The Bitcoin market has experienced significant price correction in the last few hours, with prices dropping to about $ 110,000 as The trade war Between the US and China can still resume. Before this decline, the cryptom market leader led a strong rally to set a new highest time of $ 126,198.17 on October 6, 2025. Interesting enough, recent information on the Bitcoin OPTION market indicated a wave of gentle positions among institutional investors in the middle of this price increase before the current market.

The institutions go back when Bitcoin’s rally becomes euphoric – Glassnode

In one X post On October 10, Blockchain Analytics Glassnode posts some interesting insights into its market update every week. Noteworthy Glassnode analyst reports that while Bitcoin prices increased more than 10% in the latest ascent to a new highest time, institutional traders seem to have maintained a quiet market strategy and chose to lock in the profit and protect the disadvantage rather than chasing rally.

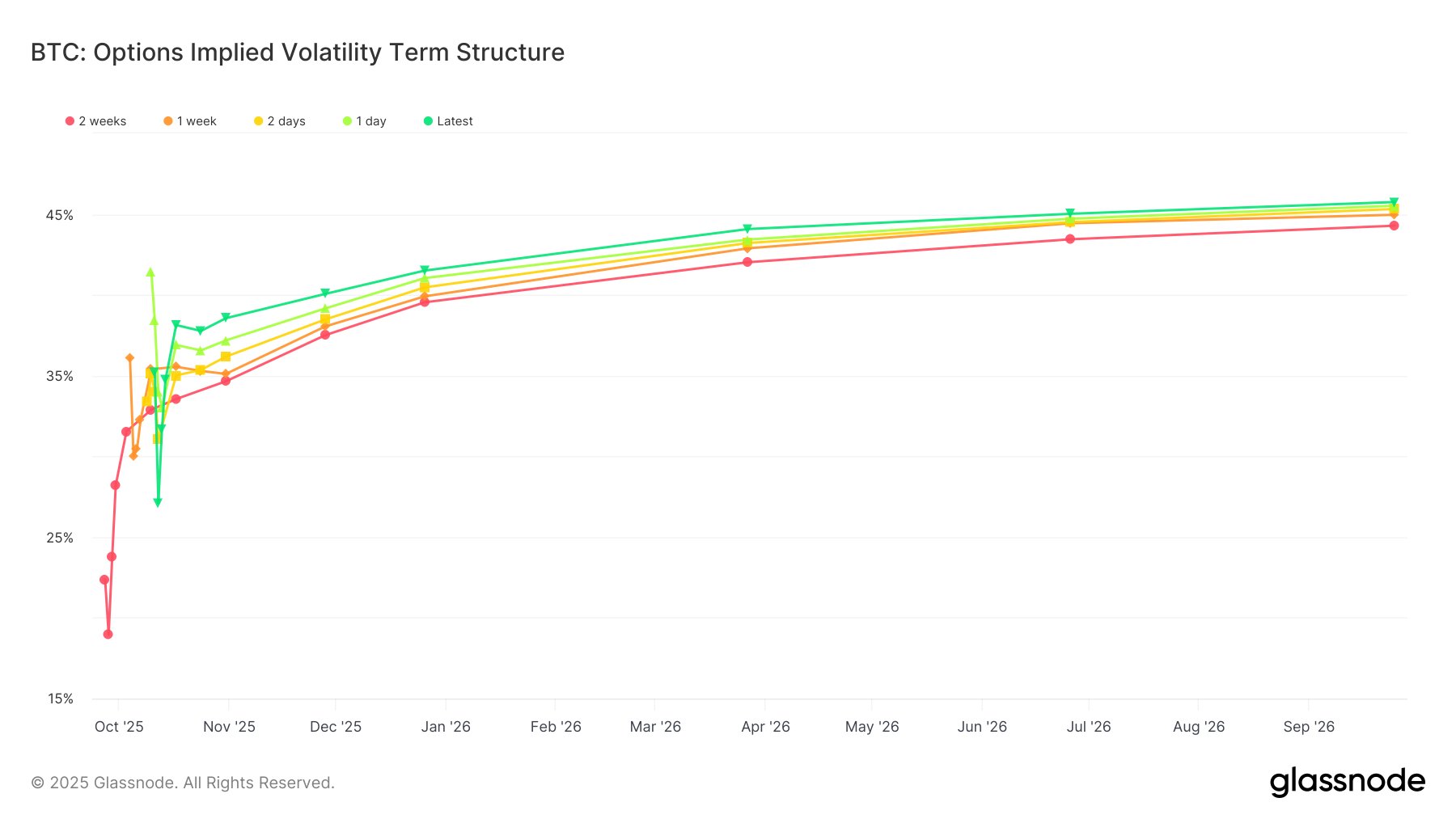

Despite the steep movement higher, implied volatility, ie. A meter of expected price fluctuations, barely burgled, floats around 38-40%. Normally, a rally of that size would press volatility higher when traders quickly call and reinforce their exposure. However, the silent reaction suggests calm from institutional investors who were already positioned for the move or simply do not want to pay for further upward.

Glassnode analysts also pay attention to another subtle but tells the login of the option. Even at the height of the rally, demand for putoptions remained strong and kept the market increased. This indicates that many major players sold calls, effectively cut potential upwards, through the option market, while maintaining insurance if the market reverse.

In addition, the PUT-Call ratio also strengthens this cautious pattern among the institutions. In the middle of the option’s end on Friday, October 9, the relationship climbed over 1.0, which indicates that more people are acting than calls because traders were busy hedging positions before the current downturn rather than chasing speed and locking in recent winnings.

In general, Glassnode Bitcoin market describes as adopting another behavior this cycle, driven by institutional discipline rather than increasing volatility and retail agreement as seen in previous cycles. The dominance of institutional funding driven by Spot ETFS And the recent creation of crypto pairs may have added a thick layer of maturity to $ 2 trillion market.

BTC market overview

At the time of writing, Bitcoin is traded at $ 110 805 after a decline of 7.54% over the past 24 hours. At the same time, daily trade volume has increased 150.37%, indicating an increase in marketing activity when traders react to the sharp return.

Image from Flickr, Chart from TradingView

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.