After a price accident to less than $ 80,000 last week, Bitcoin has experienced some market recovery over the last 48 hours and increased by over $ 7.5% to trade over $ 86,000. In the midst of this market recovery, Crypto marketers have discovered the most critical level of support for the foremost Cryptocurrency right now.

Bitcoin Faces ‘Air Gap’ Under $ 83K – a division can be brutal

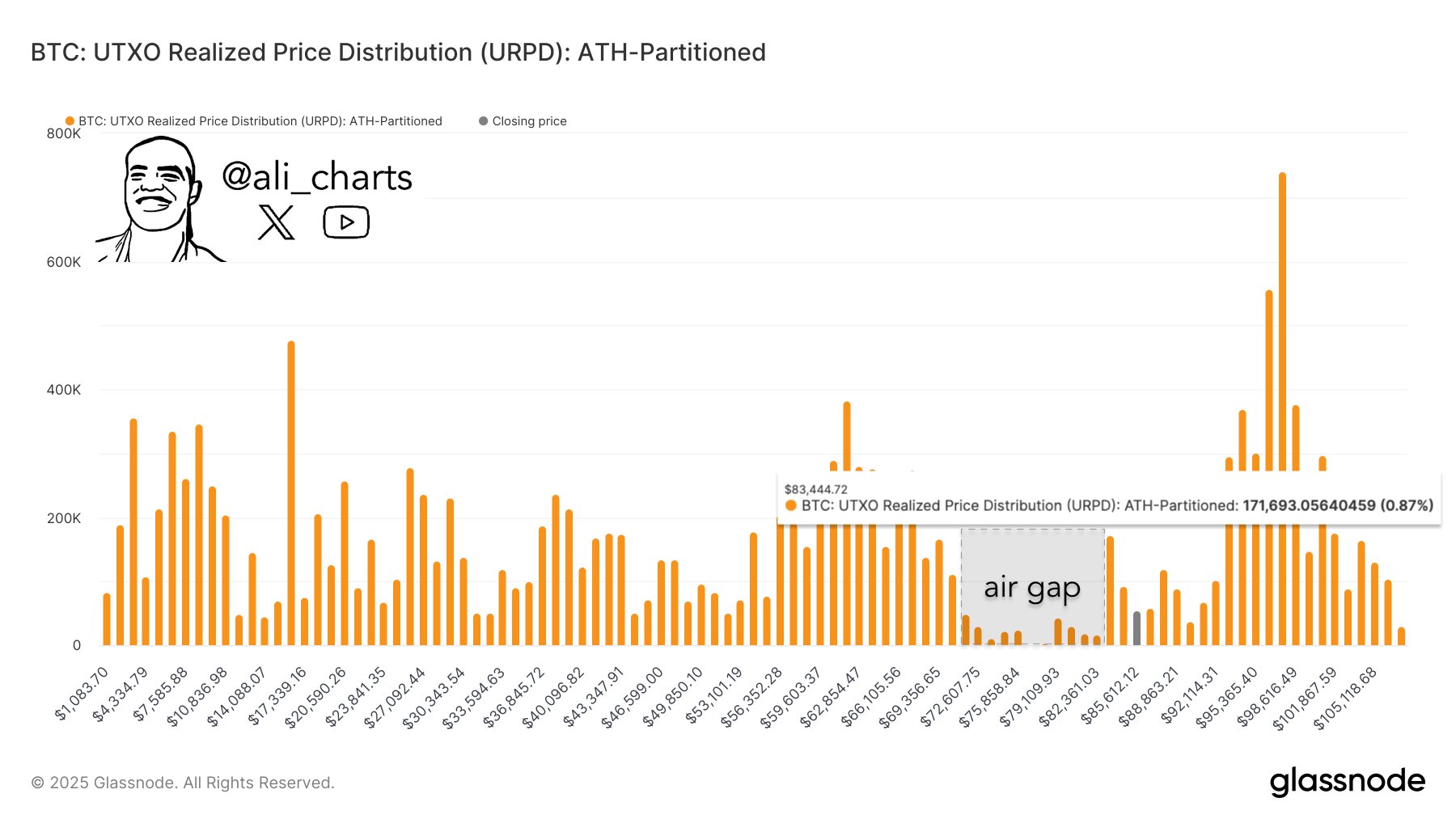

In one X post On Saturday, Martinez shared a puzzling insight into the Bitcoin market. With the help of UTXO Realized Price Distribution (URPD) Metric partitioned on All-Time Highs, the analyst has identified $ 83 440 as the most important Bitcoin support zone.

Generally speaking, URPD is one on the chain that shows the price levels at which unused transaction exits (UTXOS) last moved and thus measure how much bitcoin was carried out at different price levels. Each stack on the URPD diagram represents a price range, and the height of the rod indicates the number of BTC transacted at that level.

Therefore, URPD can be used to identify potential support and resistance levels that it would show if a significant amount of BTC was acquired or sold at a specific price level.

According to Martinez’s analysis, URPD data from Glassnode shows that investors acquired 171,693 BTC (0.87% of the total supply) to $ 83,440.72, and converted this price level to a strong support zone. This is because Bitcoin Bulls is likely to go in and acquire more BTC at this level at least by a re -tasting.

