Following an extensive price correction over the past three months, the Bitcoin Bull market continues to hang in balance. Despite a modest price recovery in April, the main Cryptocurrency is not yet a strong intention to resume its bull rally in the midst of the lack of positive market factors. Crypto analyst Axel Adler Jr. However, has emphasized a promising development that can signal greater upward potential for Bitcoin.

Bitcoin long -term holders who want to stop sales pressure

On one Last post At X, Adler shared Jr. An important update in Bitcoin long-term holders (LTH) activity, which may prove to be significantly positive for the broader BTC market.

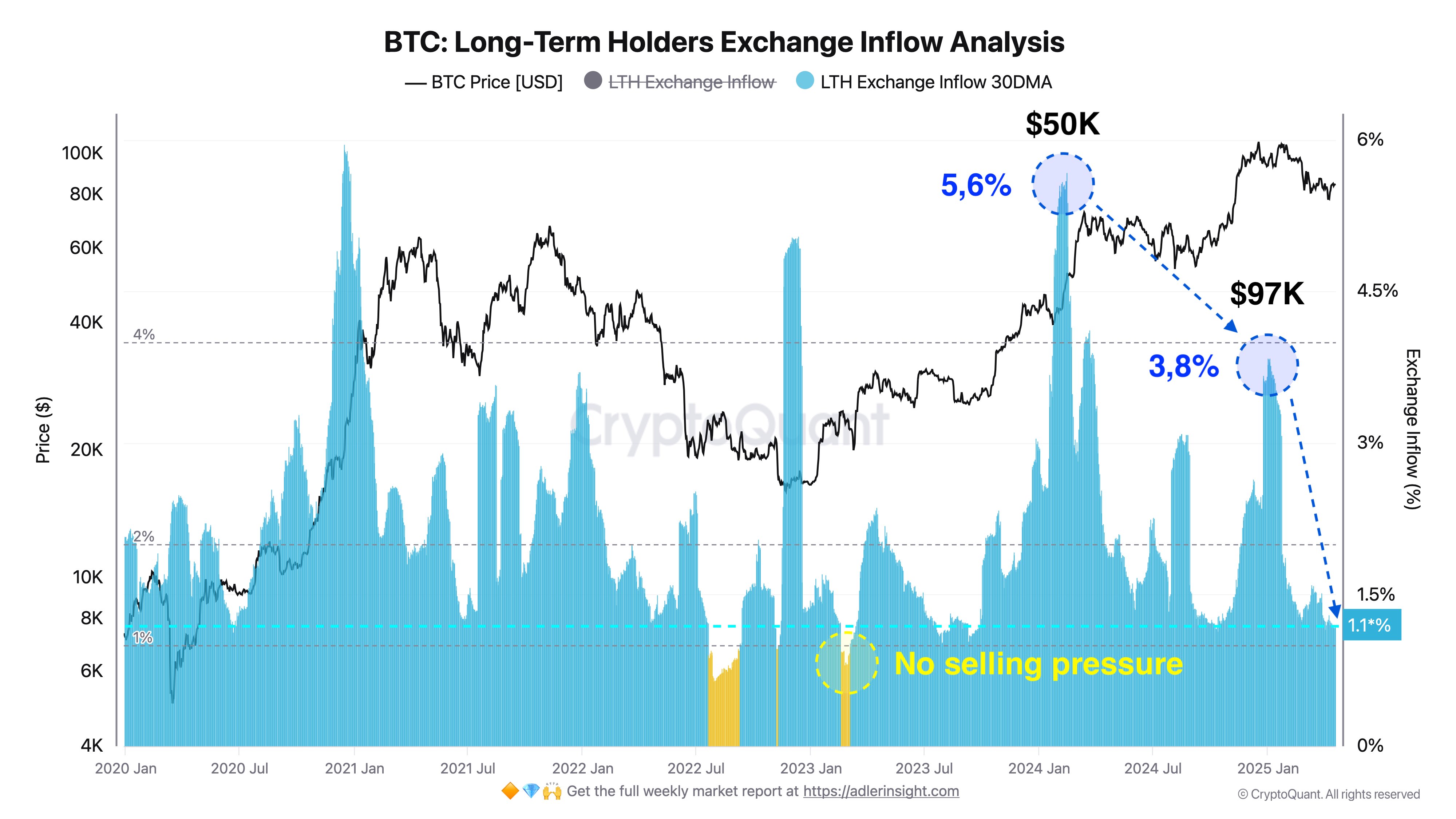

With the help of data on the Cryptoquant chain, the well -known analyst reports that sales prints from long -term holders have, ie. LTH holdings on exchanges, have now hit its lowest point of 1.1% in the past year. This development indicates that Bitcoin LTH is now choosing to stick to its assets rather than taking profits.

Adler explains that a further decline in these LTH exchange holdings to 1.0% would signal the total absence of sales pressure. In particular, this development can encourage new market entry and prolonged accumulation, create a strong rais -like momentum in the BTC market.

It is important that Alder illustrates that the majority of Bitcoin LTH entered the market at an average price of $ 25,000, since then Cryptoquant has registered the highest LTH sales pressure of 5.6% to $ 50,000 in early 2024 and 3.8% to $ 97,000 in early 2025.

According to Adler, these two cases probably represent the primary profit phases for long -term holders who intend to leave the market. Therefore, it is unlikely that a resuscitation in sales pressure from this cohort of BTC investors in the short term, which supports a building’s haus-like case, since long-term holders currently control 77.5% of Bitcoin in circulation.

BTC Price overview

At the time of writing, Bitcoin traded to $ 85 226 after a 0.36% profit over the past day and a loss of 0.02% over the past week. Both measurement values only reflect the ongoing market consolidation as BTC continues to fight to achieve a compelling price outbreak beyond $ 86,000.

At the same time, the asset’s performance on the monthly chat is now reflecting a profit of 1.97%, indicating a potential trend change that the market correction ceases. Nevertheless, BTC remains in need of a strong market catalyst to ignite any sustainable prices. With a market value of $ 1.67 trillion, Bitcoin is ranked as the largest digital asset and controls 62.9% of the crypto market.

Image from Adobe Stock, Chart from TradingView

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.