Bitcoin (BTC) Treasury companies facing a fairly critical situation as their market premium over the underlying BTC holding erodes in the midst of falling volatility and a strong slowdown in new purchases.

In particular, monthly BTC purchases from these companies have crashed by 97% since November 2024, which reflects a very cautious market method in recent months. However, new data from Cryptoquant suggests the need for an immediate change in the strategy.

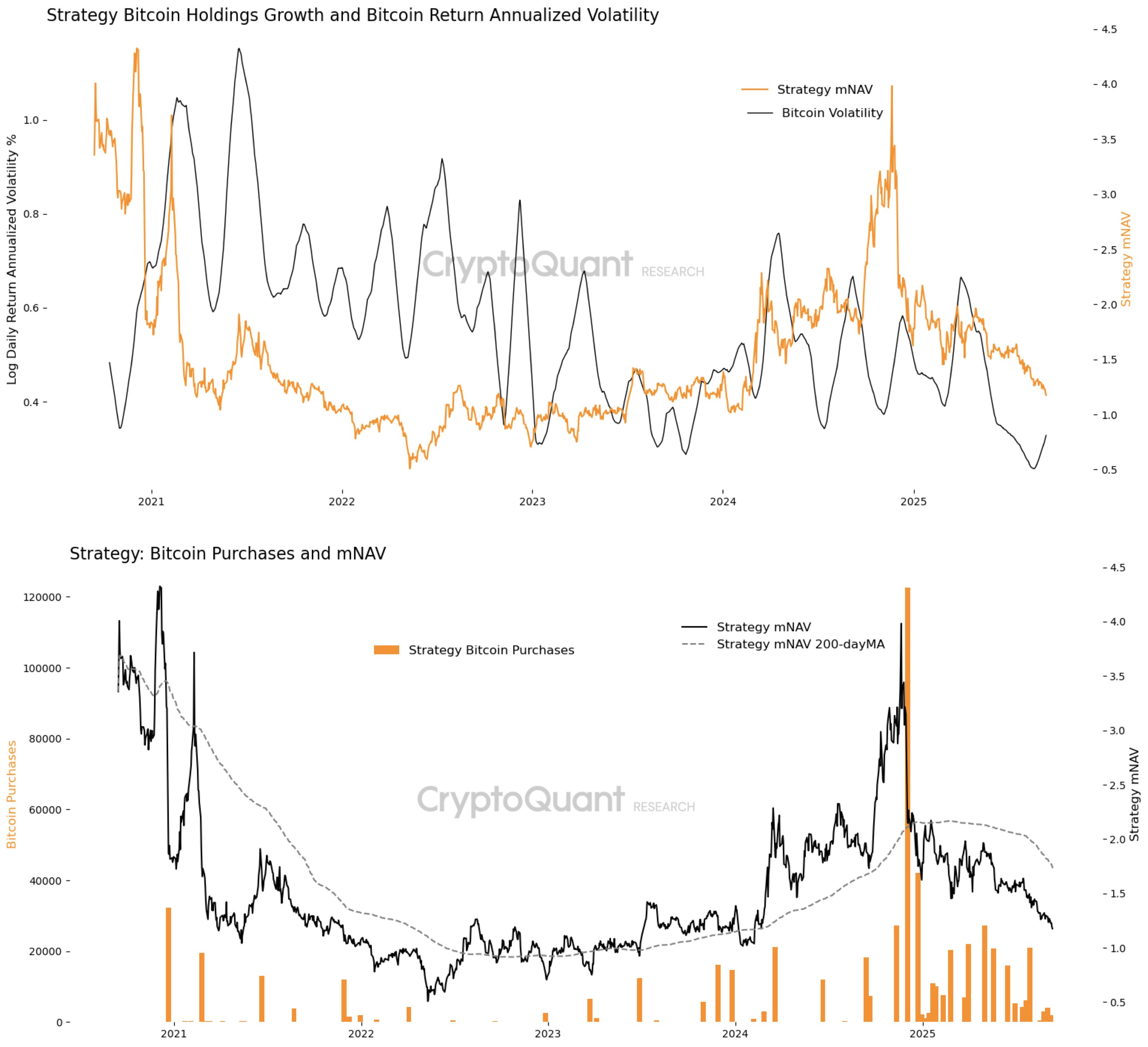

Falling Bitcoin Volatility threatens Bitcoin Treasurie’s market value

Generally, Bitcoin Treasury Trading in a premium, which means that their market value exceeds the actual value of BTC they have, as investors believe that these companies can grow their holdings, make money from volatility and serve as a safe exposure to the foremost cryptocurrency. Therefore, the market net asset value (MNAV), which compares these companies’ share price with NAV for their Bitcoin holding, is always greater than 1.

Cryptoquant research manager, Julio Moreno, share The annual Bitcoin volatility has dropped to perennial lowness and removes an important driving force for that premium as state cash registers have fewer opportunities to take advantage of price fluctuations and motivate values over their underlying BTC holdings.

When analyzing market data for Strategy, The largest company’s BTC holders, it can be observed that some nails in volatility have produced periods when MNAV grew over 2.0, especially at the beginning of 2021 and again in the middle of 2024. Under these windows, financial companies could make money on volatility, increase equity or debt to a premium and distribute these revenues.

At present, however, volatility has compressed well below 0.4 log -day return this year and reaches its lowest level since 2020. The flattening volatility curve has coincided with a steady decline in MNAV, which has slipped back to 1.25. This declining premium proposes that investors no longer see Treasury companies that offer meaningful leverage effects to simply keep bitcoin directly.

Weakening of demand compounds Treasurie’s problems

Without “fuel” of price fluctuations, Bitcoin Treasury companies fight to expand their holdings in ways that justify a premium evaluation. While there were isolated bursts of purchasing at the end of 2024 and early 2025, the overall activity remains.

Correspondingly, the strategy’s mnav has trends downwards since the beginning of 2025, even since BTC itself has acted in a relatively increased price range compared to in recent years. The information indicates that when the Treasury purchases aggressively, investor enthusiasm drives higher, which reinforces the bicycle for premium publishing and BTC accumulation.

Julio Moreno explains that for the MNAV premium to continue, a recovery in BTC volatility and renewed demand is needed through large-scale purchases immediately. Until then, Finance Companies may find it increasingly difficult to justify values over their Bitcoin net asset value, forcing investors to consider a direct exposure to Bitcoin for return rather than on a corporate strategy.

At press time, Bitcoin is shopping for $ 115,810, which reflects a profit of 4.72% over the past week.

Image from Pexels, Chart from TradingView

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.