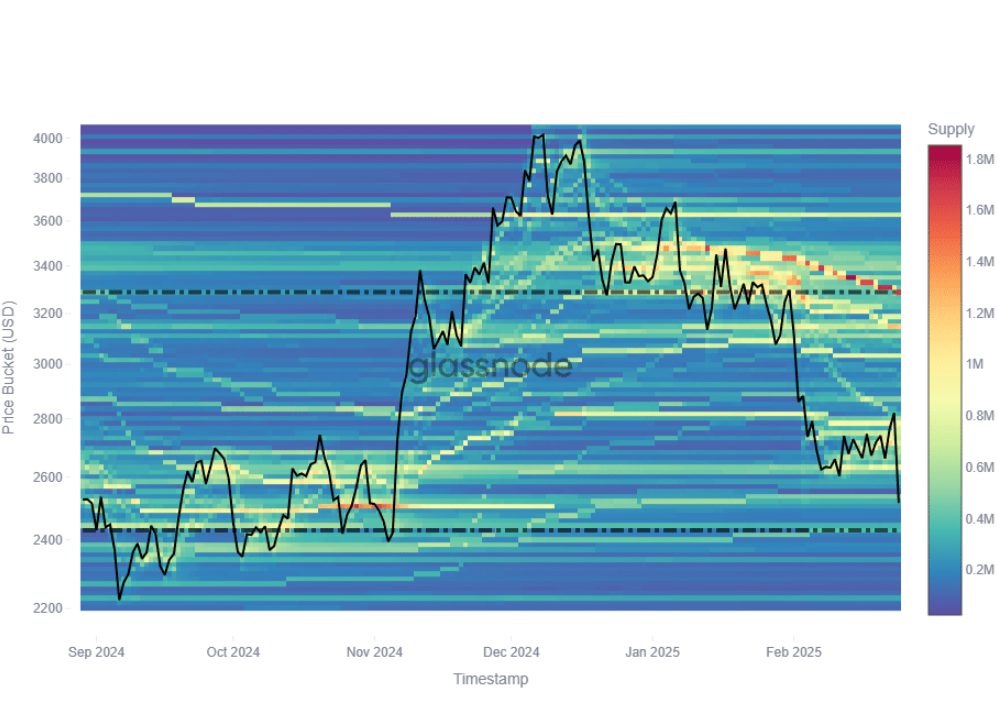

Ethereum -buyers gathered at key levels

Also read: Home Depot (HD) jumps 4% when the result exceeds

The cost base for distribution (CBD) shows that downward changes in investors’ cost bases are displayed, which indicates the persistent collection despite price vollatility. This buying behavior often precedes significant ETH -re -round movements in the Cryptocurrency market.

Technical challenges for Ethereum Foundation

Ethereum Foundation’s leadership transition occurred simultaneously with some dreaded technical challenges. The latest upgrade of Pectra encountered significant problems on the Holesky Testnet, which revealed vulnerabilities in how different execution layers processed validation deposits.

The technical difficulties mentioned above were, of course, isolated to the testnet environment and did not affect the Ethereum muste in any way. At the same time, the ongoing development challenges that the platform is facing that can affect the ETH Rebound potential.

CoinCox experts said:

“According to our current prediction of the Ethereum Prize, the price of Ethereum is predicted to rise by 13.67% and reaches $ 2,838.19 by March 28 2025. According to our technical indicators, the current feeling is Baisse while Fear & Greed Index shows 21 (extreme fear). Ethereum registered 14/30 (47%) Green days with 7.73% price volatility in the last 30 days. Based on the Ethereum forecast, it is now a bad time to buy Ethereum. “

ETH Rebound Prospects during analysis

The current technical indicators for ETH present a mixed image for Ethereum buyers. With an RSI of 33.30, Ethereum approaches oversold territory but has not reached extreme lowness, which indicates that potential downside risks remain. The MACD -Histogram has turned negatively, reinforcing baissertat momentum in the short term.

“According to our current prediction of the Ethereum Prize, the price of Ethereum is predicted to rise by 78.05% and reaches $ 4,445.85 by February 26 2026. According to our technical indicators, the current feeling is Baisse while fear & greed index shows 21 (extreme fear). Ethereum registered 14/30 (47%) Green days with 7.73% price volatility in the last 30 days. Based on the Ethereum forecast, it is now a bad time to buy Ethereum. “

Also read: Ripple XRP predicted to hit $ 4.20: Here’s when

Ethereum Price Prediction Experts monitors the $ 2,632 support level. A division under this zone can trigger a deeper correction, while continued accumulation of Ethereum buyers can push prices against $ 3,149 resistance levels.

When the Ethereum Foundation navigates both leadership changes and technical challenges during Miyaguchi’s chairmanship, the next few weeks will prove to be crucial to determine whether ETH can recover from current levels and reward the buyers who have gathered during this period of market uncertainty.