Key dealers

- Sayor’s strategy acquired more Bitcoin as the company increases its investment in the long -term upside of the asset.

- The latest Bitcoin purchase was financed by selling MSTR and STRK shares.

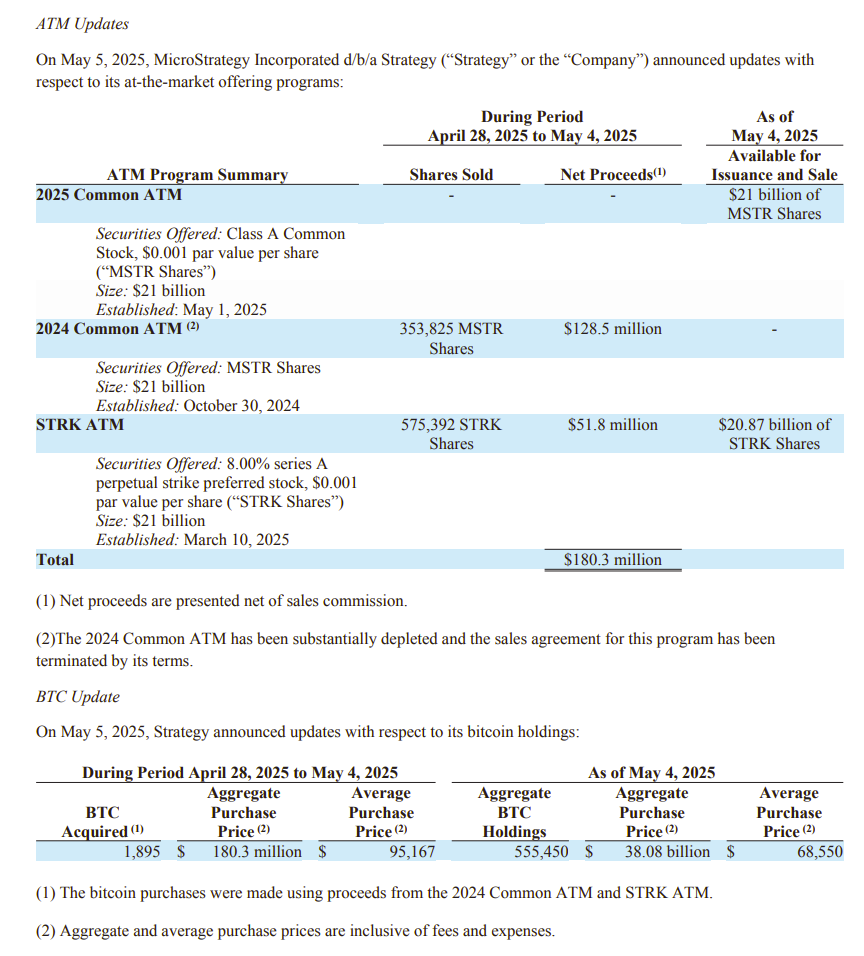

Bitcoin Proxy strategy continues to scale up its BTC exposure. On Monday, the company said it had acquired another 1,895 BTC between April 28 and May 4, which increased its holding to 555 450 BTC, or 2.6% of the total Bitcoin delivery.

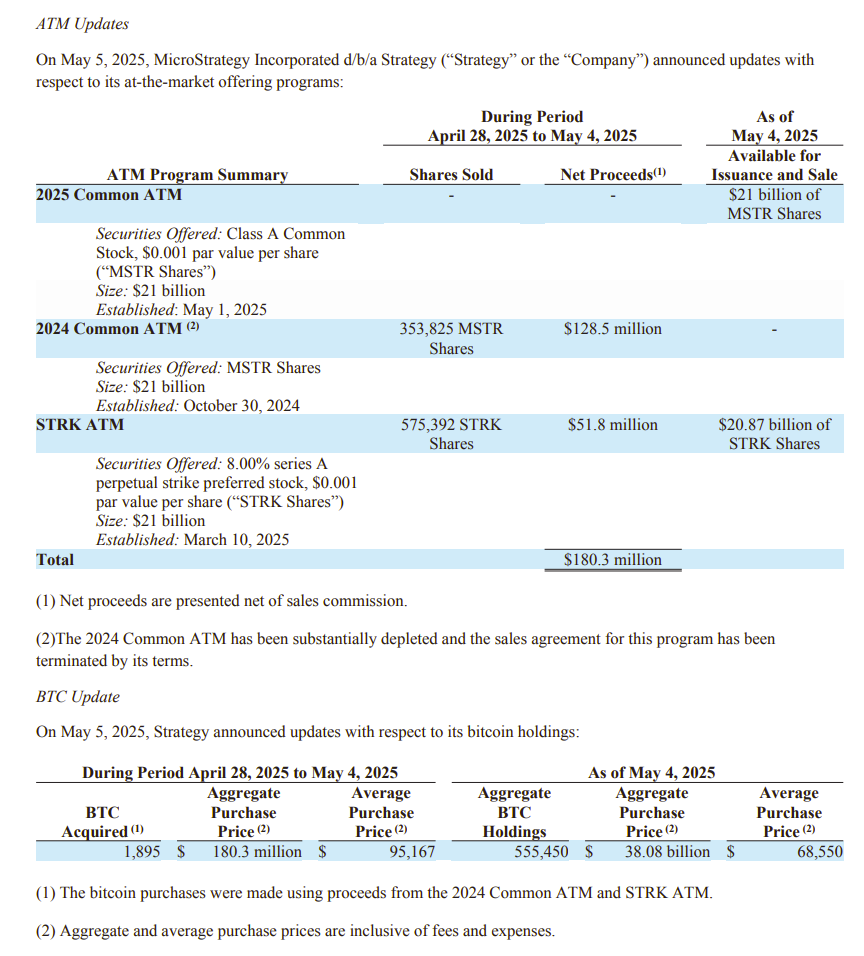

According to a new Sec FileThe purchase was financed through the sale of Strategy’s Class A Common Stock (MRST) and Series A Preferred Stock (Strk). Last week, the company sold 353,825 meters shares and 575 392 million STRK shares, which generated net rover of about $ 180 million.

The latest purchase marks the fourth week’s strategy in a row has added more bitcoin to its portfolio. Last Monday, the company revealed that it had Bought $ 1.4 billion in BTC During the week ending April 27th.

Bitcoin currently deals with about $ 94,000, a reduction of 1.5% over the past 24 hours, according to Coinmarketcap. Prices can face more volatility when the markets turn attention to the upcoming FOMC meeting, where the Fed is expected to announce its latest interest rate decision.

While President Trump repeatedly urged the Federal Reserve to lower interest rates, the central bank has not shown any signs of shift course. No interest rate reduction is expected at this week’s policy meeting.

While President Trump repeatedly urged the Federal Reserve to lower interest rates, the central bank has not shown any signs of shift course. No interest rate reduction is expected at this week’s policy meeting.

Regardless The recent recall, strategy BTC holding still reflects about $ 14 billion in unrealized profits, data from its portfolio trackers. The company has also made it clear that it does not intend to support its aggressive accumulation strategy, despite a Q1 income loss.

Last week reported a net loss of $ 4.2 billion For the first quarter of 2025, mainly due to an unrealized grounddown of $ 5.9 billion according to the new accounting rules for fair value.

Nevertheless, the company announced plans to raise another $ 21 billion to continue to expand its Bitcoin acquisition strategy. It also aims to increase its BTC return target to 25% and its BTC dollars get goals to $ 15 billion.