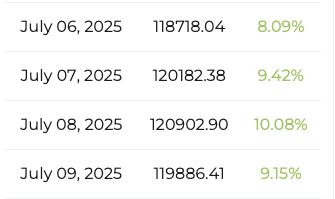

According to Bloomberg ETF analyst Eric Balchunas, Blackrock’s Bitcoin (BTC) Ibit ETF has entered the 20 most traded ETFs this year. IBIT is currently in the 13th place, just behind the Direxion Daily Semiconductor Bull 3X shares (Soxl USA). Spy US continues to dominate the chart. Spy US has been the highest traded ETF over the past ten years.

Blackrock continues bitcoin -buying

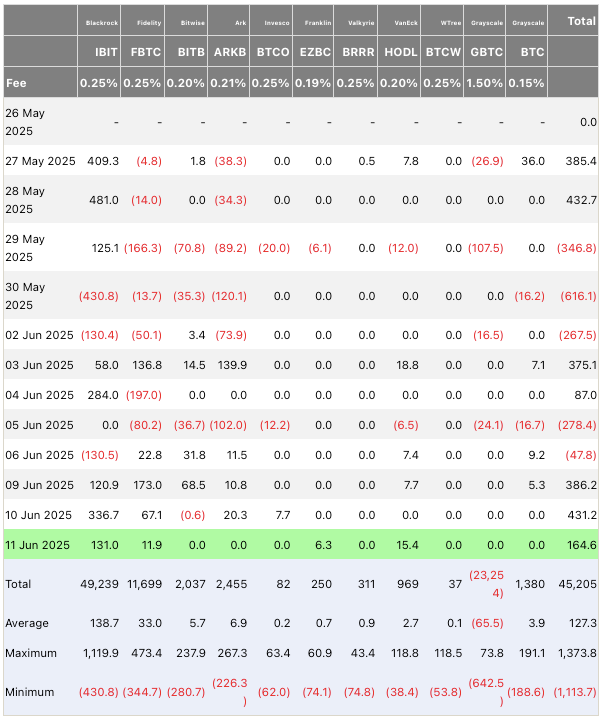

According to Farside Investors, Blackrock bought Bitcoin (BTC) at $ 930.6 million in June. The world’s largest asset manager has liquidated $ 260.9 million in BTC in the same time frame.

Will the asset continue to collect?

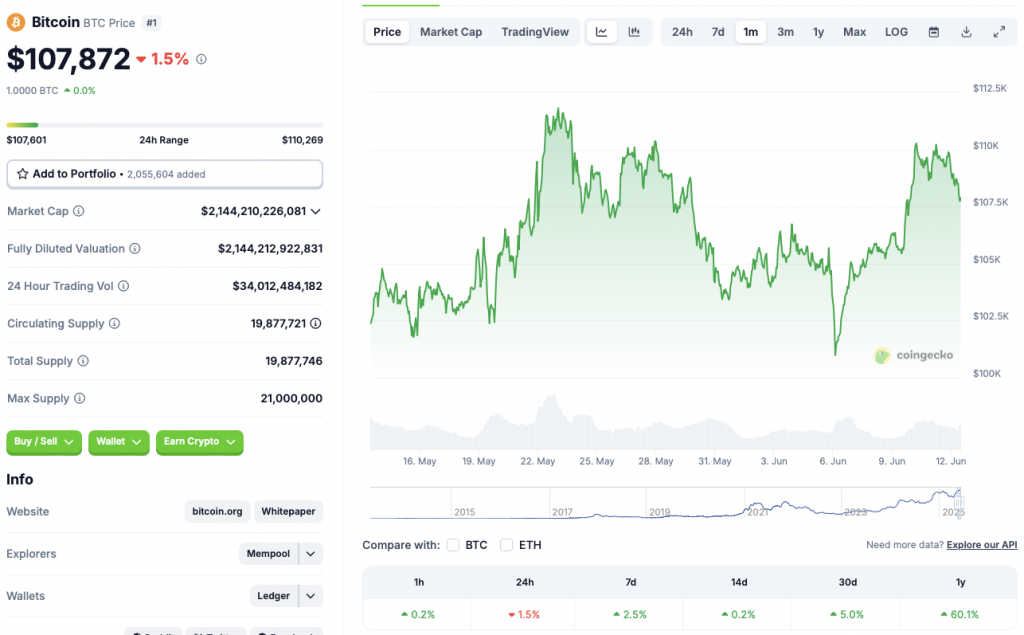

BTC has seen continued institutional inflows in recent weeks. Institutional funding is an important driving force for an asset price. BTC can continue its rise if Blackrock and other financial institutions continue to buy access. Retail investors seem to take a rear seat until now. We can see a more significant rally if retail buyers also participate.

BTC is currently facing significant resistance at the price level of $ 110,000. BTC was able to climb to a new top if it breaks the $ 110,000 mark.

Also read: Blackrock’s Ibit -SPlats Bitcoin ETF reaches $ 70 billion Aum