Black rockBitcoin ETP has just received FCA Approval, and this marks a really big step forward for institutional crypto adoption right now. The massive asset manager, who currently monitors about $ 12 trillion, has become the 51st company to be registered with the British controller, Join those like Coinbase, PayPal and even Revolut. This approval follows their latest listing on Euronext Paris and Amsterdam where they launched Ishares Bitcoin ETP during the ticker IB1T last week.

Also read: US dollar experiences sharpest monthly declines in two years

How Blackrock’s Bitcoin ETP and FCA approval affect investors

European strategy expansion

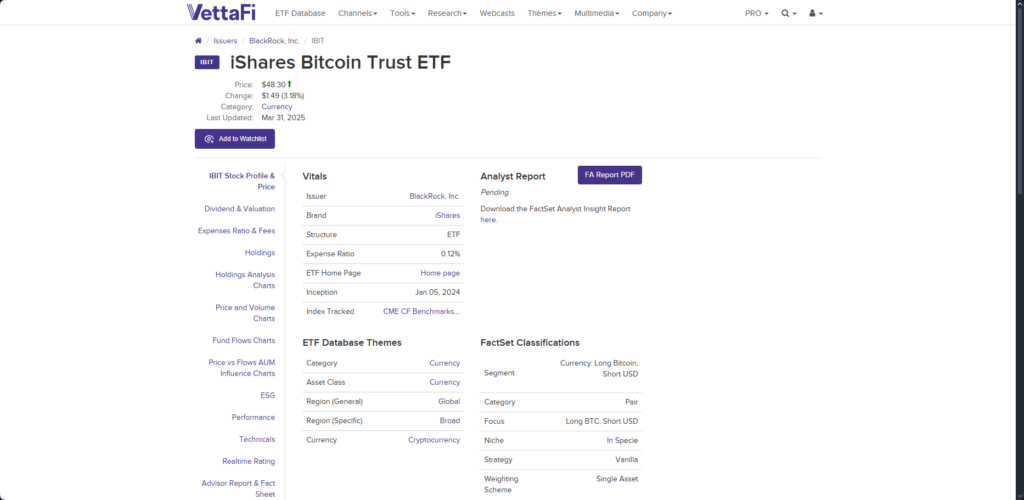

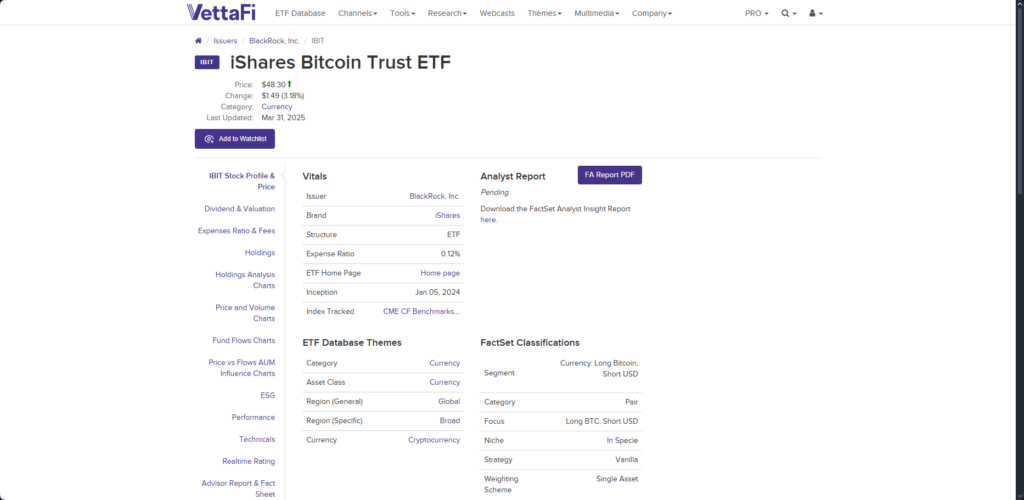

The structure for Blackrock Bitcoin ETP basically reflects its already successful American Bitcoin confidence, also known as Ibit, which has so far collected more than $ 48 billion in assets since its launch. Blackrock created the European market product through a Swiss -based special vehicle to ensure proper compliance with the various European financial regulations.

Right now, Blackrock CEO Larry Fink Have expressed some interesting views on bitcoin. He said:

“Rising US debt can weaken the dollar’s dominance and possibly strengthen Bitcoin’s case as a store of value.”

Also read: Cardano: Ai predicts the ADA Prize forecast 5 April 2025

Institutional adoption effect

The expansion of Blackrock to European crypto markets is currently signaling the growing institutional acceptance of digital assets as legitimate investment vehicles. This type of movement can help to address many investors’ concerns about uncertainty in the legislation in Bitcoin investment and also provide a safer way to get exposure to the Cryptocurrency market.

Market assessment

Blackrock Bitcoin ETP approval comes at a time when institutional crypto adoption really accelerates globally. FCA’s selective approach for registration of crypto companies suggests that increase the legitimacy of Cryptocurrency -investment products, and this can potentially lead to greater mainstream acceptance in the near future.

Also read: Gold to increase 10.7% in May 2025-Safe-Sea Demand Driving Price to $ 3,448.54

Blackrock’s expanding presence in crypto markets can significantly increase institutional investment flows in Bitcoin. Regulated Bitcoin investment products now provide access to professional investors who could not invest earlier due to mandate restrictions and regulatory problems.