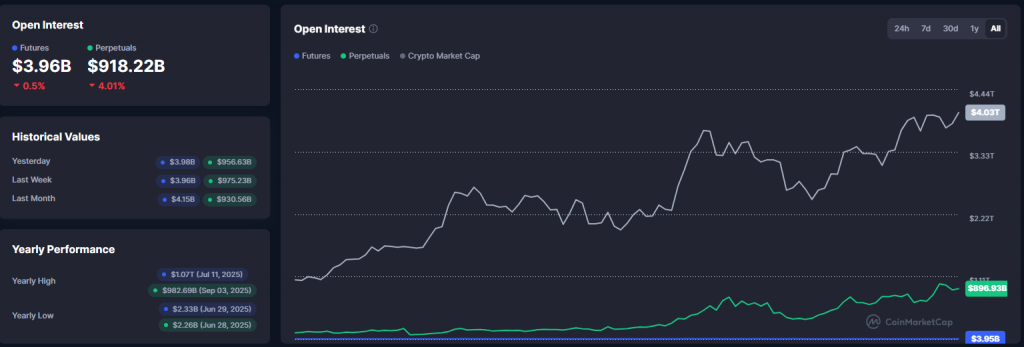

Bitcoin Futures Markets will expand quite significantly right now, as Cboe planning to launch some 10-year-old bitcoin and ethereum futuresWhich gives us-regulated assets to what is mainly Perpetual-style trading products. The Chicago Board Options Exchange has announced that these Bitcoin Futures will start shopping on November 10, pending regulatory review, which marks a fairly important moment for institutional cryptoderivate.

CBOE’s 10-year-old Bitcoin and Ethereum Futures provide regulated access

Derivat Exchange will introduce continuous bitcoin futures together with Ethereum futures which have outstanding 10-year output periods. These US-regulated products actually eliminate the need for quarterly roll, which simplifies the position management for institutional traders quite a lot.

“Futures in eternal style have received strong assumption in offshore markets. Now CBOE takes the same tool for our US-regulated futures exchange.”

Only in: 🇺🇸 The world’s leading derivative changes CBOE to “Launch continuous future for Bitcoin” 🚀

Hausse! pic.twitter.com/gdc1fv5xcp

– Bitcoin Magazine (@bitcoinmagazine) September 9, 2025

The continuous Bitcoin futures will be cassette and Cboe adjusts them daily to detect prices using transparent financing methods. CBOE’s return to cryptoderivate represents a major change, as the exchange launched its original Bitcoin Futures as early as 2017 but later interrupted them.

Also read: Fidelity Investments Files for Spot Sola Sol ETF with CBOE

Market effect and trade structure

These Ethereum-Futures and Bitcoin Futures will actually trade with CBOE Futures Exchange, and they are cleared through the CFTC-regulated CBOE Clear us the ten-year starting structure deals with institutional demand for long-term crypto exposure without the operational complexity that follows it.

Clay emphasized the exposure of the broader market:

“We expect that continuous future will appeal not only to institutional market players and existing CFE customers, but also to a growing segment of retailers who seek access to cryptoderivate.”

Also read: 1.5 trillion dollars Franklin Templeton files for Spot XRP ETF with CBOE

The Options Institute will actually host educational sessions on October 30 and November 20 to prepare traders for these new Bitcoin Futures and Ethereum Futures products.