The price action for Bitcoin in the past week was largely redemption, as the main Cryptocurrency recovered its place over the psychological $ 100,000 brand. This latest blast of Haussearted Momentum reflects a healthy growing feeling among investors.

On Friday, May 15, the Bitcoin price reached as high as $ 103,800 – its highest level since January. However, the latest information on the chain shows the absence of investment activity in the derivative market, usually seen when BTC’s value hits this level.

BTC Price rally about to meet a roadblock?

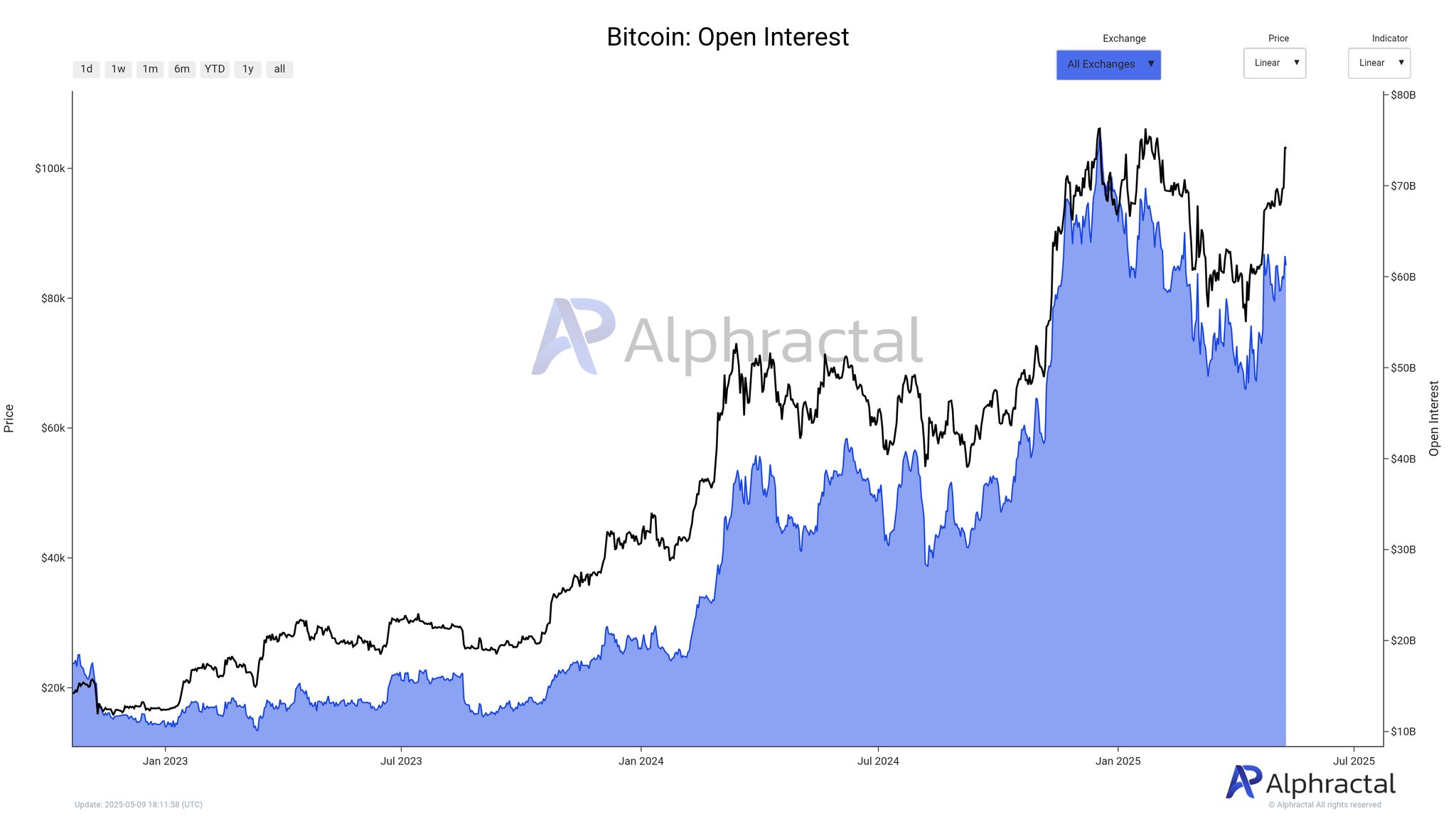

In a recent Social Media Platform X, Crypto Analytics Platform Alphractal shared That the open interest (OI) has not really moved in Tandem with the Bitcoin price in recent days. The open interest rateemetric measures the total amount that flows to BTC derivatives at any given time.

Rising open interest is often regarded as a hooked signal for the foremost cryptocurrency, especially since it suggests that fresh capital flow to the market. In the end, this trend proposes to improve investors’ feeling and growing traders trust.

According to data from Alphractal, the current aggregated OI is for Bitcoin (valued at about $ 103,000) to an estimated $ 61.3 billion. Last time BTC was at this monumental price, the open interest rate was more than $ 68 billion.

Source: @Alphractal on X

With the power Bitcoin open interest Less than Oi the last time the price was $ 103,000, Alphractal noted that this trend suggests lower leverage and reduced activity in Crypto’s largest market. The analytics company further explained that this phenomenon may be due to either recent waves of liquidations or position closures.

In the post on X, the Alphractal reasons revealed other reasons why the flagship Cryptocurrency award may risk a short-term correction movement. The relevant metric support on the chain is this baisse -like projection is the feeling of the election position.

Metric election positions trace both the shift in the direction and the trade behavior of large holders. It usually reflects the network positioning of whales, their market term and also changes in open positions.

Chart showing a decline in the Whale Position Sentiment from 1 to around 0.7 | Source: @Alphractal on X

Alphractal concluded that the decline in the feeling of the election position reflects great investors’ interest in closing long positions and thus moving the marketing entry. If the metric continues to sink, the conclusion on the chain, it ended up that it could lead to price stagnation, or worse, a correction.

Bitcoin price

From this writing, BTC’s price stands at $ 103,035, which reflects any significant movement for 24 hours. While the latest Haussearted momentum suggests that the main Cryptocurrency can hit a new highest time in the coming days, maybe investors want to be careful given the latest observations on the chain

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Image from iStock, chart from tradingview

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.