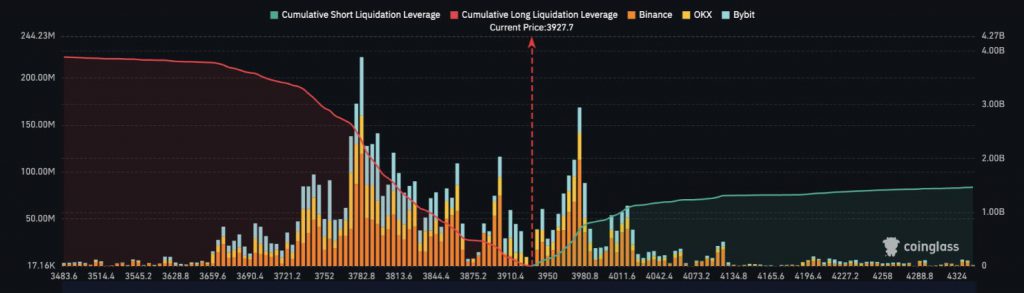

ETH ETF inflows have actually increased to $ 1.8 billion right now, and this is driving Ethereum against the $ 4000 brand while capturing almost $ 1 billion in short positions. This massive institutional demand has triggered an ETH card press and runs Ethereum Bull Run speculation, with Ethereum Futures Trading Voluming as a trader positions for potential price eruptions.

🚨 Update: Nearly $ 1 billion in Ethereum -shorts will be liquidated if $ Hits $ 4,000. pic.twitter.com/UQ2N3AU0LC

– Cointelegraph (@Cointelegraph) July 28, 2025

ETF inflows Spark ETH Short press, Fuel Bull Run Speculation

The unmatched ETF inflows have actually created perfect conditions for an ETH card press right now. Coinglass -Data shows that the US Spot Ethereum ETFs registered over $ 1.8 billion in weekly inflowsAnd this significantly exceeded Bitcoin ETF inflows of $ 720 million during the same period.

Short positions are facing $ 1B -höccid risk

Some traders get stuck with how fast these positions become vulnerable. At the time of writing, the pressure on shorts has been built steadily, and many positions that seemed safe just weeks ago are now facing potential forced closing.

Also read: Ethereum exceeds Costco in value: How high ETH plans to grow?

Ethereum Futures Trading Volumes

🔥 Update: US Spot Ethereum ETFS saw over $ 1.8 billion inflows last week and exceeded Bitcoin ETFS inflows of $ 72 million. pic.twitter.com/gx2d2xgqip

– Cointelegraph (@Cointelegraph) July 28, 2025

Ethereum Futures Trading has actually experienced significant growth together with ETF speed. The massive ETF inflows have not only affected the spot markets but also driven increased activity in derivatives. Professional traders relocate when Ethereum Bull Run Narrative gains traction, and many adjust their strategies to account for continued institutional demand.

Bull Run Indicators adapt

Several measured values point to a potential Ethereum Bull driving when ETH ETF inflows continue to drive price measures right now. The combination of card press pressure, institutional adoption and technical breakout patterns has actually created conditions reminiscent of previous bull market phases.

Also read: Blackrock Crypto Head leaves to join Ethereum Treasury Company

ETH ETF inflows have actually increased to $ 1.8 billion right now, and this is driving Ethereum against the $ 4000 brand while capturing almost $ 1 billion in short positions. This massive institutional demand has triggered an ETH card press and runs Ethereum Bull Run speculation, with Ethereum Futures Trading Voluming as a trader positions for potential price eruptions.