Ethereum’s Price Bounce has finally arrived after weeks with downward pressure on the crypto market. For the first time in over three weeks, ETH closed with almost a 4% profit after the price jumped directly from the support level of $ 1,800. This price recycling brought ETH short to about $ 2,000 before a relapse began. Right now, while this Ethereum Price Bounce continues to develop, buyers really have to drive ETH back over the $ 2,000 mark to have any chance of reversing the current downward trend that has been around since the end of 2024.

Also read: Crypto Czar David Sacks meets UAE officials to speak crypto, AI

Ethereum Price Bounce: Key support levels and market trends to look at

Ethereum’s latest price performance

Several ETH market trends are now emerging around important support zones on the market. The $ 1,800 level has served as an important study point during the latest Ethereum Price Stud that we have seen. This support also happens to adapt to 23.6% Fibonacci retracing level that many traders look closely.

If this level eventually fails, the next support is probably somewhere around $ 1,600, with additional support close to the $ 1,500 area where many long -term holders have gathered positions over time.

Long -term market prospects for ETH

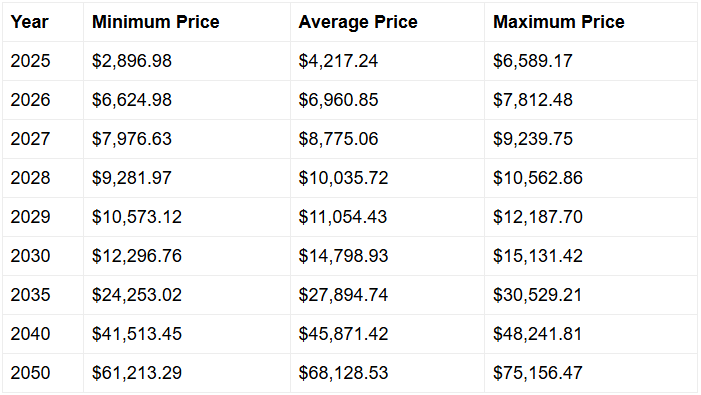

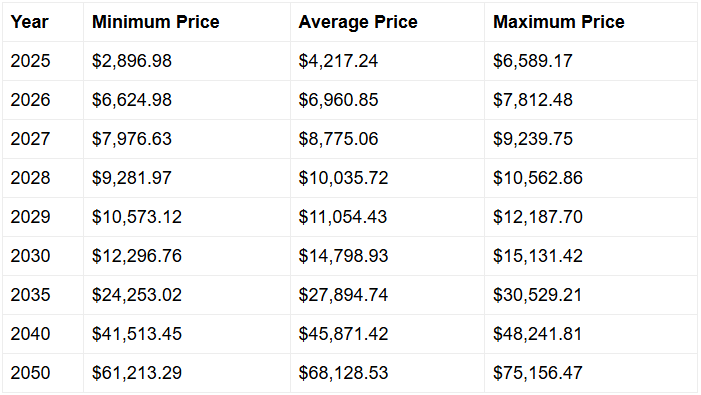

According to Telegaonprediction:

“The average price of Ethereum can reach $ 6,960.85 2026. If the current performance continues, the maximum price of Ethereum can reach $ 7,812.48 in 2026. If the market is rejected, the minimum level for Ethereum may be approximately $ 6,624.98 in 2026.

Also read: BRICS: US Dollar falls against 8 currencies 2025

A strong break over $ 2,000 would potentially open the road to test 38.2% Fibonacci level to about $ 2,400, followed by the important 50% level close to $ 2,875. These levels have served as large resistance zones during most of 2024 and early 2025 as well.

The long-term ETH market trends look potentially positive despite all the current volatility we see. The technical analysis of Ethereum suggests that a consolidation period around current price levels would probably enable a certain base building before another upward attempt can be made.

Ethereum Price -Studs from $ 1,800 have resulted in a certain temporary relief for investors, but several factors will ultimately determine whether this marks a genuine recovery or not.

Key factors for Ethereum’s recovery path

Prevention of lower lows in the price measure is a crucial element to look at in the coming weeks. If ETH can maintain levels above the latest lows, this may signal reinforcing market confidence.

Increasing trade volume under upward price movements is another really important indicator for monitoring. Higher volumes of green light would suggest genuine buyers’ interest rather than just a technical bounce.

The regulatory development that affects Cryptocurrency in general can also play an important role in ETH’s course. All significant announcements from major jurisdictions can trigger significant price movements in both directions.

The technical analysis of Ethereum suggests that traders should see for increased volume as a confirmation signal for this bounce. At the same time, regulatory clarity from major jurisdictions can significantly affect Ethereum’s price track in either direction in the coming months.

Also read: If you invest $ 5,000 in Solana today, how much can it be worth 2030?