A generally followed crypto strategist believes that a correction in a secure sea is likely to trigger the risk of behavior that could benefit Altcoins.

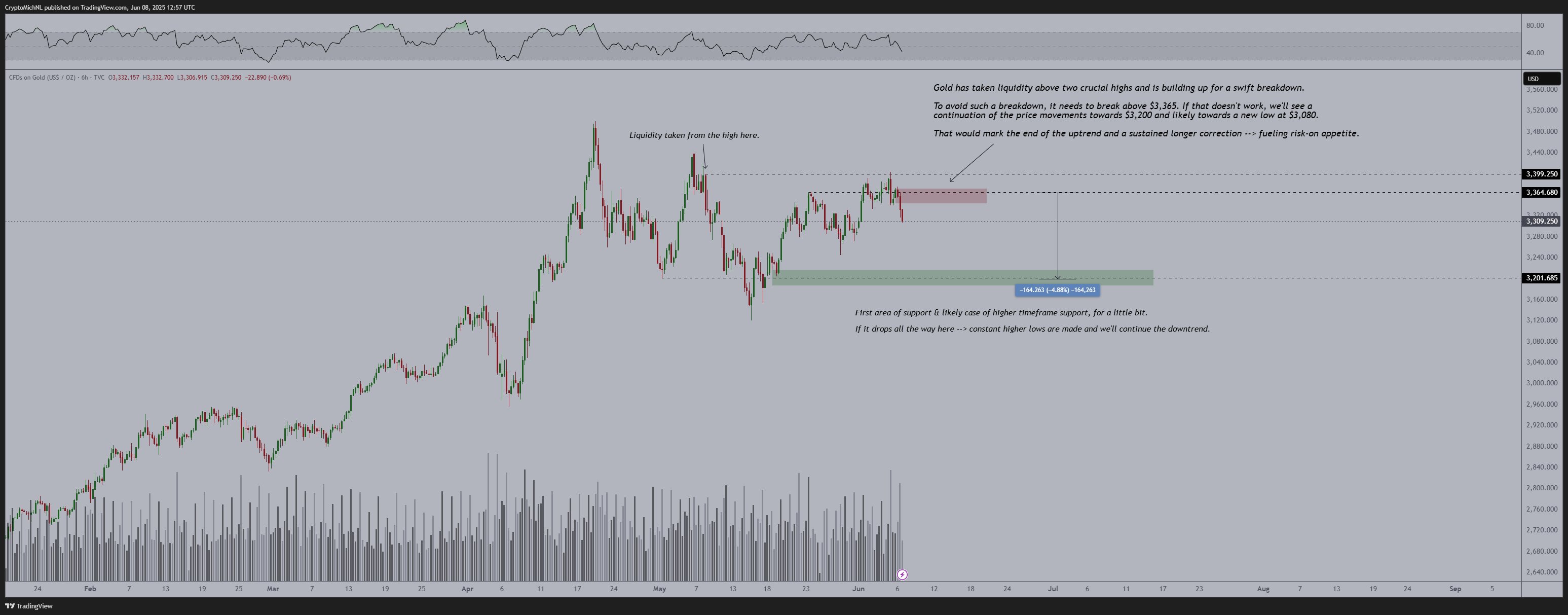

Analyst Michaël van de Poppe tells his 791,800 followers on the social media platform X that he maintains an accuracy on Gold’s price action, note That the precious metal’s diagram is the “most important chart to look at” this week.

According to the trader, gold seems to have printed a baissel lower high setting on six hours charts, which indicates that the precious metal could fall as low as $ 3,200 in the short term.

“As long as gold remains below $ 3,365, we will probably see a sharp case in the coming to two weeks of everything between 4-10%, resulting in a sudden macroeconomic change.”

Van de Poppe believes that falling gold prices will be beneficial for altcoins, as it suggests an increased appetite for risk among investors.

“At the end of the (last) week owned a sudden (gold) correction, which can lead to confirmation of a short -term downward trend.

This is important, as it would attract more investors to altcoins.

Why?

It would allow more investors to jump to risks, when gold suggests that it continues to fall.

This means-> money/liquidity flows from risks to assets to risks, and the best asset class remains to be crypto. ”

But the trader warns that altcoins are likely to see lower levels if gold bursts $ 3,365.

“If it breaks over the decisive level, the theory is invalid, and we are probably open to print new heights, which means that we print new lows on Altcoins.

For me, this is crucial, as a correction in gold and rally in CNH (Offshore Chinese Renminbi) means that we will see more interest flowing into crypto after that. “

At the time of writing, gold is traded for $ 3,324, an increase of more than 60% over the past 18 months.

Generated Picture: Midjourney