However, there is a remarkable air gap between $ 72,000 – $ 82,000 with low levels of UTXO registered in this price range. Thus, a decisive case below $ 83,440 will result in a further price decline due to the lack of demand in the immediate lower price ranges.

Bitcoin RSI Backs Rebound Quest – More winnings ahead?

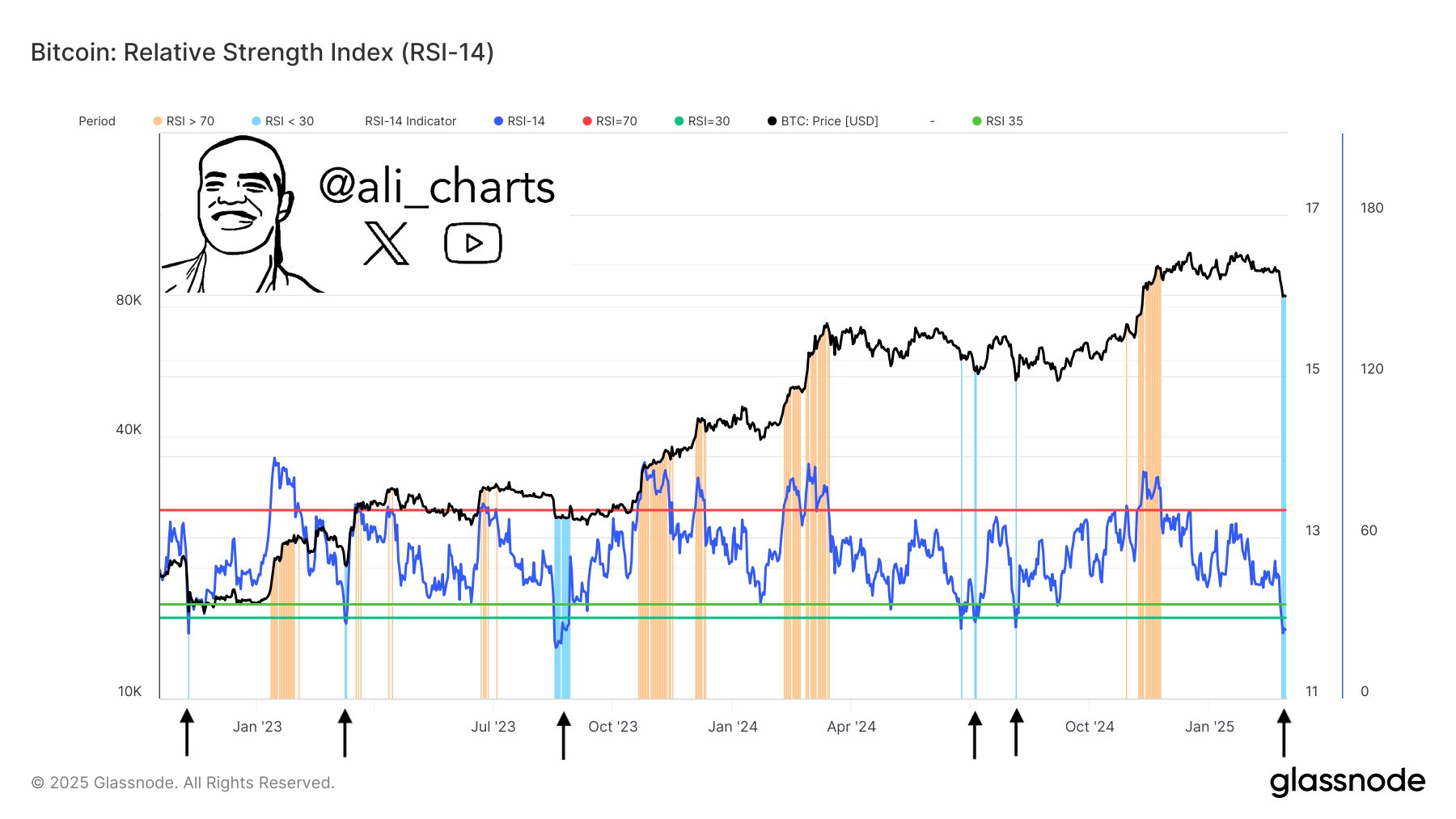

In another Analysis Post In the BTC market, Martinez has suggested the potential for additional price gains in the middle of the ongoing price recycling. According to the Crypto expert, Bitcoin has historically registered a price recovery after its relative strength index (RSI) went below 30.

RSI measures the momentum for price movements and decides whether an asset is over purchase (over 70) or over -age (below 30). Martinez says that Bitcoin’s RSI has recently touched on 24 in the over -sold zone suggesting that a recovery to recover previously high price levels may arise according to historical data.

At the press time, Bitcoin is shopping for $ 86,383 after increasing by 2.32% over the past 24 hours. After the price correction in the past week, BTC remains 21.02% discount from its all the time at $ 109.114.

Image from iStock, chart from tradingview