Head of macro research at the global market investor Julien Bittel has given an interesting insight into the Bitcoin market after a large price loss during the past week. In a bold feature, financial analysts have supported the foremost Cryptocurrency to soon pull off a rebound that links the latest price fall to wider macroeconomic conditions.

Why Bitcoin drops below $ 80,000 could have highlighted the end of sales

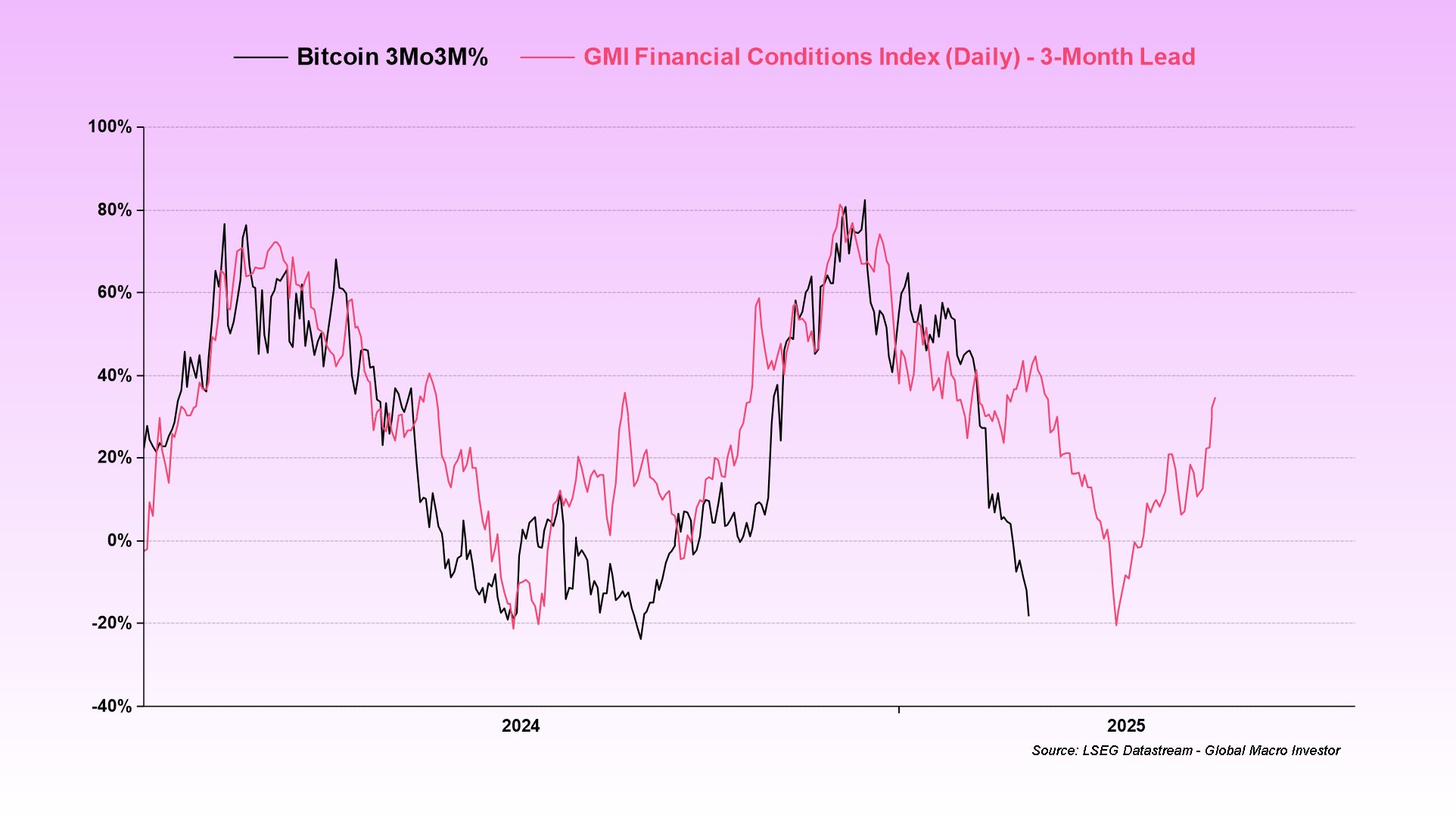

In the past week, the BTC market registered a significant Baisse Prize actionwith prices falling from over $ 96,000 to under $ 80,000. In one X post On February 28, Bittel attributed this price fall to the tightening of the financial conditions during the fourth quarter of 2024, which has emptied liquidity from the market, making it more difficult for speculative assets such as Bitcoin to maintain upward speed.

As market similarity decreases, slow surprises slowly lead to concerns about a potential recession and ultimately induces market uncertainty and a risk-off behavior. However, Bittel expects these investors’ feeling to turn in March and make a case for a bitcoin recovery.

The analyst notes that the market conditions over the past two weeks have been facilitated quickly, which is indicated by a weakened dollar, decreasing bond rates and falling oil prices. This macroeconomic development indicates that liquidity returns to the financial system that signals a potential recovery in the marketing entry.

With Bitcon’s latest dip below $ 80,000, Julien Bittel says the effects of tightening the liquidity conditions has been fully reflected. And although a potential fall in prices is still possible, sentiment indicators signal a little space for further disadvantage. For example, Bitcoin’s relative Strength Index (RSI) has recently touched on 23, which represents its most exaggerated level since August 2023. Such market conditions support the perception of incoming price recovery.

BTC market: A counter -carriage?

In the last remarks about an exciting analysis, Bittel has urged investors to be too comfortable baisse -like, but rather pressed on a greedy way of thinking in the midst of the widespread market’s fear.

Noteworthy blockchain analytics company Santiment Notes That the “market mass” tends to go wrong on predictions, ie when traders predict Bitcoin to go lower, prices go up and vice versa based on historical data. Therefore, the current Bitcoin market can provide a unique opportunity for accumulation despite general expectations for a long -term price dip.

At the time of writing, Bitcoin is shopping for $ 84,750 after some price gains on Friday in the middle of a positive American inflation report. With a market value of $ 1.68 trillion, the main Cryptocurrency remains the greatest digital asset with an astonishing market dominance of 60%.

The picture from The Independent, Chart from TradingView