After a dry start to the week, the price of Bitcoin finally seems to stabilize and build a little haussertat momentum. On Friday, March 14, the flagship Cryptocurrency showed this growing momentum, as it steadily climbed on the lists and crossed the $ 85,000 briefly to close the week.

Interestingly, BTC Open interest (OI) has also moved In a similar direction as the price in recent days. With the rising open interest is the pressing question that requires a quick answer – is Bitcoin Bull back on the right track?

BTC Open interest jumps to $ 27.9 billion – what does that mean?

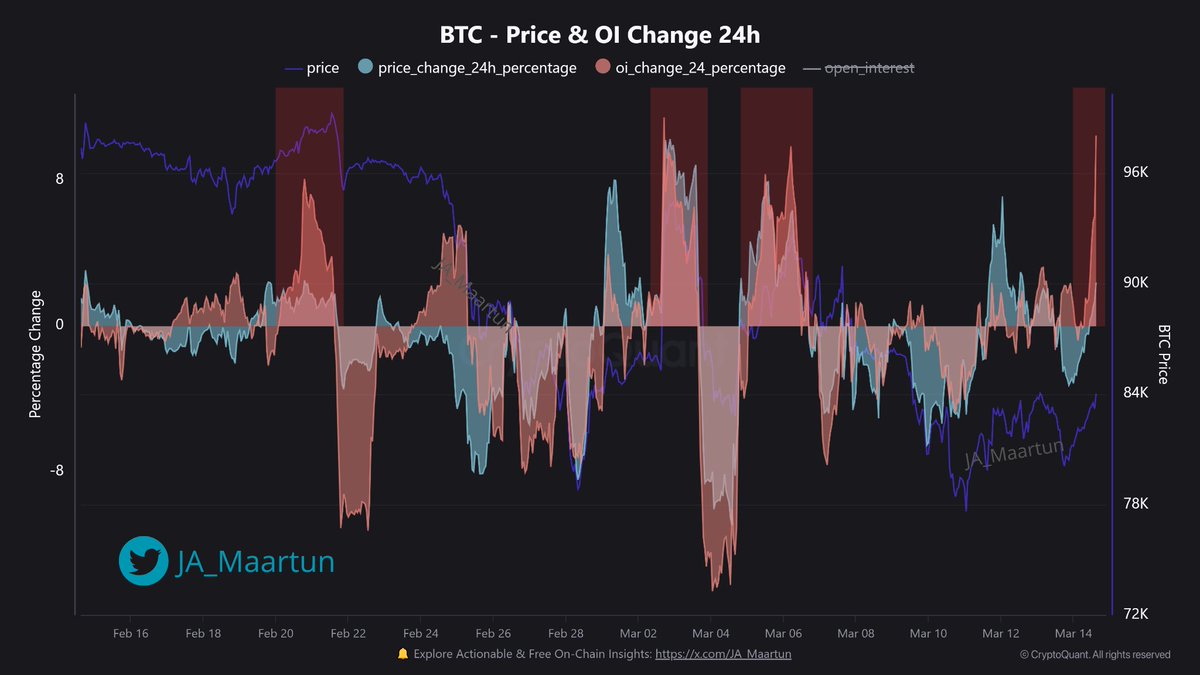

In a new post on the X platform, a Cryptoquant Community Analyst with pseudonym Maartunn revealed that Bitcoin open interest is increasing. For the context, the Metric Open Interest traces the total amount that is poured into BTC derivatives at any given time.

According to data from Cryptoquant, Bitcoin Oi witnessed a remarkable rise on Friday and rose to $ 27.9 billion. Maartunn noted that this significant feature marked an over 13% jump (more than $ 3.3 billion) from the latest low of the meters.

Source: @JA_Maartun

Usually one Increase in bitcoin open interest Suggest that investors open new positions in the future and option market. This means that investors pour money into BTC derivatives at that time. Conversely, a falling Oi value indicates that derivatives trader leaves their positions or become liquidated on the market.

A growing open interest can be a healthy haussearted sign for the main Cryptocurrency – especially if historical precedence is something to pass by. The influx of fresh capital in the market indicates that investors’ feeling (usually trust) or speculation about the Bitcoin price track.

As more investors flood the derivative market and continue to invest in BTC’s price, the rising open interest rate can increase the volatility of the Bitcoin market. Increased volatility signals that the flagship Cryptocurrency may soon experience large price movements soon.

What kind of bitcoin price?

BTC’s price seems to be united for a significant transition to the upside. Chartered marketing technician Tony Severino divided into x Platform that the market leader was able to make a drive to about $ 95,000 in the next few days.

Source: @tonythebullBTC

The Crypto expert noted that this projection depends on the Bitcoin Prize, which recycles 200-day sliding average (MA). If the price of BTC decisive is closed over this MA, it can go to 50-day MA around the middle of $ 90,000.

From this writing, the price of Bitcoin amounts to approximately $ 84,500, which reflects an almost 5% increase over the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured Image Created by Dall-E, Chart from TradingView

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.