The Bitcoin Prize has been in impressive form in recent weeks and breaks over the psychological level of $ 90,000 over the past week. Premier Cryptocurrency seems to approach the weekend with the same – if not bigger – Momentum after crossing $ 95,000 on Friday 25 April.

Who really is behind BTC rally?

In a new post on the X platform, at-chain analysts took the tech one Deep dive For the latest Bitcoin Price rally, the catalysts for driving from about $ 74,000 identify to $ 95,000. According to a crypto -pound, recent blockchain data shows that there has been a clear rotation of capital over the past month.

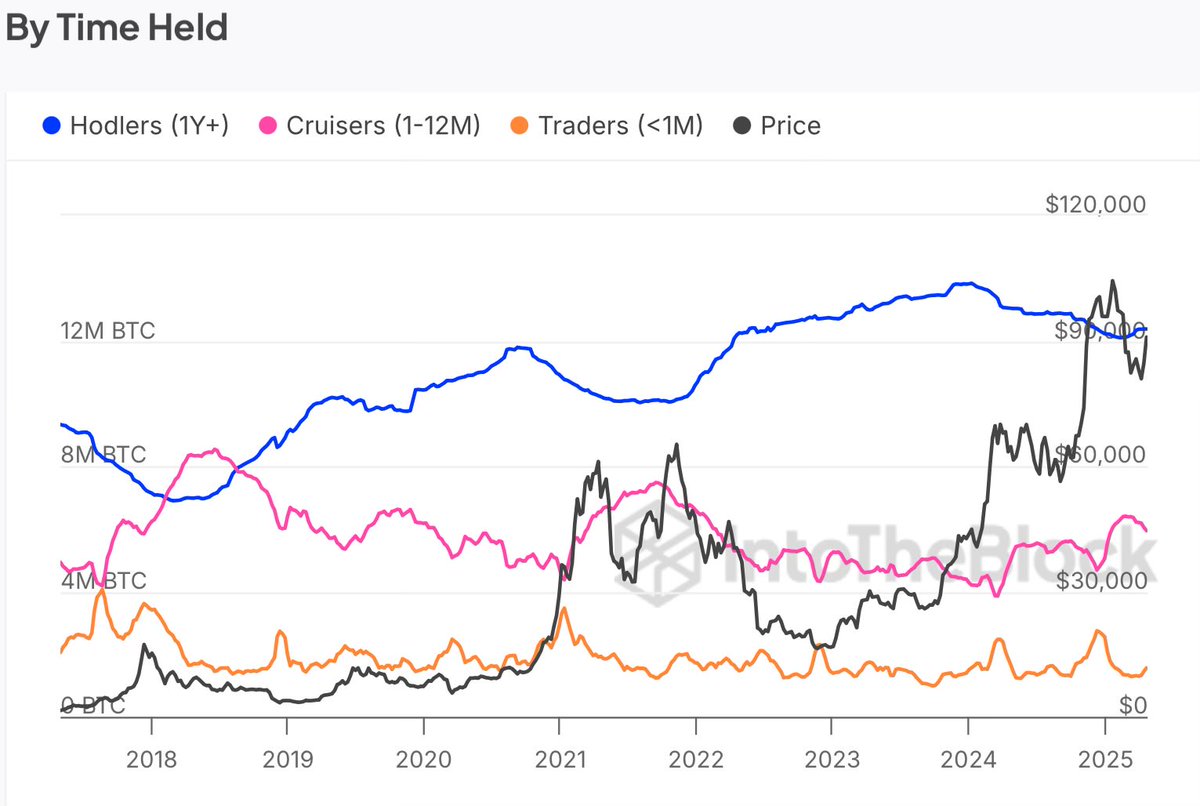

This analysis revolves around the activity of different classes of bitcoin investors (based on the time that takes place with their coins). According to information from intotheblock, most activities have not surprisingly come from the traders (or short -term holders), which have increased the balance by almost 19% over the past 30 days.

The technical noted that these merchants, faithful to their reactive nature and are driven by Fomo (fear of missing), have been aggressively buy BTC Since the price fell to about $ 74,000. At the same time, the short-term traders have not taken the foot of the gas with the Bitcoin Prize, which now dances over $ 95,000.

In addition, long-term holders seem to have stopped shaving off their holdings in recent weeks and removed the “big overhead pressure” on the Bitcoin Prize. According to information from Intoteblock, the balance between BTC-long-term holders has grown by at least 0.3% over the past 30 days.

Source: @IT_Tech_PL on X

Finally, the technology emphasized that an investor cohort called “cruisers”, with Bitcoin holding between 1 and 12 months. Given that their balance decreased by 4.4% over the past month, it mentioned in chain analysts that these investors either mature to “Hodlers“Or take a profit.

This technology concluded that the Bitcoin Prize could enter into a speculative haus phase characterized by significant short-term capital inflows and long-term stability. However, the analyst warned of the dominance of the short -term hands.

Given their reactive nature, very volatile periods are historically correlated with dominance of short -term holders. This means that there may be high volatility in the future of Bitcoin market. In any case, it thinks that the Bitcoin price is not yet reach the local top.

Bitcoin price

From this writing, bitcoin is valued at about $ 95,210, which reflects an increase of 2% over the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Image from iStock, chart from tradingview

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.